Germany Furniture Manufacturing Software Market Size, Share, and COVID-19 Impact Analysis, By Deployment (On Premises, Cloud-based), By Application (Large Companies, Small and Medium Sized Companies) and Germany Furniture Manufacturing Software Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyGermany Furniture Manufacturing Software Market Insights Forecasts to 2035

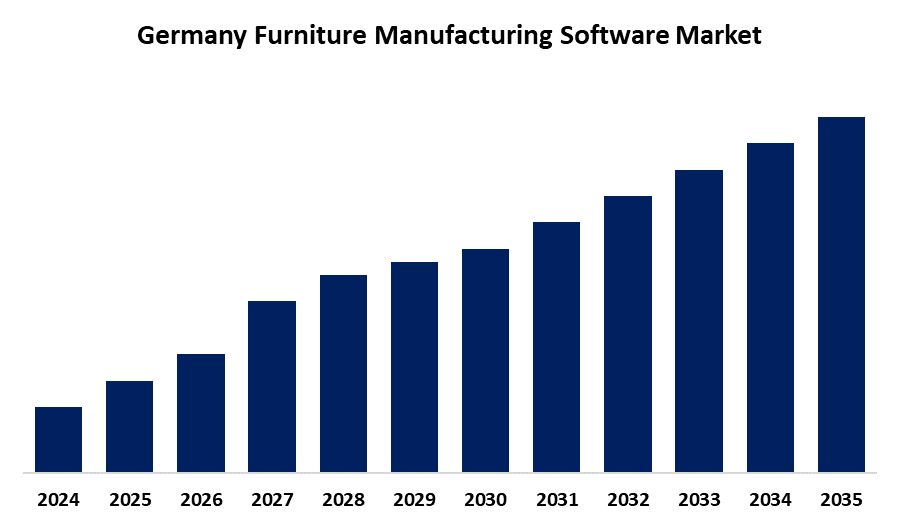

- The Germany Furniture Manufacturing Software Market Size is Expected to Grow at a CAGR of around 5.5% from 2025 to 2035.

- The Germany Furniture Manufacturing Software Market Size is Expected to Hold a Significant Share By 2035.

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the Germany Furniture Manufacturing Software Market Size is Expected to Grow at a CAGR of 5.5% during the forecast period 2025-2035. The market is driven due to several key factors, including the rising demand for mass customization, the expansion of e-commerce, and the need for streamlined operations and efficient production planning.

Market Overview

The furniture manufacturing software market has included a dedicated industry to develop and provide sequential software solutions for furniture businesses in the market. These solutions streamline various aspects of furniture production, including design, production plan, inventory management, supply chain adaptation and quality control, all in terms of unique demands of furniture manufacturing. Essentially, it is the markets for digital devices that help furniture companies manage their operation more efficiently and effectively. The German furniture manufacturing software offers important opportunities operated by the need for automation, efficiency and adaptation in market production. The increasing demand for smart furniture and the rise of e-commerce is also making new avenues for development. The German government supports the furniture manufacturing industry through various initiatives, especially focused on digitization and "industry 4.0". The purpose of these schemes is to increase productivity, efficiency and stability within the field, including adopting advanced software solutions. The Ministry of Economic Affairs and Climate Action provides funds for research and innovation in Industry 4.0 through programs like Autonomics for Industry 4.0 and "Smart Service World". These programs can support furniture manufacturers in developing and implementing new software solutions.

Report Coverage

This research report categorizes the market for the Germany furniture manufacturing software market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany furniture manufacturing software market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany furniture manufacturing software market.

Germany Furniture Manufacturing Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 5.5% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 150 |

| Tables, Charts & Figures: | 133 |

| Segments covered: | By Deployment, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | SYSPRO, Global Shop Solutions, MRPEas, SyteLine, Epicor, WinMan, Sanderson Unity, SapphireOne, Apprise, TRIMIT Furniture and Others. |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The German furniture manufacturing software market is powered by several major factors, including increasing demand for adaptation, requirement of efficient production processes and the rise of e-commerce. Focusing on the strong manufacturing sector and innovation of Germany, with the adoption of industry 4.0 technologies, also plays an important role in running the market.

Restraining Factors

The German furniture manufacturing software faces several preventive factors in the market, including high physical costs, especially for wood and special foam, and increasing cost of energy. Additionally, the market experiences pressure from low cost imports, especially from Eastern Europe, and the impact of stringent environmental rules on production. In addition, the industry struggles with a lack of efficient labor, which is increased by an aging workforce.

Market Segmentation

The Germany furniture manufacturing software market share is classified into deployment and application.

- The cloud-based segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany furniture manufacturing software market is segmented by deployment into on premises, cloud-based. Among these, the cloud-based segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is primarily due to the cloud's lower upfront costs, scalability, and ease of implementation, making it particularly attractive to smaller and medium-sized enterprises (SMEs) and start-ups. While on-premises solutions are still favoured by larger enterprises for their enhanced control and data security, the cloud's advantages are increasingly driving its widespread adoption in the German market.

- The large companies segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany furniture manufacturing software market is segmented by application into large companies, small and medium sized companies. Among these, the large companies segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This preference is largely driven by the scale of operations and IT investment capabilities of each group. Large companies benefit from the robust functionality and data management capabilities of ERP systems like SAP, while SMEs find cloud-based solutions like those offered by IMOS or specialized software tailored for furniture manufacturing more suitable due to lower upfront costs and easier implementation.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany furniture manufacturing software market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- SYSPRO

- Global Shop Solutions

- MRPEas

- SyteLine

- Epicor

- WinMan

- Sanderson Unity

- SapphireOne

- Apprise

- TRIMIT Furniture

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany furniture manufacturing software market based on the below-mentioned segments:

Germany Furniture Manufacturing Software Market, By Deployment

- On Premises

- Cloud-based

Germany Furniture Manufacturing Software Market, By Application

- Large Companies

- Small and Medium Sized Companies

Need help to buy this report?