Germany Data Centers Market Size, Share, and COVID-19 Impact Analysis, By Size (Large, Massive, Medium, Mega, Small), By Tier Type (Tier 1 and 2, Tier 3, Tier 4), and Germany Data Centers Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyGermany Data centers Market Insights Forecasts to 2035

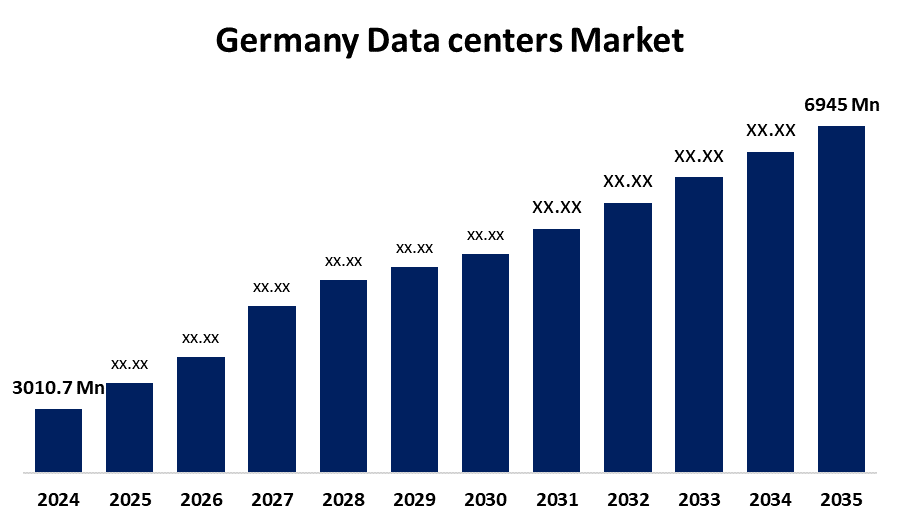

- The Germany Data Centers Market Size was Estimated at USD 3010.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.89% from 2025 to 2035

- The Germany Data Centers Market Size is Expected to Reach USD 6945 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Germany Data Centers Market Size is expected to grow from USD 3,010.7 Million in 2024 to USD 6945 Million by 2035, growing at a CAGR of 7.89% during the forecast period 2025-2035. The increasing adoption of cloud computing, deeper internet penetration, increase in digital data traffic, public cloud services, and growth of IoT are driving the data centers market in the Germany.

Market Overview

The German data center is an industry involved in providing and managing the physical infrastructure (server, storage, and networking) required for hosting IT system, including services such as market hosting, colours and managed data centers solutions. Data centers is a physical feature that stores and shares applications and data. Germany stands as a decisive hub in Europe's digital infrastructure landscape, especially hosting a significant concentration of data centers in cities such as Frankfurt, Berlin and Munich. Commitment to the country's strategic location, strong economy and data sovereignty makes it an attractive destination for data center investment. Germany's focus on becoming a leader in AI and Quantum Technologies is opening the way to special data centers for these advanced computing needs. Companies around the city are searching for the conversion of low office locations in data centers, adapting the existing real estate assets. He is running the development of IOT and real-time data processing requirements, which is providing opportunities to increase decentralized locations. The German federal government's AI strategy involves significant investment to increase AI capabilities, indirectly supports the data center market through increasing demand for computing resources. This initiative of this European Union is the objective of the participation of Germany to develop a world -class super computer ecosystem, which provides funds opportunities for data centers focused on HPC.

Report Coverage

This research report categorizes the market for the Germany Data centers market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany data centers market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany data centers market.

Germany Data Centers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3010.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 7.89% |

| 2035 Value Projection: | USD 6945 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 273 |

| Tables, Charts & Figures: | 109 |

| Segments covered: | By Size and By Tier Type |

| Companies covered:: | Equinix Digital Realty CyrusOne Amazon Web Services (AWS) Microsoft Azure Google Cloud Platform Iron Mountain Colt Data Center Services Hetzner Online GmbH Others |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

Sudden shifts toward digitalization in sectors have raised the demand for cloud service, which has made data center capacities more in demand. Large cloud companies like AWS, Microsoft Azure and Google Cloud are opening up their services to meet the rising demand in Germany. Telecom operators are expanding 5G network across-country rollout connectivity like Dutash Telecom and Vodafone connectivity, and thereby giving more demand to age data centers which process data near the source. General Data Safety Regulation (GDPR), including Germany's harsh data security norms, compel local data storage solutions to drive the domestic data center market.

Restraining Factors

Germany's electricity prices are the highest in Europe, offering an important operating cost for data center operators. Energy Efficiency Act makes compulsory stringent energy efficiency measures for data centers, including specific power use effectiveness (PUE) targets and waste heat use requirements, which can be challenging to apply. Searching appropriate places with access to essential infrastructure such as power grids and cooling systems, especially in urban areas, is becoming increasingly difficult.

Market Segmentation

The Germany Data Centers Market share is classified into type and tier type.

- The massive segment held a dominant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany data centers market is segmented by size into large, massive, medium, mega, and small. Among these, the massive segment held a dominant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This size category includes large data centers with substantial capacity, often catering to hyper scale needs. While mega data centers are also significant globally, the massive segment holds a larger share within the German market.

- The tier 3 segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany data centers market is segmented by tier type into tier 1 and 2, tier 3, tier 4. Among these, the tier 3 segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is driven by their balanced features and cost-effectiveness, making them popular among medium and large businesses. Tier 3 facilities offer comprehensive redundancy, disaster recovery options, and power outage protection, catering to the growing demand for reliable infrastructure.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany data centers market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Equinix

- Digital Realty

- CyrusOne

- Amazon Web Services (AWS)

- Microsoft Azure

- Google Cloud Platform

- Iron Mountain

- Colt Data Center Services

- Hetzner Online GmbH

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany data centers market based on the below-mentioned segments:

Germany Data Centers Market, By Size

- Large

- Massive

- Medium

- Mega

- Small

Germany Data Centers Market, By Tier Type

- Tier 1 and 2

- Tier 3

- Tier 4

Need help to buy this report?