Germany Lip Care Products Market Size, Share, and COVID-19 Impact Analysis, By Category (Non-Medicated, Medicated & Therapeutic, Sun Protection), By Product Type (Lip Balm, Lip Butter, Lip Scrubs, Lip Oil, Others), By Distribution Channel (Hypermarkets & Supermarkets, Specialty Stores, Pharmacies & Drug Stores, Others), and Germany Lip Care Products Market Insights, Industry Trend, Forecasts to 2033

Industry: Consumer GoodsGermany Lip Care Products Market Insights Forecasts to 2033

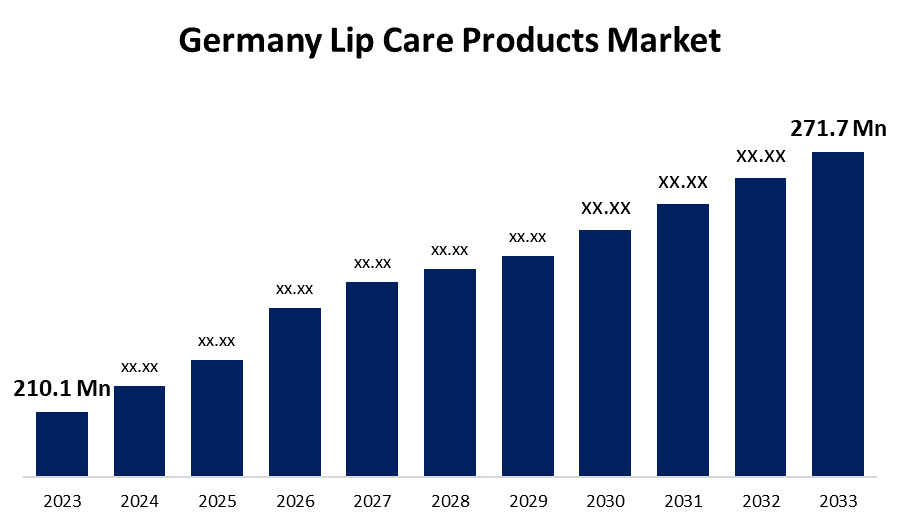

- The Germany Lip Care Products Market Size was valued at USD 210.1 Million in 2023.

- The Market Size is Growing at a CAGR of 2.60% from 2023 to 2033

- The Germany Lip Care Products Market Size is expected to reach USD 271.7 Million by 2033

Get more details on this report -

The Germany Lip Care Products Market is anticipated to exceed USD 271.7 Million by 2033, growing at a CAGR of 2.60% from 2023 to 2033. The increasing demand of the natural & organic lips, increasing awareness & innovation of lip products are driving the growth of the lip care products market in the Germany.

Market Overview

Lip-care products form a key part of the daily skin-care regime. It is an essential part of personal care routines, offering protection, hydration, and aesthetic enhancement for the lips. It has not only assisted the maintaining the moisture-content lips but also helps to protect the lips against cold, wind, & UV radiations. The lip care products include lip balms, lip gloss, lipstick, Lip Plumper, lip conditioners, lip butter, and lip moisturizer, etc. factors such as the increased emphasis on young looks and beauty are significant drivers of the market. Lipsticks with moisturizing characteristics and lip treatments with SPF (sun protection factor) are becoming popular in the German market. These products combine lip color and care, simplifying cosmetic procedures and providing convenience to customers. Increasing demand for value-added and natural products are also creating a positive impact on the growth of the Germany lip care products market.

Report Coverage

This research report categorizes the market for the Germany lip care products market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the lip care products market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the lip care products market.

Germany Lip Care Products Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 210.1 Million |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 2.60% |

| 2033 Value Projection: | USD 271.7 Million |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Category, By Product Type, By Distribution Channel. |

| Companies covered:: | Beiersdorf AG, loreal, Labello, Alverde Naturkosmetik, Lavera Naturkosmetik, Eucerin, Weleda AG, Babor GmbH & Co. KG, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing demand for natural and organic lip care products contributes to market growth. The application of lip care products is frequently driven by concerns about dryness, chapping, and early lip aging. Innovations in lip care formulations support market growth. Increasing awareness of lip health and demand for consumer preferences for multifunctional lip products bolster market growth. Growing consumer demand for natural and value-added products is also helping the market growth. Hence, these factors are significant growth of the German lip care products market during the forecast period.

Restraining Factors

Contamination risks associated with lip balms, especially when not used hygienically, can also be a restraining factor, as it may lead to infections and impact consumer confidence. The need for products free of dangerous chemicals and consumer preferences for sustainable and natural products may restrict the expansion of the lip care product market.

Market Segmentation

The Germany lip care products market share is classified into category, product type, distribution channel.

- The non-medicated segment is expected to hold a significant share of the Germany lip care products market during the forecast period.

The Germany lip care products market is segmented by category into non-medicated, medicated & therapeutic, and sun protection. Among these, the non-medicated segment is expected to hold a significant share of the Germany lip care products market during the forecast period. Increased demand for preventive lip care solutions. Increasing the natural and organic ingredients contributes to the lip care products. These non-medicated products are suitable for all-age groups with children and may be used in various weather conditions for regular use. Additionally, their extensive availability in retail shops, supermarkets, and online retailers supports to drive of their Germany lip care products market during the forecast period.

- The lip balm segment is expected to hold the largest share of the Germany lip care products market during the forecast period.

Based on the product type, the Germany lip care products market is divided into lip balm, lip butter, lip scrubs, lip oil, and others. Among these, the lip balm segment is expected to hold the largest share of the Germany lip care products market during the forecast period. The segmental growth can be attributed to people using lip balm, a smooth, wax-like substance, to moisturize and relieve the pain of dry or chapped lips. Lips are more susceptible to dryness due to their thin skin. Lip balms, resembling wax, protect them from wind, dry air, & cold temperatures, making them popular for treating chapped lips during winter and requiring multiple tubes.

- The hypermarkets & supermarkets segment is expected to hold the largest share of the Germany lip care products market during the forecast period.

Based on the distribution channel, the Germany lip care products market is divided into hypermarkets & supermarkets, specialty stores, pharmacies & drug stores, others. Among these, the hypermarkets & supermarkets segment is expected to hold the largest share of the Germany lip care products market during the forecast period. The segmental growth can be attributed to the widespread, allowing a large market base to easily availability of lip care products. Retail giants leverage economies of scale to negotiate competitive pricing for lip care products, attracting cost-conscious consumers and driving market share through effective marketing & promotional activities. Customers prefer to hypermarkets & supermarkets from these stores due to their convenience, wide network, and exclusive selection of products at suitable prices.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany lip care products market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Beiersdorf AG

- l'oréal

- Labello

- Alverde Naturkosmetik

- Lavera Naturkosmetik

- Eucerin

- Weleda AG

- Babor GmbH & Co. KG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2023, Beiersdorf following last year’s sustainability innovations around NIVEA Shower lightweight bottle and NIVEA Soft more climate-friendly formula – both achieving significant CO2 emission reductions, Beiersdorf now brings NIVEA Sun and NIVEA lip care to market with relevant improvements and a reduced CO2 footprint. Eucerin is also making good headway with its product transition; most recently, it introduced a refill jar for its Hyaluron-Filler line. Retail giants leverage economies of scale to negotiate competitive pricing for lip care products, attracting cost-conscious consumers and driving market share through effective marketing and promotional activities.

- In January 2023, L'Oreal launched a new motorized lipstick tool meant for persons with restricted mobility. L’Oréal unveiled the first handheld, ultra-precise computerized makeup applicator designed to advance the beauty needs of people with limited hand and arm mobility, called HAPTA.

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Germany lip care products market based on the below-mentioned segments:

Germany Lip Care Products Market, By Category

- Non-Medicated

- Medicated & Therapeutic

- Sun Protection

Germany Lip Care Products Market, By Product Type

- Lip Balm

- Lip Butter

- Lip Scrubs

- Lip Oil

- Others

Germany Lip Care Products Market, By Distribution Channel

- Hypermarkets & Supermarkets

- Specialty Stores

- Pharmacies & Drug Stores

- Others

Need help to buy this report?