Germany Consumer Appliances Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Kitchen Appliances, Household Appliances), By Distribution Channels (Supermarkets, Online, And Specialty Stores), and Germany Consumer Appliances Market Insights, Industry Trend, Forecasts to 2033

Industry: Consumer GoodsGermany Consumer Appliances Market Insights Forecasts to 2033

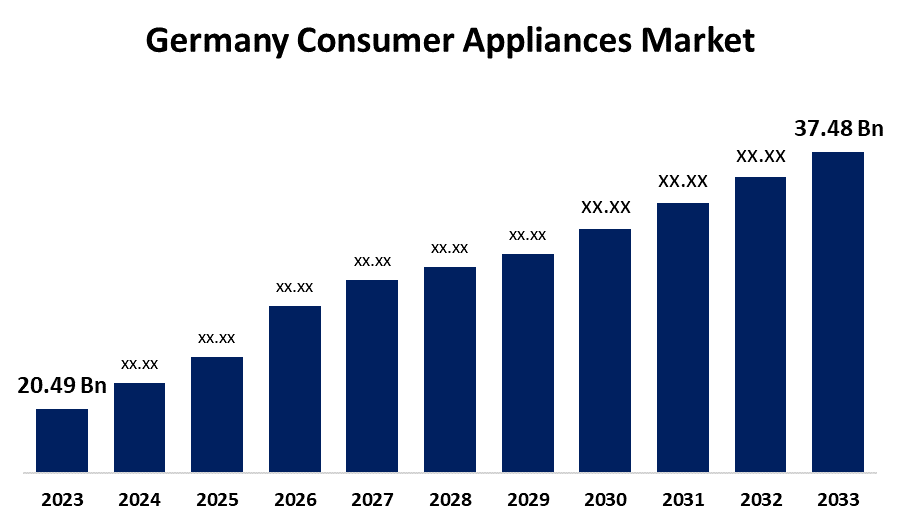

- The Germany Consumer Appliances Market Size was valued at USD 20.49 Billion in 2023

- The Market Size is growing at a CAGR of 6.22% from 2023 to 2033

- The Germany Consumer Appliances Market Size is expected to reach USD 37.48 Billion by 2033

Get more details on this report -

The Germany Consumer Appliances Market Size is anticipated to exceed USD 37.48 Billion by 2033, growing at a CAGR of 6.22% from 2023 to 2033.

Germany's consumer appliances market is thriving as a result of a growing need for modern, innovative technologies that help people complete daily tasks in less time, as well as trade deals for upgrading and remodelling homes or swapping outdated home appliances.

Market Overview

Consumer appliances refer to electrical or mechanical devices designed for use in households to perform various tasks or functions, primarily for the convenience, comfort, or efficiency of individuals or families. These appliances are typically used in kitchens, laundry rooms, living rooms, and other areas of the home. Companies in Germany's household appliance sector produce both large and small appliances. The increases in sales of the richest residences in Germany have resulted in a boost in demand for high-end luxury kitchens and domestic appliances. The market's rapid rise is primarily due to the popularity of high-quality and premium items. Increased per capita income, increased affordability, limited space, and a need for convenience are also factors. Furthermore, as the proportion of dual-income families rises across the country, so does interest in various home equipment, as these households often have more money than most single-income homes. Furthermore, when the country's economy grows, disposable income rises, enhancing consumer buying power. Individual enterprises in the household appliance sector develop revenue through extremely successful marketing techniques and efficient operations. Developed distribution channels, such as large stores, have an advantage over competitors in the distribution chain for this market.

Report Coverage

This research report categorizes the market for the Germany consumer appliances market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the consumer appliances market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the consumer appliances market.

Germany Consumer Appliances Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 20.49 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.22% |

| 2033 Value Projection: | USD 37.48 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type, By Distribution Channels |

| Companies covered:: | Liebherr, BSH Hausegrate GmbH, Electrolux Group, Gorenje, Bosch, Panasonic Corporation, Miele, Thermador, Gaggenau, Philips GmbH, Electrolux, Bauknecht appliances, Siemens, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Major market participants are investing greater funds in R&D initiatives to produce distinctive products that include innovative technologies such as artificial intelligence and the global Internet of things. However, through rising funding for the construction of smart houses throughout Germany's industrialized regions, interest in new consumer goods products and related gadgets such as smart kitchen appliances are rapidly increasing in the household sector. This also helps the market development. The launch of innovative consumer electronics showrooms is projected to increase sales of kitchen equipment. Consumer electronics companies are increasingly looking at setting up new showrooms and stores to capitalize on the growing demand for novel consumer products such as electric cooktops, standard grills, and others in modern German homes.

Restraining Factors

Smart home gadgets are pricey, with additional upfront expenses for installation and maintenance. The high cost of smart devices prohibits many businesses and people from adopting them. According to the GFK research, 36% of the participants indicated their main concern was the expensive cost of smart home equipment. This may hamper the market growth.

Market Segmentation

The Germany consumer appliances market share is classified into product type and distribution channels.

- The household appliances segment is expected to hold a significant share of the Germany consumer appliances market during the forecast period.

The Germany consumer appliances market is segmented by product type into kitchen appliances and household appliances. Among these, the household appliances segment is expected to hold a significant share of the Germany consumer appliances market during the forecast period. Consumers have begun to use trendy and technologically advanced devices and appliances due to their simplicity and time-saving benefits. This segment is expected to increase consistently in Germany. The elements driving this expansion could be improved consumer lifestyles, increased spending power, and relocation of the rural population to metropolitan regions. The supply of essential household appliances is heavily influenced by consumer income, property restoration and remodeling, and the replacement of an appliance due to a malfunction or failure. During forecast period, the market for large domestic household appliances is predicted to grow rapidly.

- The online segment is expected to hold the largest share of the Germany consumer appliances market during the forecast period.

Based on the distribution channels, the Germany consumer appliances market is divided into supermarkets, online, and specialty stores. Among these, the online segment is expected to hold the largest share of the Germany consumer appliances market during the forecast period. In Germany, there is a higher level of concentration since established shops such as Metro (Media Markt and Saturn) have huge market shares, preventing new entries. E-commerce has become popular in Germany, with Amazon and Otto dominating the sector. Department shops are Germany's second-fastest-growing distribution channel, after only e-retail. The German public has shown a preference for retail deals and discounts, as well as a wide range of secure e-payment methods. Therefore, the German e-retail and departmental stores are projected to have rapid growth during forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany consumer appliances market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Liebherr

- BSH Hausegrate GmbH

- Electrolux Group

- Gorenje

- Bosch

- Panasonic Corporation

- Miele

- Thermador

- Gaggenau

- Philips GmbH

- Electrolux

- Bauknecht appliances

- Siemens

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent developments

- In April 2023, the technology company from Germany that produces household appliances is planning to increase its facility in Aguascalientes, Mexico. The company initially intended to invest $75.3m in its operations in the city, but has now decided to raise the investment to $258.2m. This advancement will result in the creation of 400 additional positions.

Market Segment

This study forecasts country revenue from 2020 to 2033. Spherical Insights has segmented the Germany washing machine market based on the below-mentioned segments:

Germany Consumer Appliances Market, By Product Type

- Kitchen Appliances

- Household Appliances

Germany Consumer Appliances Market, By Distribution Channels

- Super Markets

- Online

- Specialty Stores

Need help to buy this report?