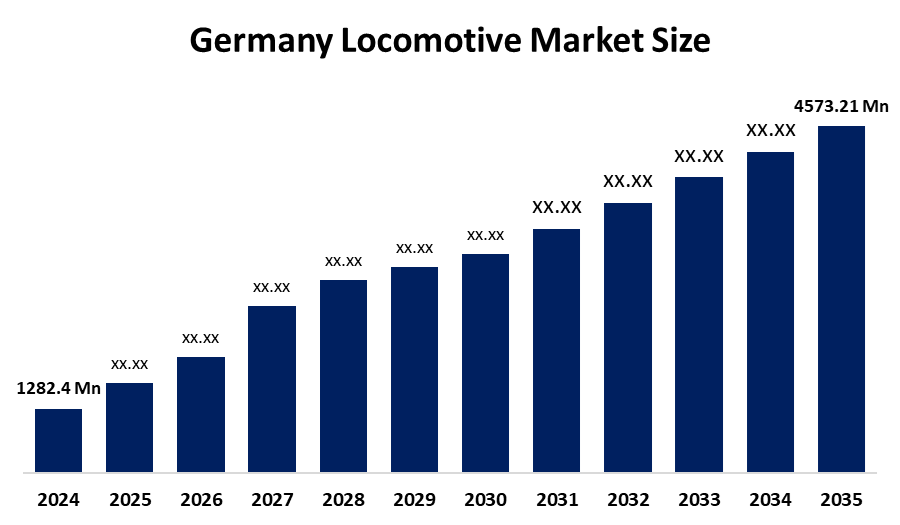

Germany Locomotive Market is Expected To Grow From USD 1282.4 Million in 2024 to USD 4573.21 Million By 2035, Growing at a CAGR of 12.25% during the forecast period of 2025-2035.

Industry: Information & TechnologyGermany Locomotive Market Size Insights Forecasts to 2035

- The Germany Locomotive Market Size Was Estimated at USD 1282.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 12.25% from 2025 to 2035

- The Germany Locomotive Market Size is Expected to Reach USD 4573.21 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, Germany Locomotive Market Size is Anticipated to Reach USD 4573.21 Million By 2035, Growing at a CAGR of 12.25% from 2025 to 2035. The Growth of the locomotive industry is primarily driven by rising investments in rail network infrastructure by both public and private entities.

Market Overview

The locomotive market refers to the industry involved in the manufacturing, maintenance, and operation of railway locomotives used for freight and passenger transportation. A crucial role in enhancing connectivity, reducing road congestion, and promoting energy-efficient travel. The lower greenhouse gas emissions, cost-effective long-distance transport, and improved logistics. The rising demand for high-speed trains, electrification of railways, and advancements in autonomous and hybrid locomotive technologies. Governments worldwide are supporting this market through initiatives such as infrastructure modernization, subsidies for electric locomotives, and public-private partnerships to expand railway networks. These efforts aim to boost sustainable transport and economic development while reducing dependency on fossil fuels and minimizing environmental impact.

Report Coverage

This research report categorizes the market for Germany locomotive market based on various segments and regions forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany locomotive market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment Germany locomotive market.

Germany Locomotive Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024 : | USD 1282.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 12.25% |

| 2035 Value Projection: | USD 4573.21 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Technology, By Component |

| Companies covered:: | ABB Germany (railway components), Knorr-Bremse AG, MTU Friedrichshafen GmbH (part of Rolls-Royce Power Systems), Stadler Rail (German operations), Schaltbau Holding AG, Siemens Mobility, Bombardier Transportation (now part of Alstom), Alstom, Vossloh AG, Deutsche Bahn AG (DB Cargo - locomotive operations), Krauss-Maffei Wegmann GmbH & Co. KG, Voith Turbo GmbH & Co. KG, Others, and and |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing demand for efficient and sustainable transportation, rapid urbanization, and expanding trade. Growing environmental concerns and the push for low-emission transport solutions are accelerating the shift toward electric and hybrid locomotives. Technological advancements, such as automation and smart control systems, enhance operational efficiency and safety. Additionally, government investments in railway infrastructure and modernization projects further boost market growth, while rising fuel costs encourage the adoption of energy-efficient rail transport over road alternatives.

Restraining Factors

The high initial investment and maintenance costs, which can limit adoption, especially in developing regions. Aging railway infrastructure in some countries hampers the integration of modern locomotives. Additionally, the long lifecycle of locomotives delays replacement demand. Regulatory hurdles and environmental concerns related to diesel locomotives also pose challenges.

Market Segmentation

The Germany locomotive market share is classified into type, technology, and component.

- The diesel segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany locomotive market is segmented by type into diesel and electric. Among these, the diesel segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period. Diesel locomotives offer flexibility, lower upfront infrastructure costs, and are suitable for long-distance and freight operations. Their ability to operate independently of electric grids makes them ideal for rural or underdeveloped routes. Additionally, ongoing advancements in fuel efficiency and emissions reduction technologies are making diesel locomotives more viable.

- The IGBT module segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany locomotive market is segmented by technology into IGBT module and GTO thyristor. Among these, the IGBT module segment dominated a share in 2024 and is expected to grow at a significant CAGR during the forecast period. Its superior efficiency, reliability, and performance in power conversion and control. IGBT technology enables better speed control, reduced energy losses, and improved traction performance, making it ideal for modern electric locomotives. Its compact size and ability to handle high voltage and current levels further support its adoption. As Germany advances in railway electrification and smart transportation systems

- The rectifier segment dominated a share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany locomotive market is segmented by component into rectifier and inverter. Among these, the rectifier segment dominated a share in 2024 and is expected to grow at a significant CAGR during the forecast period. Its essential role in converting alternating current (AC) to direct current (DC) for traction motors in electric locomotives. As Germany continues to expand its electrified rail network, the demand for efficient and reliable rectifiers increases. Rectifiers support stable power supply and enhance locomotive performance. Technological advancements improving their efficiency and durability.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany locomotive market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Siemens Mobility

- Bombardier Transportation (now part of Alstom)

- Alstom

- Vossloh AG

- Deutsche Bahn AG (DB Cargo – locomotive operations)

- Krauss-Maffei Wegmann GmbH & Co. KG

- Voith Turbo GmbH & Co. KG

- ABB Germany (railway components)

- Knorr-Bremse AG

- MTU Friedrichshafen GmbH (part of Rolls-Royce Power Systems)

- Stadler Rail (German operations)

- Schaltbau Holding AG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany locomotive market based on the below-mentioned segments:

Germany Locomotive Market, By Type

- Diesel

- Electric

Germany Locomotive Market, By Technology

- IGBT Module

- GTO Thyristor

Germany Locomotive Market, By Component

- Rectifier

- Inverter

Need help to buy this report?