Germany Internet Data Center (IDC) Market Size, Share, and COVID-19 Impact Analysis, By Services (Colocation, Hosting, CDN, and Others), By Deployment (Public, Private, and Hybrid), and Germany Internet Data Center (IDC) Market Insights, Industry Trend, Forecasts to 2035.

Industry: Information & TechnologyGermany Internet Data Center (IDC) Market Insights Forecasts to 2035

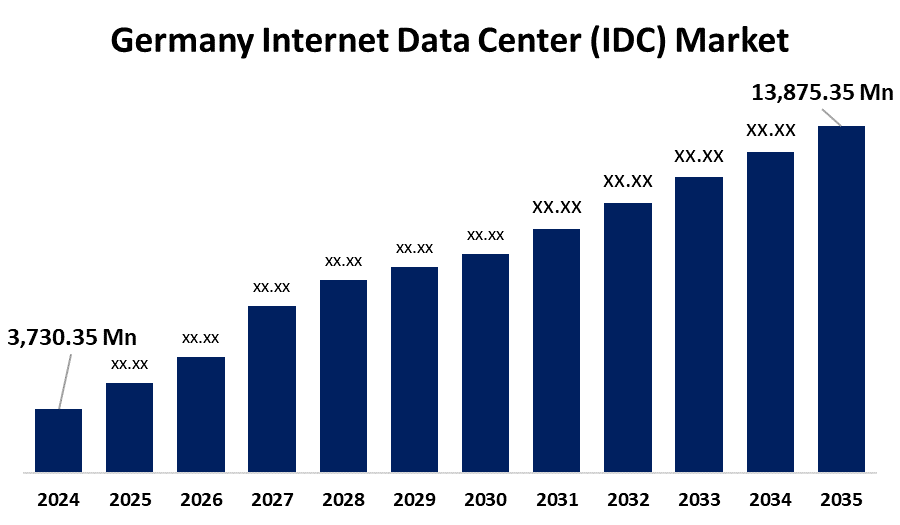

- The Germany Internet Data Center (IDC) Market Size was estimated at USD 3,730.35 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 12.68% from 2025 to 2035

- The Germany Internet Data Center (IDC) Market Size is Expected to Reach USD 13,875.35 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Germany Internet Data Center (IDC) Market Size is anticipated to reach USD 13,875.35 Million by 2035, growing at a CAGR of 12.68% from 2025 to 2035. The Germany internet data center (IDC) market is driven by rapid digital transformation, rising cloud usage, and the introduction of IoT and AI technologies. Strong infrastructure investments, a prime location, and strict data sovereignty laws all contribute to demand. Additionally, the push for energy-efficient, sustainable data centers fosters market expansion and supports Germany's environmental goals.

Market Overview

The Germany internet data center (IDC) market is an international sector offering services and infrastructure to facilitate data management, processing, storage, and distribution for digital and internet applications. These centers physically house servers, networking hardware, and storage systems to facilitate cloud computing, enterprise apps, data backup, disaster recovery, and content delivery. The Germany Internet Data Center (IDC) market may benefit from micro data centers situated in urban and industrial areas. It offers the low-latency processing needed for driverless cars, AR/VR, and the Internet of Things. Furthermore, tech companies and telecom operators are interested in localized compute capacity. It encourages network operators and colocation providers to work together. Opportunities for growth outside of traditional facilities are presented by the requirement for real-time analytics. Moreover, through partnerships between cloud providers and companies, the Internet Data Center (IDC) market in Germany is reflecting this shift. In the face of shifting demand, it improves workload flexibility and risk management. Businesses create hybrid environments to save costs and maintain performance levels.

Report Coverage

This research report categorizes the market for Germany internet data center (IDC) market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany internet data center (IDC) market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany internet data center (IDC) market.

Germany Internet Data Center (IDC) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3,730.35 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 12.68% |

| 2035 Value Projection: | USD 13,875.35 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 218 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Services (Colocation, Hosting, CDN, and Others), By Deployment (Public, Private, and Hybrid) |

| Companies covered:: | Goodman Group, Green Mountain, VIRTUS Data Centres, Hochtief AG, Siemens AG, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The demand for data center capacity in Germany is driven by cloud adoption and digital transformation. Mission-critical workloads are moved by organizations to adaptable platforms that grow with their needs. It helps businesses be resilient and agile in the face of market pressures. Deployments of both public and private clouds are driving the internet data center (IDC) market in Germany. Businesses spend money on hybrid solutions that blend cloud resources with on-premises infrastructure. Furthermore, high-performance computing, artificial intelligence, and advanced analytics drive the demand for reliable infrastructure. For complex workloads, research institutions, financial institutions, and automakers need high-capacity, low-latency solutions. It forces operators to implement sophisticated cooling systems and high-density power.

Restraining Factors

Building data centers requires a large investment from operators; costs are driven by advanced cooling systems, power setup, and land acquisition. High electricity rates and high real estate prices put a strain on the budgets of the Germany internet data center (IDC) market. Additionally, smaller providers are under pressure to find funding or collaborate with bigger stakeholders.

Market Segmentation

The Germany internet data center (IDC) market share is classified into services and deployment.

- The colocation segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany internet data center (IDC) market is segmented by services into colocation, hosting, CDN, and others. Among these, the colocation segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is due to its scalability, affordability, and strict adherence to regional data protection regulations. Without having to worry about constructing their facilities, businesses can take advantage of dependable infrastructure, improved connectivity, and security. Furthermore, colocation is a popular option in Germany's expanding digital market because it enables businesses to concentrate on their core competencies while maintaining uninterrupted data services.

- The public segment accounted for the fastest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The Germany internet data center (IDC) market is segmented by deployment into public, private, and hybrid. Among these, the public segment accounted for the fastest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth is attributed to the increasing use of cloud services, particularly by SMEs looking for scalable and affordable solutions. Rapid growth is a result of growing remote work, digital transformation, and the growth of hyperscale providers like Microsoft Azure and AWS. Additionally, businesses find public cloud options more appealing due to GDPR compliance and strict data protection regulations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany internet data center (IDC) market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Goodman Group

- Green Mountain

- VIRTUS Data Centres

- Hochtief AG

- Siemens AG

- Others

Recent Developments:

- In May 2024, Amazon Web Services (AWS) is investing €7.8 Billion through 2040 to construct a European Sovereign Cloud in Brandenburg, with plans to begin operations by the end of 2025. This initiative aims to adhere to the stringent EU data residency regulations while also assisting regulated industries and public sector entities.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany internet data center (IDC) market based on the below-mentioned segments:

Germany Internet Data Center (IDC) Market, By Services

- Colocation

- Hosting

- CDN

- Others

Germany Internet Data Center (IDC) Market, By Age

- Public

- Private

- Hybrid

Need help to buy this report?