Germany Medical Device Contract Manufacturing Market Size, Share, and COVID-19 Impact Analysis, By Class (Class I, Class II, and Class III), By Services (Accessories Manufacturing, Assembly Manufacturing, Component Manufacturing, Device Manufacturing, Packaging and Labelling, and Others), and Germany Medical device contract manufacturing Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareGermany Medical Device Contract Manufacturing Market Insights Forecasts to 2035

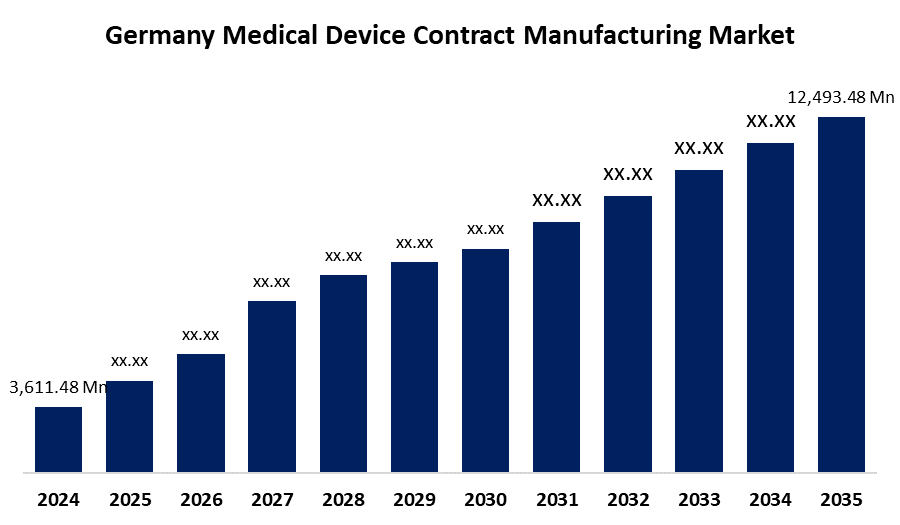

- The Germany Medical Device Contract Manufacturing Market Size was estimated at USD 3,611.48 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 11.94% from 2025 to 2035

- The Germany Medical Device Contract Manufacturing Market Size is Expected to Reach USD 12,493.48 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Germany Medical Device Contract Manufacturing Market is anticipated to reach USD 12,493.48 Million by 2035, growing at a CAGR of 11.94% from 2025 to 2035. The Germany medical device contract manufacturing market is driven by the aging population, growing healthcare demands, and the growing demand for cutting-edge medical technologies. The market's expansion is further supported by developments in digital health, such as personalized medicine and IoT integration.

Market Overview

The Germany medical device contract manufacturing market entails outside companies manufacturing medical equipment for original equipment manufacturers. Design, assembly, packaging, and regulatory support are among the services that allow OEMs to cut expenses, boost productivity, and concentrate on new product development and market expansion. The adoption of advanced manufacturing technologies is one important trend affecting the course of the German medical device contract manufacturing market. Furthermore, by using automation and robotics to streamline production lines, manufacturers can reduce human error and increase efficiency. AI-driven systems simplify procedures and lower errors while enabling real-time production quality monitoring. Additionally, 3D printing has gained a lot of traction in the medical device sector, allowing for the creation of highly personalized, patient-specific products that meet strict medical requirements.

Report Coverage

This research report categorizes the market for Germany medical device contract manufacturing market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany medical device contract manufacturing market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany medical device contract manufacturing market.

Germany Medical Device Contract Manufacturing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3,611.48 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 11.94% |

| 2035 Value Projection: | USD 12,493.48 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 268 |

| Tables, Charts & Figures: | 109 |

| Segments covered: | By Class and By Services |

| Companies covered:: | Medtronic, Vention Medical, Sartorius Stedim Biotech, Fiedler GmbH, Hapman GmbH, and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The market for medical device contract manufacturing in Germany is expanding due in large part to the rising demand for cutting-edge medical technologies. High-tech medical devices that provide better patient outcomes, treatments, and diagnostics are becoming more and more important as healthcare systems change. Furthermore, the increasing demand for devices like wearable health monitors, robotic surgery instruments, and diagnostic imaging systems calls for advanced manufacturing capabilities. Manufacturers can create these advanced products on a strong foundation thanks to Germany's well-known engineering sector. Additionally, specialized contract manufacturers that can meet these exacting standards are needed because medical devices must be precise and technologically advanced.

Restraining Factors

The intricacy of regulatory requirements is one of the main issues facing Germany's medical device contract manufacturing market. A maze of regulations that differ by region and device type must be negotiated by manufacturers, which can make approval more difficult and lengthen the time to market.

Market Segmentation

The Germany Medical Device Contract Manufacturing Market share is classified into class and services.

- The Class I segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany medical device contract manufacturing market is segmented by class into Class I, Class II, and Class III. Among these, the Class I segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is due to these products, which include surgical instruments, thermometers, and bandages, and are common and low-risk. Additionally, they can be produced more quickly and affordably because they don't need as much regulatory approval. This increases the market share of Class I devices by incentivizing OEMs to outsource them more frequently.

- The device manufacturing segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The Germany medical device contract manufacturing market is segmented by services into accessories manufacturing, assembly manufacturing, component manufacturing, device manufacturing, packaging and labelling, and others. Among these, the device manufacturing segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth is attributed to it entails full manufacturing of completed medical devices, which are highly sought after by OEMs looking to cut costs associated with internal manufacturing. Furthermore, contract manufacturers are experts in precision, cutting-edge technology, and regulatory compliance, all of which are necessary in this market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany medical device contract manufacturing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Medtronic

- Vention Medical

- Sartorius Stedim Biotech

- Fiedler GmbH

- Hapman GmbH

- Others

Recent Developments:

- In June 2024, Freudenberg Medical is bolstering its business in a major European life sciences hub by investing more than $50 million in a new production facility in Aachen, Germany, which will produce drug-device combination products.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany medical device contract manufacturing market based on the below-mentioned segments:

Germany Medical Device Contract Manufacturing Market, By Class

- Class I

- Class II

- Class III

Germany Medical Device Contract Manufacturing Market, By Services

- Accessories Manufacturing

- Assembly Manufacturing

- Component Manufacturing

- Device Manufacturing

- Packaging and Labelling

- Others

Need help to buy this report?