Germany Flocculants & Coagulants Market Size, Share, and COVID-19 Impact Analysis, By Type (Flocculants and Coagulants), By End-use (Municipal Water Treatment, Oil & Gas, and Mining), and Germany Flocculants & Coagulants Market Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsGermany Flocculants & Coagulants Market Insights Forecasts to 2035

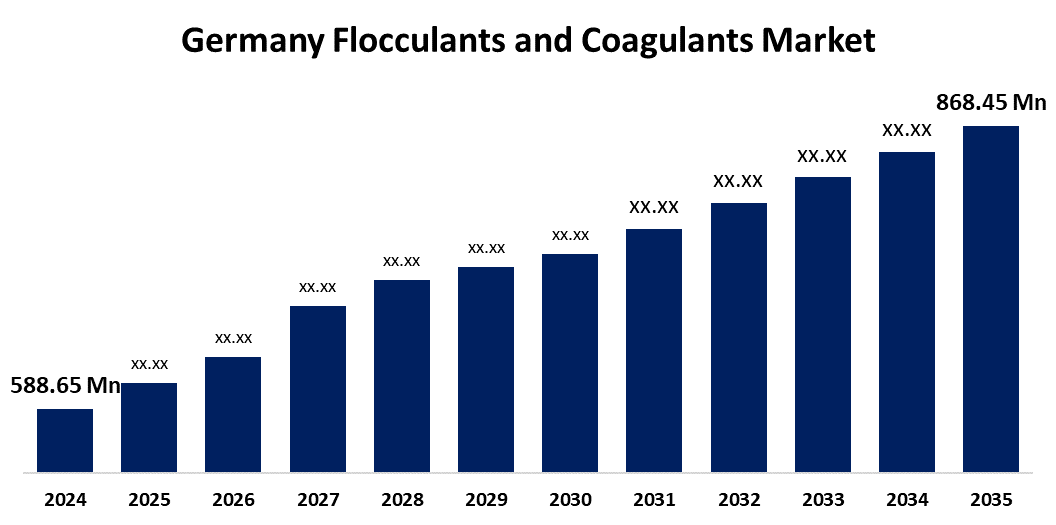

- The Germany Flocculants and Coagulants Market Size Was Estimated at USD 588.65 Million in 2024

- The Market Size is Expected to Grow at a CAGR od around 3.6% from 2025 to 2035

- The Germany Flocculants and Coagulants Market Size is Expected to Reach at USD 868.45 Million in 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Germany Flocculants and Coagulants Market Size is Expected to Grow USD 868.45 Million by 2035, Growing at a CAGR of 3.6% from 2025-2035. The increasing demand for wastewater treatment, which has triggered the imposition of strict regulations by governments around the world. The increasing popularity of eco-friendly solutions in water treatment processes has also acted as a major driver for the market.

Market Overview

The Flocculants and Coagulants Market Size involves chemicals used in water and wastewater treatment to remove suspended solids, making water cleaner and safer. These agents aggregate particles, aiding in efficient separation. The improved water quality, reduced environmental pollution, and cost-effective treatment processes. The rising demand for clean water in industrial and municipal sectors. The expanding urban infrastructure, stricter environmental regulations, and the growing need for sustainable water management. Governments are supporting this market through initiatives like stricter wastewater discharge norms, smart city projects, and subsidies for water treatment facilities. Such policies encourage adoption, fostering innovation and investment in eco-friendly flocculant and coagulant solutions.

Report Coverage

This research report categorizes the market for Germany flocculants & coagulants market based on various segments and regions forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany flocculants & coagulants market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment Germany flocculants & coagulants market.

Germany Flocculants and Coagulants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 588.65 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 3.6% |

| 2035 Value Projection: | USD 868.45 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 185 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By End-use |

| Companies covered:: | Tricura GmbH & Co. KG (flocculants), Sachtleben Chemie GmbH, SNF Flogger (SNF Germany operations), Chemische Werke Klute GmbH, Envirocheie GmbH, PRO-ENTEC GmbH (listed as coagulants/flocculants supplier), Separ Chemie GmbH, H20rtner GmbH, Envirocheie (part of EnviroWater Group) as flocculants supplier, Kurita (Germany distribution through Kurita Kurifloc), Reiflock Abwassertechnik GmbH, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing demand for clean and safe water across industrial, municipal, and agricultural sectors. Rapid urbanization, industrialization, and rising environmental concerns have heightened the need for efficient water and wastewater treatment solutions. Stringent government regulations on wastewater discharge and pollution control further propel market growth. Additionally, growing awareness about sustainable water management and advancements in chemical treatment technologies contribute to the expanding application of flocculants and coagulants.

Restraining Factors

The high cost of advanced and eco-friendly chemical formulations, which can limit adoption, especially in developing regions. Environmental and health concerns related to the excessive use of synthetic coagulants also pose challenges. Additionally, fluctuations in raw material prices and the availability of substitutes, such as membrane filtration and UV treatment, can hinder market growth.

Market Segmentation

The Germany flocculants & coagulants market share is classified into type and end-use.

- The flocculants segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany flocculants & coagulants market is segmented by type into flocculants and coagulants. Among these, the flocculants segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period. Their high efficiency in separating suspended particles in water and wastewater treatment processes. Their widespread use across municipal, industrial, and chemical sectors drives demand. With growing environmental regulations and increasing focus on water reuse and sustainability, the need for effective water treatment solutions is rising.

- The municipal water treatment segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany flocculants & coagulants market is segmented by end-use into municipal water treatment, oil & gas, and mining. Among these, the municipal water treatment segment dominated a share in 2024 and is expected to grow at a significant CAGR during the forecast period. The increasing demand for clean and safe drinking water, driven by population growth and urbanization. Strict environmental regulations and EU directives on wastewater treatment have accelerated the adoption of advanced treatment chemicals like flocculants and coagulants. Government investments in upgrading water infrastructure further support market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany flocculants & coagulants market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Tricura GmbH & Co. KG (flocculants)

- Sachtleben Chemie GmbH

- SNF Flogger (SNF Germany operations)

- Chemische Werke Klute GmbH

- Envirocheie GmbH

- PRO-ENTEC GmbH (listed as coagulants/flocculants supplier)

- Separ Chemie GmbH

- H20rtner GmbH

- Envirocheie (part of EnviroWater Group) as flocculants supplier

- Kurita (Germany distribution through Kurita Kurifloc)

- Reiflock Abwassertechnik GmbH

- Other

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany flocculants & coagulants market based on the below-mentioned segments:

Germany Flocculants & Coagulants Market, By Type

- Flocculants

- Coagulants

Germany Flocculants & Coagulants Market, By End-use

- Municipal Water Treatment

- Oil & Gas

- Mining

Need help to buy this report?