Germany Core Banking Software Market Size, Share, and COVID-19 Impact Analysis, By Deployment (SaaS/Hosted and Licensed), By Banking Type (Large Banks, Midsize Banks, Small Banks, Community Banks, and Credit), and Germany Core Banking Software Market Insights, Industry Trend, Forecasts to 2035.

Industry: Banking & FinancialGermany Core Banking Software Market Insights Forecasts to 2035

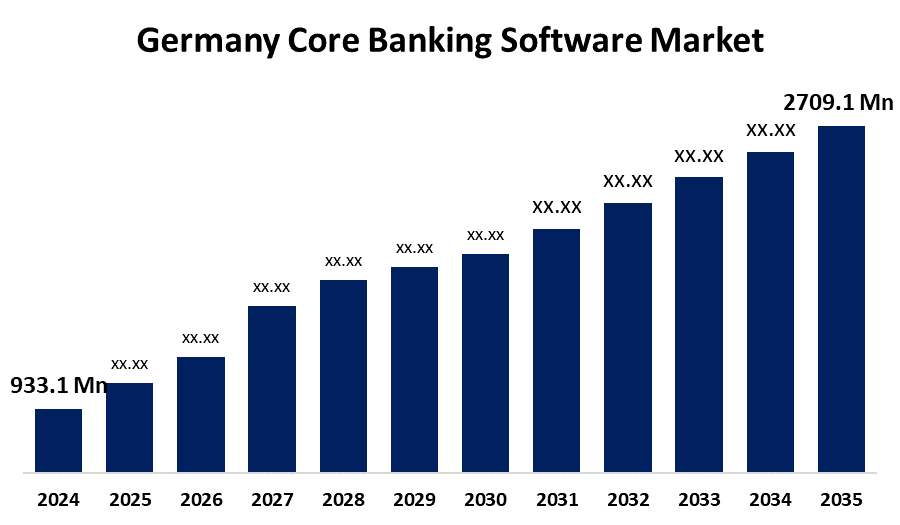

- The Germany Core Banking Software Market Size was estimated at USD 933.1 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.17% from 2025 to 2035

- The Germany Core Banking Software Market Size is Expected to Reach USD 2709.1 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Germany Core Banking Software Market Size is anticipated to reach USD 2709.1 Million by 2035, growing at a CAGR of 10.17% from 2025 to 2035. The Germany core banking software market is driven by the expansion of financial institutions, the growing need for centralized account management, and the expansion of regions due to earlier technological developments and applications.

Market Overview

The Germany core banking software market refers to the sector that offers digital platforms that let banks handle essential operations like client accounts, transactions, loans, deposits, and compliance in real time. In retail and corporate banking settings, these centralized systems facilitate smooth banking across branches and digital channels, boosting operational effectiveness, data accuracy, and customer satisfaction. Through a range of add-ons to their core banking software and platforms, banks provide their customers with all-encompassing support for their routine financial management. These solutions include Personal Finance Management (PFM) tools, various investment options, risk profiles, automated investment advice, and portfolio management. Moreover, the finAPI offers core banking software that includes automated reconciliation, scalability, customizable platforms, and API architecture. The purchase increased the company's customer base and opened doors for growth in other areas.

Report Coverage

This research report categorizes the market for Germany core banking software market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany core banking software market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany core banking software market.

Germany Core Banking Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 933.1 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 10.17% |

| 2035 Value Projection: | USD 2709.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 213 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Deployment (SaaS/Hosted and Licensed), By Banking Type (Large Banks, Midsize Banks, Small Banks, Community Banks, and Credit) |

| Companies covered:: | GFT Technologies SE, SAP SE, FinTech Group AG, FinLeap GmbH, Sopra Banking Software, Infosys Finacle, Fiducia and GAD IT AG, Temenos AG, Mambu GmbH, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Core banking software is being adopted by German banks and financial institutions in order to provide centralized, real-time banking services and streamline operations. Furthermore, banks are being pushed to adopt core banking platforms, automate manual processes, and improve data management in order to lower operating costs and increase efficiency. Moreover, to improve user experience and streamline financial operations, Germany's banking industry is utilizing automation, AI-driven solutions, and analytical tools. Additionally, the need for scalable and effective core banking solutions is being driven by Germany's expanding bank and financial service provider landscape. German banks are investing in core banking software to ensure compliance, improve risk management, and strengthen cybersecurity in light of the country's strict financial regulations.

Restraining Factors

The core banking software solutions necessitate large upfront investments in both staff and technology; their implementation can be costly. For small and midsize banks with tight budgets, this poses a serious obstacle to entry. Furthermore, integrating core banking software is a difficult and time-consuming process that calls for a large amount of technical know-how and resources.

Market Segmentation

The Germany core banking software market share is classified into deployment and banking type.

- The SaaS/hosted segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Germany core banking software market is segmented by deployment into SaaS/hosted and licensed. Among these, the SaaS/hosted segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth is driven by the scalability, cost-effectiveness, and seamless integration with modern banking systems. Many financial institutions in Germany are making the switch to cloud-based core banking platforms. This move is all about boosting operational efficiency and keeping up with changing regulatory demands.

- The large bank segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany core banking software market is segmented by banking type into large banks, midsize banks, small banks, community banks, and credit unions. Among these, the large banks segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is due to the vast customer bases and intricate operations that demand strong, scalable, and secure core banking systems. These institutions pour significant resources into digital transformation, which fuels the need for cutting-edge core banking software that enables real-time processing, omnichannel banking, regulatory compliance, and seamless integration with fintech solutions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany core banking software market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- GFT Technologies SE

- SAP SE

- FinTech Group AG

- FinLeap GmbH

- Sopra Banking Software

- Infosys Finacle

- Fiducia and GAD IT AG

- Temenos AG

- Mambu GmbH

- Others

Recent Developments:

- In May 2025, Banking software provider Temenos recently unveiled the Temenos Product Manager Copilot at the Temenos Community Forum 25 in Madrid, Spain. This innovative tool is designed to help banks with the design, launch, testing, and optimization of financial products, all powered by Generative AI (Gen AI) technology.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany core banking software market based on the below-mentioned segments:

Germany Core Banking Software Market, By Deployment

- SaaS/Hosted

- Licensed

Germany Core Banking Software Market, By Banking Type

- Large Banks

- Midsize Banks

- Small Banks

- Community Banks

- Credit

Need help to buy this report?