Germany Digital Payment Market Size, Share, and COVID-19 Impact Analysis, By Mode of Payment (Bank Cards, Digital Currencies, Digital Wallets, Net Banking, Point of Sales, and Others), By Organization Size (Small Medium Enterprise and Large Enterprise), and Germany Digital Payment Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyGermany Digital Payment Market Forecasts to 2035

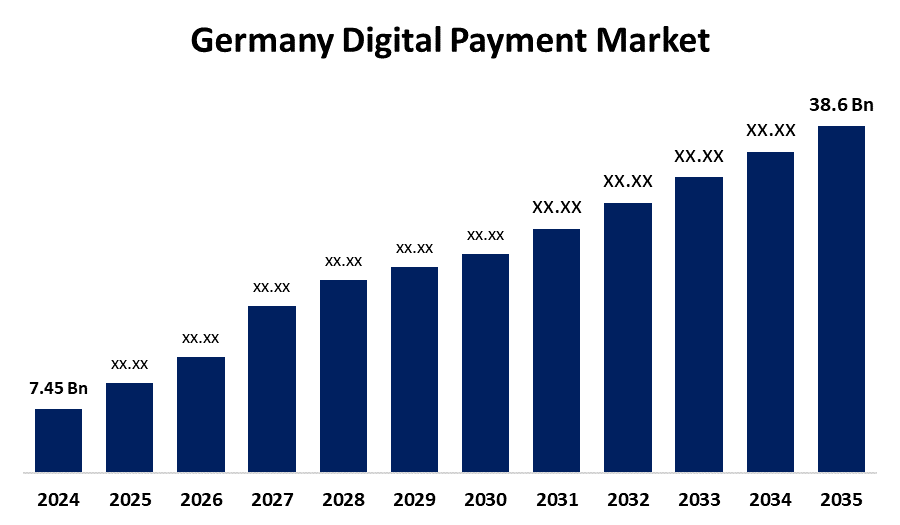

- The Germany Digital Payment Market Size Was Estimated at USD 7.45 Billion in 2024

- The Germany Digital Payment Market Size is Expected to Grow at a CAGR of around 16.13% from 2025 to 2035

- The Germany Digital Payment Market Size is Expected to Reach USD 38.6 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Germany Digital Payment Market is anticipated to reach USD 38.6 billion by 2035, growing at a CAGR of 16.13% from 2025 to 2035. The Germany digital payment industry is rapidly growing due to the convenience and speed of online transactions. Increased smartphone usage, faster internet, rising consumer preference, and widespread acceptance by retailers are key factors driving the adoption of digital payment solutions.

Market Overview

The German digital payment market refers to the secure transmission of money via electronic platforms such as mobile devices and the internet, as opposed to cash and traditional banking. Card payments, internet transfers, and cryptocurrency are all common payment options. Increased smartphone use, growing e-commerce, and customer demand for easy, contactless payment methods are all driving the Germany digital payment market's rapid expansion. This change is supported by government initiatives to encourage digitalisation, and the financial industry's creativity is highlighted by the increasing acceptance of digital currencies and blockchain. Fostering customer trust, improving security protocols, and placing an emphasis on data encryption and fraud prevention are all contributing to market expansion. Innovation is being fuelled by partnerships between fintech firms and traditional banks that combine cutting-edge, user-friendly technology with safe financial infrastructure. These partnerships offer faster digital payments and customised financial services. This modern marketplace is expected to grow further as issues relating to cybercrime are mitigated and the digital infrastructure continues to advance. The digital payments landscape is rapidly evolving in Germany to meet the increasing demand for effective, secure and convenient digital financial solutions, backed by both the public and private sectors.

Report Coverage

This research report categorizes the market for the Germany digital payment market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany digital payment market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany digital payment market.

Germany Digital Payment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 7.45 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 16.13% |

| 2035 Value Projection: | USD 38.6 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Mode of Payment, By Organization Size |

| Companies covered:: | N26, Adyen, Giropay, Apple Pay, American Express, PayPal, Visa, Alipay, Google Pay, Wirecard, Revolut, Mastercard, Klarna, SOFORT, Twint, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Increased e-commerce, growing mobile payment acceptance, encouraging government digitalisation measures, and increased demand for safe transactions are the main drivers of the German digital payment market. Although banks and telecom companies supply cutting-edge mobile wallets, consumers prefer easy, contactless solutions. Digital infrastructure is further improved by government funding and policy support. Increased security concerns also encourage the use of sophisticated, encrypted payment systems, which builds confidence and broadens the use of digital payments across sectors and demographics.

Restraining Factors

Privacy and data security concerns now impair the digital payments sector in Germany, which has implications for consumer confidence. Ultimately, digital payments may be hindered nationally due to unanticipated interruptions in digital infrastructure, regulatory hurdles, privacy and data security hurdles as well as challenges for older adults utilizing new technology. These factors hamper the digital payment market during the forecast period.

Market Segmentation

The Germany digital payment market share is classified into mode of payment and organization size.

- The point of sales digital payment segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany digital payment market is segmented by mode of payment into bank cards, digital currencies, digital wallets, net banking, point of sales, and others. Among these, the point of sales segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Retail establishments use point-of-sale systems to handle transactions. Point-of-sale systems enable businesses to accept several payment methods, provide a distinctive client experience, and offer quick checkout options. Retailers all over Germany are implementing cloud-based point-of-sale systems in an effort to boost productivity and enhance consumer satisfaction.

- The large enterprise segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany digital payment market is segmented by organization size into small medium enterprise, and large enterprise. Among these, the large enterprise segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Large businesses usually use sophisticated digital payment systems to handle large volumes of transactions, providing smooth customer experiences and making a substantial contribution to the expansion of the market as a whole.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany digital payment market and a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- N26

- Adyen

- Giropay

- Apple Pay

- American Express

- PayPal

- Visa

- Alipay

- Google Pay

- Wirecard

- Revolut

- Mastercard

- Klarna

- SOFORT

- Twint

- Others

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany digital payment market based on the below-mentioned segments:

Germany Digital Payment Market, By Mode of Payment

- Bank Cards

- Digital Currencies

- Digital Wallets

- Net Banking

- Point of Sales

- Others

Germany Digital Payment Market, By Organization Size

- Small Medium Enterprise

- Large Enterprise

Need help to buy this report?