Germany DC Distribution Networks Market Size, Share, and COVID-19 Impact Analysis, By Technology (High Voltage Direct Current (HVDC), Low Voltage Direct Current (LVDC)), By Application (Smart Grids and Microgrids, Transportation Electrification, and Industrial Applications), and Germany DC Distribution Networks Market Insights, Industry Trend, Forecasts to 2035.

Industry: Energy & PowerGermany DC Distribution Networks Market Insights Forecasts to 2035

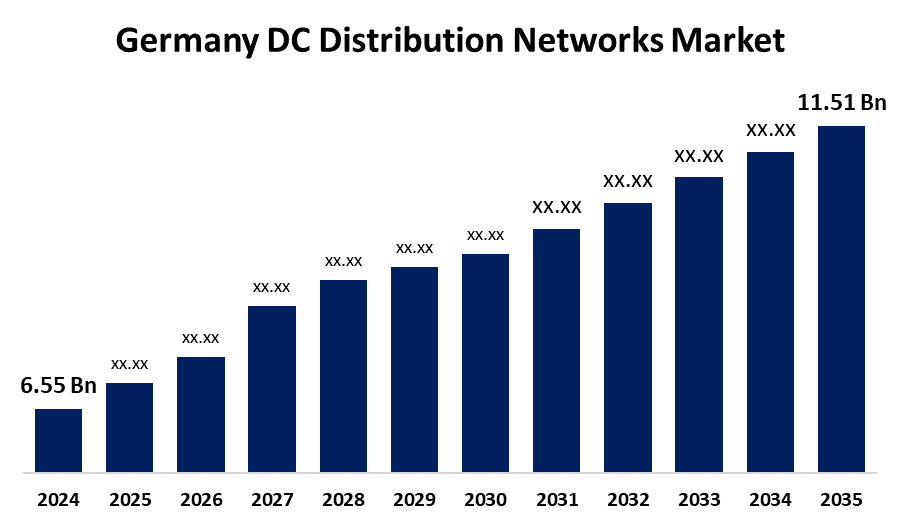

- The Germany DC Distribution Networks Market Size was estimated at USD 6.55 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.26% from 2025 to 2035

- The Germany DC Distribution Networks Market Size is Expected to Reach USD 11.51 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Germany DC Distribution Networks Market Size is Anticipated to reach USD 11.51 Billion by 2035, Growing at a CAGR of 5.26% from 2025 to 2035. The Germany DC distribution networks market is driven by the surging need for power distribution systems with low energy requirements, boost by the shift towards renewable energy resources and the pickup in the usage of electric vehicles.

Market Overview

The Germany DC distribution networks market is the sector that to electrical power grids that supply direct current (DC) electricity, which in certain applications, has an advantage over standard alternating current (AC) networks. The capacity of renewable energy generation is increasing at a greater pace. Most of the renewable power generation plants are far away from the load centres. The growth in the market is the increasing demand for effective power management within data centers and industrial usage. As data centers continue to grow with the rise in cloud computing and data storage demands, there is growing concern to optimize power consumption and reduce energy expenditure. Furthermore, DC distribution networks provide a simplified solution for power management by minimizing conversion losses and ensuring direct links between loads and renewable energy sources. In industrial uses as well, the implementation of DC networks can minimize power losses and enhance the efficiency of equipment, providing a competitive advantage to industries focusing on energy efficiency.

Report Coverage

This research report categorizes the market for Germany DC distribution networks market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany DC distribution networks market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany DC distribution networks market.

Germany DC Distribution Networks Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6.55 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.26% |

| 2035 Value Projection: | USD 11.51 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 255 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Technology, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Siemens AG, Eaton Corporation PLC, ABB Ltd, Vertiv Group Corp, Secheron SA, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The need for energy-saving solutions for power distribution. Perhaps the most promising opportunity is in the integration of renewable energy sources, as nations around the globe work to lower carbon emissions and move towards an improved, sustainable energy future. The efficiency and reliability of renewable energy integration that DC networks can offer make them one of the enablers for new energy infrastructure development. Furthermore, as investment in renewable energy schemes increases, demand for DC Distribution Networks is likely to increase, providing great prospects for market growth.

Restraining Factors

The steep initial investment for the adoption of DC networks, a strong disincentive for adoption, especially by small and medium-sized businesses. Additionally, the absence of an established set of standardized components and systems makes the integration of DC networks into existing systems challenging, thereby constraining adoption at a mass level.

Market Segmentation

The Germany DC distribution networks market share is classified into technology and application.

- The high voltage direct current (HVDC) segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Germany DC distribution networks market is segmented by technology into high voltage direct current (HVDC) and low voltage direct current (LVDC). Among these, the high voltage direct current (HVDC) segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth is driven by its efficiency in long-distance transmission, capability for integrating renewable energy, and its pivotal position in national and cross-border grid infrastructure. Additionally, the government of Germany is investing significantly in the strengthening of the national grid to facilitate the energy transition (Energiewende).

- The smart grids and microgrids segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The Germany DC distribution networks market is segmented by application into smart grids and microgrids, transportation electrification, and industrial applications. Among these, the smart grids and microgrids segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth is attributed to their critical function of facilitating the incorporation of renewable energy sources, enhancing grid stability, and serving Germany's energy transition goals. These systems ensure effective management of energy and are extensively employed in urban as well as rural areas.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany DC distribution networks market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Siemens AG

- Eaton Corporation PLC

- ABB Ltd

- Vertiv Group Corp

- Secheron SA

- Others

Recent Developments:

- In August 2024, German battery maker Varta launched Varta.wall, the new generation of its DC high-voltage storage systems. Varta has since early 2023 been prioritizing a far-reaching restructuring and has coped with a declining market, especially in the AC storage system segment that its current product portfolio addresses.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany DC distribution networks market based on the below-mentioned segments

Germany DC Distribution Networks Market, By Technology

- High Voltage Direct Current (HVDC)

- Low Voltage Direct Current (LVDC)

Germany DC Distribution Networks Market, By Application

- Smart Grids and Microgrids

- Transportation Electrification

- Industrial Applications

Need help to buy this report?