Germany Investigational New Drug CDMO Market Size, Share, and COVID-19 Impact Analysis, By Service (Contract Development and Contract Manufacturing), By End-Use (Pharmaceutical Companies, Biotech Companies, and Others), and Germany Investigational new drug CDMO Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareGermany Investigational new drug CDMO Market Size Insights Forecasts to 2035

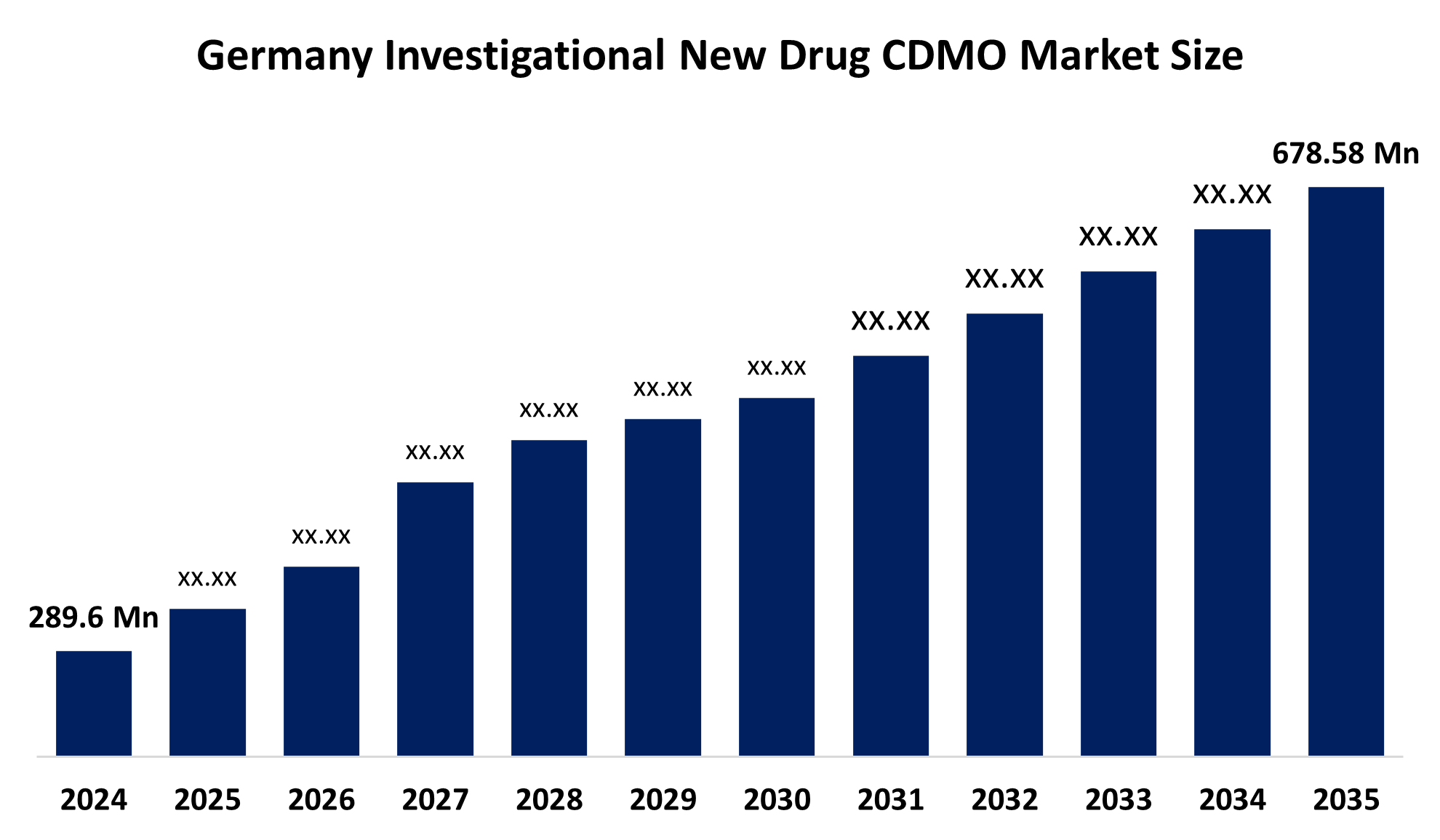

- The Germany Investigational New Drug CDMO Market Size Was Estimated at USD 289.6 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 8.08% from 2025 to 2035

- The Germany Investigational New Drug CDMO Market Size is Expected to Reach USD 678.58 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Germany Investigational New Drug CDMO Market Size is Anticipated to Reach USD 678.58 Million by 2035, Growing at a CAGR of 8.08% from 2025 to 2035. The investigational new drug CDMO market in Germany is driven by boosting time-to-market, and collaborations with specialized CDMOs have been used to mitigate the risks associated with early-phase development. Furthermore, IND new drug CDMO services have been further stimulated by the increasing therapeutic focus on oncology, uncommon disorders, and advanced biologics.

Market Overview

An expert service provider, known as an investigational new drug (IND) contract development and manufacturing organization (CDMO), helps biotechnology and pharmaceutical companies to transfer medical possibilities in human studies before pregnancy. Periodically accelerating the market and reducing the dangers of early phase development has been achieved through partnership with special CDMOs. In addition, the growing medical emphasis on oncology, rare diseases, and sophisticated biologics has further stimulated the new drug CDMO services. The growing requirement of outsourced development services, especially from up-end biopharma companies without internal resources, has made the Ind CDMO industry more important. To speed up the initial stage of drug research, these firms provide scalable infrastructure, technical information, and regulatory expertise. In addition, CDMOs provide flexibility in managing intricate, specific features and handling processes, such as biologics, cells, and genes for treatment, and extremely powerful chemicals. Investigational new drug CDMO also follows the stringent regulatory structures in Germany and other developed countries, giving a strong emphasis on data integrity, security, and quality. Their value proposal is further reinforced by knowledge of strategic participation, investment in state -of -the -art facilities, and regenerative medicine.

Report Coverage

This research report categorizes the market for the Germany investigational new drug CDMO market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany investigational new drug CDMO market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany investigational new drug CDMO market.

Germany Investigational New Drug CDMO Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 289.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.08% |

| 2035 Value Projection: | USD 678.58 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Service, By End-Use |

| Companies covered:: | Lonza, Catalent, Thermo Fisher, Aenova Group, and Others |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Driving Factors

The market of investigational new drug CDMO in Germany is driven by the expansion of complex therapies, increased outsourcing by small and mid-sized biotech companies, rising demand for flexible and cost-effective development solutions, rising biopharmaceutical R&D, and strict regulatory requirements that necessitate specialized knowledge, all of which contribute to the growth of IND-focused CDMOs.

Restraining Factors

The market of investigational new drug CDMO in Germany is restrained by high service costs, intricate regulatory compliance, a lack of specialized infrastructure, issues with intellectual property, and reliance on external timeframes, which mostly constrain the investigational new drug CDMO market. Additionally, smaller businesses may not be able to afford high-quality IND development services due to capacity limitations and increased rivalry among CDMOs.

Market Segmentation

The Germany investigational new drug CDMO market share is classified into service and end-use.

- The contract development segment held the largest market share in 2024 and is expected to grow at a rapid CAGR during the forecast period.

The Germany investigational new drug CDMO market is segmented by service into contract development and contract manufacturing. Among these, the contract development segment held the largest market share in 2024 and is expected to grow at a rapid CAGR during the forecast period. This is due to speeding up drug pipelines, and more biotech and pharmaceutical companies are expanding their early-stage R&D and outsourcing. Additionally, CDMOs ideally assist sponsors in managing intricate submission requirements while lowering costs and development risks by fusing cutting-edge technologies with regulatory experience.

- The pharmaceutical companies segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany investigational new drug CDMO market is segmented by end-use into pharmaceutical companies, biotech companies, and others. Among these, the pharmaceutical companies segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to drug pipelines, and more biotech and pharmaceutical companies are outsourcing and expanding their early-stage R&D. Additionally, by combining cutting-edge technologies with regulatory knowledge, CDMOs can help sponsors navigate complicated submission procedures while lowering costs and development risks.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany investigational new drug CDMO market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Lonza

- Catalent

- Thermo Fisher

- Aenova Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany investigational new drug CDMO market based on the below-mentioned segments:

Germany Investigational New Drug CDMO Market, By Service

- Contract Development

- Contract Manufacturing

Germany Investigational New Drug CDMO Market, By End-Use

- Pharmaceutical Companies

- Biotech Companies

- Others

Need help to buy this report?