Germany Life and Non-Life Insurance Market Size, Share, and COVID-19 Impact Analysis, By Insurance Type (Life Insurance and Non-Life Insurance), By Distribution Channel (Direct and Agency), and Germany Life and Non-Life Insurance Market Insights, Industry Trend, Forecasts to 2035.

Industry: Banking & FinancialGermany Life and Non-Life Insurance Market Insights Forecasts to 2035

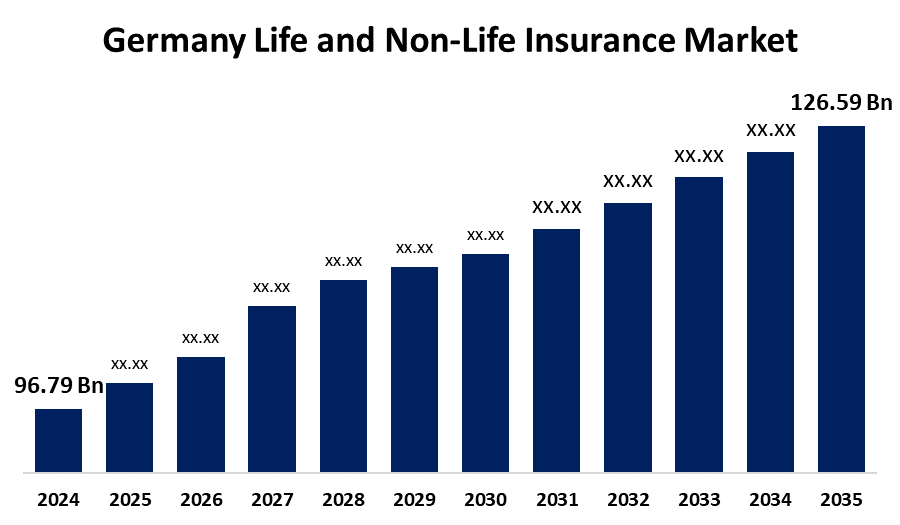

- The Germany Life and Non-Life Insurance Market Size was estimated at USD 96.79 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 2.47% from 2025 to 2035

- The Germany Life and Non-Life Insurance Market Size is Expected to Reach USD 126.59 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Germany Life And Non-life Insurance Market Size is Anticipated to reach USD 126.59 Billion By 2035, Growing at a CAGR of 2.47% from 2025 to 2035. The Germany life and non-life insurance market is driven by the aging population and rising life expectancy. The demand for insurance products, especially among individuals and businesses, is increasing due to the growing need for risk management and financial security.

Market Overview

The Germany life and non-life insurance market in the event of the insured person's passing, life insurance market offers beneficiaries financial stability. It can be used to cover funeral expenses, debt obligations, or provide ongoing income for dependents. General insurance, commonly referred to as non-life insurance, protects a range of risks, such as theft, accidents, health problems, and property damage. The demand for life insurance products, especially retirement and pension plans, has surged as such of this demographic change. The market's growth has also been aided by younger generations' growing awareness of retirement planning. Furthermore, businesses are increasingly looking for comprehensive coverage against climate risks, and the increased frequency of extreme weather events has led to a particular growth in property insurance.

Report Coverage

This research report categorizes the market for Germany life and non-life insurance market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany life and non-life insurance market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany life and non-life insurance market.

Germany Life and Non-Life Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 96.79 Billion |

| Forecast Period: | 2025 - 2035 |

| Forecast Period CAGR 2025 - 2035 : | 2.47% |

| 2035 Value Projection: | USD 126.59 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Insurance Type, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | Allianz Group, Munchener Ruck Gruppe, Talanx Konzern, R+V Konzern, Generali Deutschland AG, Debeka Versicherungen, AXA Konzern AG, Signal Iduna Gruppe, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The main factors propelling the German life and non-life insurance markets are the country's aging population. There is a greater need for insurance products designed specifically for senior citizens as the nation's demographics change and the number of senior citizens rises. Moreover, to guarantee financial stability in later years, life insurance, especially retirement and pension plans, is becoming more and more crucial. The need for comprehensive health insurance policies is increasing as a result of older people needing medical care more frequently. Additionally, the need for long-term care insurance, which pays for nursing and home care, frequently rises as the population ages. Seniors' desire to safeguard their homes and assets is driving growth in non-life insurance products like home insurance. The insurance market is being shaped by this demographic trend, which is forcing insurers to provide senior citizens with specialized insurance options.

Restraining Factors

Traditional life insurance products are less appealing to customers looking for higher yields as a result of the European Central Bank's prolonged period of low or negative interest rates, which has compressed investment returns for life insurers. Additionally, many customers underinsure because they are unaware of the significance of life insurance.

Market Segmentation

The Germany life and non-life insurance market share is classified into insurance type and distribution channel.

- The life insurance segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Germany life and non-life insurance market is segmented by insurance type into life insurance and non-life insurance. Among these, the life insurance segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth is driven by the growing need for retirement planning and long-term financial security brought on by an aging population. Furthermore, many policies provide benefits for investments and savings, frequently backed by government-sponsored pension plans and tax breaks. German customers also have faith in life insurers because of their sound financial standing.

- The direct segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The Germany life and non-life insurance market is segmented by distribution channel into direct and agency. Among these, the direct segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth is attributed to the emergence of insurtech businesses and the digital transformation of conventional insurers. The rising customer preference for digital insurance solutions and self-service platforms is additional proof of the expansion of direct distribution in Germany's insurance industry.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany life and non-life insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Allianz Group

- Munchener Ruck Gruppe

- Talanx Konzern

- R+V Konzern

- Generali Deutschland AG

- Debeka Versicherungen

- AXA Konzern AG

- Signal Iduna Gruppe

- Others

Recent Developments:

- In January 2025, Axco Insurance Information Services (Axco) has published its most recent non-life insurance market study for Germany, which offers a thorough examination of the non-life (P&C) insurance industry in that nation.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany life and non-life insurance market based on the below-mentioned segments

Germany Life and Non-Life Insurance Market, By Insurance Type

- Life Insurance

- Non-Life Insurance

Germany Life and Non-Life Insurance Market, By Distribution Channel

- Direct

- Agency

Need help to buy this report?