Germany Engineering Plastics Market Size, Share, and COVID-19 Impact Analysis, By Resin Type (Fluoropolymer, Polyamide (PA), Polycarbonate (PC), Polyethylene Terephthalate (PET), Polyimide (PI), and Polyoxymethylene), By End-User Industry (Aerospace, Automotive, Building and Construction, Electrical and Electronics, Industrial and Machinery, and Packaging), and Germany Engineering Plastics Market Insights, Industry Trend, Forecasts to 2035

Industry: Construction & ManufacturingGermany Engineering Plastics Market Insights Forecasts to 2035

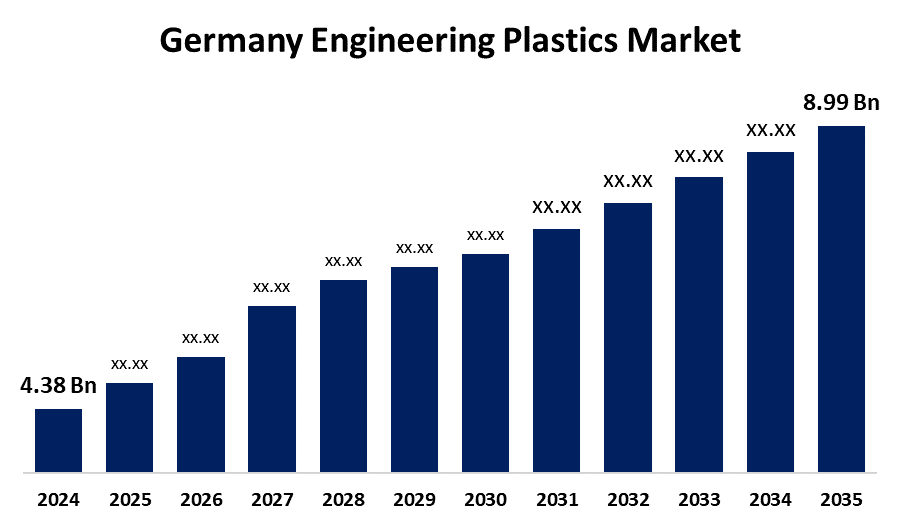

- The Germany Engineering Plastics Market Size was Estimated at USD 4.38 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.76% from 2025 to 2035

- The Germany Engineering Plastics Market Size is Expected to Reach USD 8.99 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Germany Engineering Plastics Market Size is anticipated to reach USD 8.99 Billion by 2035, Growing at a CAGR of 6.76% from 2025 to 2035. The Germany engineering plastics market is driven by the increasing demand for lightweight and fuel-efficient cars. Increased focus on research and development, resulting in the creation of next-generation engineering plastics with better properties such as high strength, heat resistance, and chemical resistance.

Market Overview

The Germany engineering plastics market is a sector that is a class of high-performance polymers suited to challenging industrial uses. They have better mechanical, thermal, and chemical characteristics than conventional plastics. These materials are known for their strength, endurance, and heat resistance, making them ideal for applications where dependability and effectiveness are crucial. Germany's engineering plastics sector is undergoing dramatic change, led by digitalization and sustainability strategies. Furthermore, the robust manufacturing industry and technological leadership of the country make it a leading innovation center for the development of advanced plastics. The Federal Government's decarbonization strategy aimed at climate neutrality is supported by advanced manufacturing innovation and the application of digital and energy-efficient solutions. Additionally, the trend of technology-powered packaging, tailored solutions, and eco-friendly product-driven packaging focuses on minimizing the generation of waste and carbon footprint

Report Coverage

This research report categorizes the market for Germany engineering plastics market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany engineering plastics market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany engineering plastics market.

Germany Engineering Plastics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.38 Billion |

| Forecast Period: | 2025 - 2035 |

| Forecast Period CAGR 2025 - 2035 : | 6.76% |

| 2035 Value Projection: | USD 8.99 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 167 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Resin Type, By End-User Industry, By End-User and COVID-19 Impact Analysis |

| Companies covered:: | 3M, BARLOG Plastics GmbH, BASF SE, Celanese Corporation, Covestro AG, DuBay Polymer GmbH, Equipolymers, Evonik Industries AG, Grupa Azoty S.A., and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The engineering plastics industry is experiencing a growing demand from the automotive sector for lighter, high-performance materials. Engineering plastics have emerged as superior metal substitutes, providing a weight reduction in vehicles that has a direct bearing on better fuel economy and reduced carbon emissions. Furthermore, governments across the globe have been putting stringent emissions standards, leaving auto makers with no choice but to turn to materials that will help them meet standards without compromising on safety and performance. Moreover, engineering plastics are preferred due to their corrosion resistance, rigidity, and freedom of design in construction, industrial equipment, and consumer products.

Restraining Factors

The engineering plastics industry is the high cost of production involved in using these materials. Manufacturing engineering plastics involves sophisticated production processes and special equipment, which makes the total costs more expensive. Furthermore, raw material prices, including crude oil derivatives applied in plastic manufacturing, are unstable and can vary dramatically.

Market Segmentation

The Germany engineering plastics market share is classified into resin type and end-user industry.

- The polyethylene terephthalate (PET) segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The Germany engineering plastics market is segmented by resin type into fluoropolymer, polyamide (PA), polycarbonate (PC), polyethylene terephthalate (PET), polyimide (PI), and polyoxymethylene. Among these, the polyethylene terephthalate (PET) segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth is attributed to the widespread use in the packaging sector, where its cost-saving and recyclable nature make it especially appealing. Moreover, PET's uses go beyond packaging to other industrial applications, with producers increasingly turning to sustainable methods in PET manufacturing.

- The packaging segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Germany engineering plastics market is segmented by end-user industry into aerospace, automotive, building and construction, electrical and electronics, industrial and machinery, and packaging. Among these, the packaging segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth is driven by the rising demand for convenience food that is ready-to-eat and the new trend of on-the-move lifestyles, which has supported the sales of PET plastic for packaging applications. Additionally, supported by the growing e-commerce industry has generated huge demand for packaging materials.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany engineering plastics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 3M

- BARLOG Plastics GmbH

- BASF SE

- Celanese Corporation

- Covestro AG

- DuBay Polymer GmbH

- Equipolymers

- Evonik Industries AG

- Grupa Azoty S.A.

- Others

Recent Developments:

- In April 2025, Materials producer Covestro launched a new family of post-consumer recycled (PCR) polycarbonates from end-of-life automotive headlamps, another milestone in closing the loop for automotive materials. Based on a joint program launched by the German federal enterprise GIZ (Deutsche Gesellschaft für Internationale Zusammenarbeit), with Volkswagen and NIO as main partners.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany engineering plastics market based on the below-mentioned segments:

Germany Engineering Plastics Market, By Risen Type

- Fluoropolymer

- Polyamide (PA)

- Polycarbonate

- Polyethylene Terephthalate (PET)

- Polyimide (PI)

- Polyoxymethylene

Germany Engineering Plastics Market, By End-User Industry

- Aerospace

- Automotive

- Building and Construction

- Electrical and Electronics

- Industrial and Machinery

- Packaging

Need help to buy this report?