Germany Fertilizer Market Size, Share, and COVID-19 Impact Analysis, By Type of Fertilizer (Chemical Fertilizers and Organic Fertilizers), By Application (Agricultural Fertilizers, Non-Agricultural Fertilizers, and Industrial Fertilizers), and Germany Fertilizer Market Insights, Industry Trend, Forecasts to 2035.

Industry: AgricultureGermany Fertilizer Market Insights Forecasts to 2035

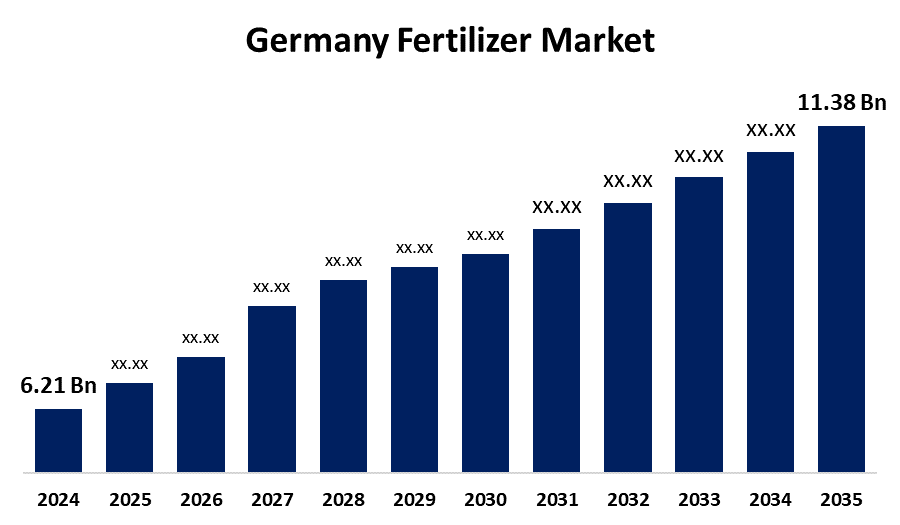

- The Germany Fertilizer Market Size was estimated at USD 6.21 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.66% from 2025 to 2035

- The Germany Fertilizer Market Size is Expected to Reach USD 11.38 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Germany Fertilizer Market Size is anticipated to reach USD 11.38 Billion by 2035, growing at a CAGR of 5.66% from 2025 to 2035. The market is driven by increased investments in novel feed solutions, such as enzymes and probiotics, to adhere to regulatory requirements and support sustainable animal nutrition.

Market Overview

The Germany fertilizer market refers to the industry that the global industry engages in the manufacture, distribution, and sale of fertilizers and chemicals that are used to supply necessary nutrients to soil or plants and add to the agricultural output. It encompasses different forms like nitrogenous, phosphatic, and potash fertilizers, and supplies to industries like agriculture, horticulture, and commercial farming. The Fertilizer Ordinance of the German government controls the application of fertilizers to avoid environmental degradation and optimal use of nutrients. These regulations try to minimize nutrient runoff into water bodies and ensure proper fertilizer application. These policies also support the innovation of controlled-release fertilizers and precision agriculture technologies to maximize nutrient use and minimize waste. Furthermore, a German agricultural innovation leader, Germany, is increasing fertilizer demand with the use of sophisticated farming methods such as precision farming. Germany has spent significantly on digital farming technology, and digital farms have grown by 25% over the last five years. Additionally, the shift to technology enhances fertilizer effectiveness and is compatible with eco-friendly farming methods, which is contributing to the market for specialized fertilizer.

Report Coverage

This research report categorizes the market for the Germany fertilizer market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany fertilizer market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the German fertilizer market.

Germany Fertilizer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6.21 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.66% |

| 2035 Value Projection: | USD 11.38 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type of Fertilizer (Chemical Fertilizers and Organic Fertilizers), By Application (Agricultural Fertilizers, Non-Agricultural Fertilizers, and Industrial Fertilizers) |

| Companies covered:: | BASF SE, K+S AG, Yara International ASA, EuroChem Group, CF Industries, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for fertilizers the growing world demand for food with a rising population. As arable land decreases and soil loses nutrients due to intensive farming, fertilizers are essential to enhance crop yields. Government policies of subsidy and support schemes, especially in emerging economies, also promote the use of fertilizers. Advances like precision agriculture and smart fertilizers also drive the market. Moreover, shifting climatic conditions and the growing popularity of horticulture and organic cultivation boost the demand for both chemical and bio-based fertilizers globally.

Restraining Factors

The Germany fertilizer market is challenged by environmental effects, especially nutrient runoff into water bodies. This results in lower fertilizer efficiency, higher expenditure, and environmental issues, as degraded soils have lower nutrient retention ability, which calls for the use of larger application amounts to ensure the desired yield.

Market Segmentation

The Germany fertilizer market share is classified into types of fertilizer and application.

- The chemical fertilizers segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Germany fertilizer market is segmented by type of fertilizer into chemical fertilizers and organic fertilizers. Among these, the chemical fertilizers segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is driven by agriculture has a long history of dependence on chemical fertilizers, specifically straight fertilizers such as nitrogen, phosphorus, and potassium. These are preferred due to their established efficiency, affordability, and compatibility with current farming practices.

- The agricultural fertilizers segment held the largest share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period.

The Germany fertilizer market is segmented by application into agricultural fertilizers, non-agricultural fertilizers, and industrial fertilizers. Among these, the agricultural fertilizers segment held the largest share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period. The segmental growth is due to gradually embracing precision agriculture methods, like soil analysis and variable rate application, to better utilize fertilizers. This method maximizes nutrient efficiency and facilitates sustainable agriculture.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany fertilizer market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- K+S AG

- Yara International ASA

- EuroChem Group

- CF Industries

- Others

Recent Developments:

- In February 2025, K+S introduced the C: LIGHT product family, providing CO2-reduced potash and magnesium fertilizers. The products reduce carbon emissions by as much as 90% relative to conventional alternatives. The introduction fits into K+S's climate strategy, supporting sustainable agriculture.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany fertilizer market based on the below-mentioned segments:

Germany Fertilizer Market, By Type of Fertilizer

- Chemical Fertilizers

- Organic Fertilizers

Germany Fertilizer Market, By Application

- Agricultural Fertilizers

- Non-Agricultural Fertilizers

- Industrial Fertilizers

Need help to buy this report?