Germany Frozen Dessert Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Ice Cream, Yogurts, Cakes, and Others), By Category (Conventional, Sugar-Free), and Germany Frozen Dessert Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesGermany Frozen Dessert Market Forecasts to 2035

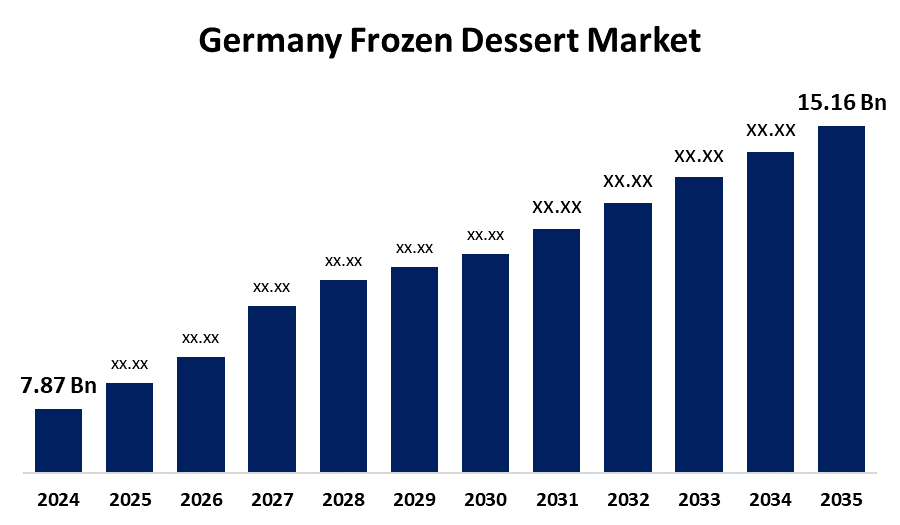

- The Germany Frozen Dessert Market Size Was Estimated at USD 7.87 Billion in 2024

- The Germany Frozen Dessert Market Size is Expected to Grow at a CAGR of around 6.14% from 2025 to 2035

- The Germany Frozen Dessert Market Size is Expected to Reach USD 15.16 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Germany Frozen Dessert Market Size is anticipated to reach USD 15.16 Billion by 2035, growing at a CAGR of 6.14% from 2025 to 2035. Growing demand for convenient, premium, and health-conscious dessert options is driving the Germany frozen dessert market. Increased online shopping, seasonal consumption, and interest in artisanal, plant-based products also contribute to market growth.

Market Overview

The industry that manufactures and sells a variety of cold, sugary treats that are consumed frozen is included in the Germany frozen dessert market. Dairy products, semi-solids, freezing liquids, vegetable fats, and a blend of dried fruits are used to make frozen desserts. The frozen dessert market in Germany is changing to accommodate consumers' growing demands for sustainability, convenience, and health. Demand for natural, low-sugar desserts free of additives, as well as an increasing interest in vegan and dairy-free options, has been fuelled by rising health consciousness. This gives marketers the chance to reach plant-based and health-conscious consumers. Convenience is still a major consideration, as busy lives increase demand for readily available goods and online buying, particularly for limited-edition and seasonal items. The market is also influenced by an increasing focus on sustainability, as consumers will choose businesses with sustainable sources and eco-friendly packaging. There is also a growing trend towards premium, gourmet frozen desserts with unique flavours, quality ingredients and a willingness to pay more for better quality. All things considered, the industry offers significant development potential for companies that reflect contemporary values and evolving eating patterns in Germany.

Report Coverage

This research report categorizes the market for the Germany frozen dessert market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany frozen dessert market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub segment of the Germany frozen dessert market.

Germany Frozen Dessert Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 7.87 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.14% |

| 2035 Value Projection: | USD 15.16 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 213 |

| Tables, Charts & Figures: | 117 |

| Segments covered: | By Product Type and By Category |

| Companies covered:: | Wall’s, Nestle, Langnese, Blue Bunny, Ben and Jerry’s, Tice, HaagenDazs, Breyers, Daiya Foods, Oetker, Unilever, Frosta, General Mills, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Germany frozen dessert market is experiencing growth in health driven offerings, due to the consumer push around low sugar, low fat, and natural ingredient options; Unilever, Dr. Oetker and other leading brands are continuing to innovate in this segment. The increase of retail chains and e-commerce platforms, including REWE and Amazon Fresh, has also supported the increased availability and services to consumers. In addition, seasonal and festive consumption is also contributing to increased sales, providing cyclic demand opportunities to grow the market across different consumer segments.

Restraining Factors

The German market for frozen desserts faces health problems caused by the high fat and sugar content, which prompts consumers to reduce their consumption of traditional frozen sweets or search for healthier alternatives. The competition from replacement products and the appearance of new competitors can pose challenges. Growing costs and the perception that frozen food is inferior to fresh food are further preventing the market from growing. These factors hamper the frozen dessert market during the forecast period.

Market Segmentation

The Germany frozen dessert market share is classified into product type and category

- The ice cream segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany frozen dessert market is segmented by product type into ice cream, yogurts, cakes, and others. Among these, the ice cream segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. It is anticipated that the ice cream will see a sharp increase in demand due to consumer preferences shifting towards rich desserts, improvements in flavour profiles, and the increasing acceptance of premium-grade light items. The market for frozen desserts is dominated by the ice cream category because of its popularity.

- The conventional segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany frozen dessert market is segmented by source into conventional, sugar-free. Among these, the conventional segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Traditional dessert lovers find it so enticing, and the conventional sector, which stands out for its rich flavours and textures, continues to lead. The conventional group will hold the highest share because regular frozen desserts are easy to sell, customers are used to classic flavours, and there is a persistent need for rich, decadent tasting sweets.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany frozen dessert market and a with comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Wall's

- Nestle

- Langnese

- Blue Bunny

- Ben and Jerry's

- Tice

- HaagenDazs

- Breyers

- Daiya Foods

- Oetker

- Unilever

- Frosta

- General Mills

- Others

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany frozen dessert market based on the below-mentioned segments:

Germany Frozen Dessert Market, By Product Type

- Ice Cream

- Yogurts

- Cakes

- Others

Germany Frozen Dessert Market, By Category

- Conventional

- Sugar-Free

Need help to buy this report?