Germany Commercial Real Estate Software Market Size, Share, and COVID-19 Impact Analysis, By Functionality (Risk Management, Portfolio Management, Transaction Management, and Operations Management, and Others), By End-User (Real Estate Agents/Brokers, Property Owners/Investors, and Property Managers), and Germany Commercial Real Estate Software Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyGermany Commercial Real Estate Software Market Insights Forecasts to 2035

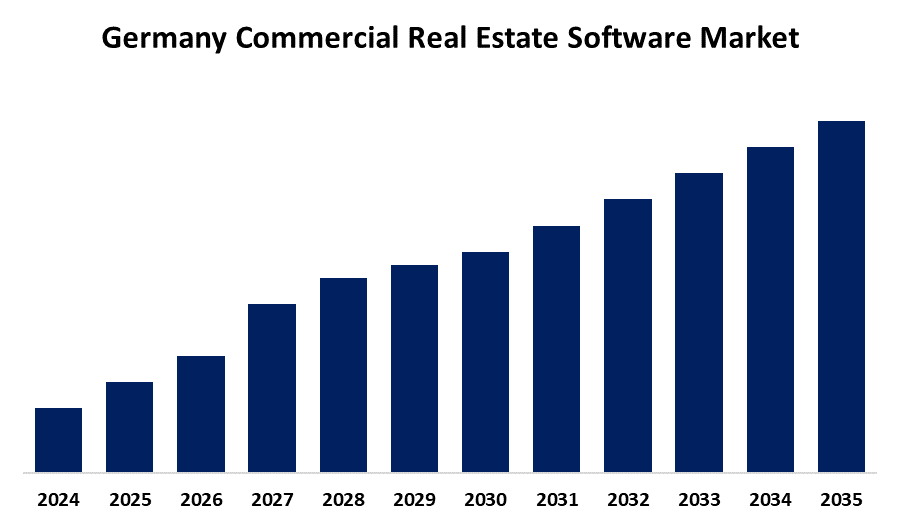

- The Germany Commercial Real Estate Software Market size is Expected to grow at a CAGR of around 7.1% from 2025 to 2035.

- The Germany Commercial Real Estate Software Market size is Expected to Hold a Significant Share by 2035.

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the Germany Commercial Real Estate Software Market Size is Expected to Grow at a CAGR of 7.1% during the forecast period 2025-2035. The market is driven by the rising adoption of AI and data analytics for smarter property management and investment decisions. Increasing demand for energy-efficient buildings and ESG compliance tools is also boosting software uptake. Government initiatives like the BIM mandate and EU digitalization funding further support market expansion.

Market Overview

The German Commercial Real Estate (CRE) refers to the section of digital solutions designed for management, operation and adaptation of commercial properties such as mixed-utilization in the software market, office buildings, retail centers, warehouses and Germany. These software platforms provide functionality like lease management, property account, asset tracking, building maintenance, tenant engagement and data analytics. Inspired by the increasing demand for digital changes, stability compliance and increasing demand for smart building techniques, the market is developing rapidly with the integration of AI, IOT, and cloud-based solutions, which corresponds to property owners, managers, investors and developers. Along with increasing the appetite of the investor for data intelligence, the providers offering AI-based valuation, risk scoring and tenant forecast are well deployed. As the Germany efficiency tightens the mandate (begging renewal grant), software that helps in compliance when optimizing performance is ready for the market. Emerging opportunities are present in block chains, which are on platforms based on real estate assets, which improve liquidity and transparency. Germany took advantage of € 1.3 billion in support of the European Union for digital infrastructure including Cree Tech. Since 2025, Building Information Modeling (BIM) becomes mandatory on Federal Road and Rail Projects, which demands BIM- compatible CRE platforms.

Report Coverage

This research report categorizes the market for the Germany commercial real estate software market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany commercial real estate software market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany commercial real estate software market.

Germany Commercial Real Estate Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 7.1% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 123 |

| Segments covered: | By Functionality, By End-User and COVID-19 Impact Analysis. |

| Companies covered:: | Yardi Systems, MRI Software, CBRE Germany, ImmobilienScout24, Accruent, Altus Group, CoStar Group, Oracle and Others. |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

Cloud is now the largest and fastest growing deployment model in Germany's CRE Software Market. Energy use, occupancy, and maintenance system is the system of integrating the IOT sensor, partially powered by the European Union Energy Efficiency Rules. Regulatory requirements to monitor and report ESG Matrix generate demand for software to use energy use and carbon performance.

Restraining Factors

Limited in-house IT expertise increases dependence on expensive advisors. GDPR compliance, increasing cyber threats, and multi-jurisdiction data complications are obstructions. Diverse local building regulations and permission delays (especially in rural municipalities) complicate the standardized CRE software rollout.

Market Segmentation

The Germany commercial real estate software market share is classified into functionality and end-user.

- The transaction management segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany commercial real estate software market is segmented by functionality into risk management, portfolio management, transaction management, and operations management, and others. Among these, the transaction management segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This dominated driven by a strong focus on rental deals and the need for efficient management of complex transactions. While other areas like portfolio management, risk management, and operations management are also important, the high volume of rental transactions in the German market necessitates robust software solutions for handling leases, contracts, and related processes.

- The property managers segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany commercial real estate software market is segmented by end-user into real estate agents/brokers, property owners/investors, and property managers. Among these, the property managers segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is primarily due to their extensive use of software to manage daily tasks, such as tenant screening, rent collection, maintenance requests, and financial reporting. The complexity and volume of these tasks, coupled with the need for efficient and centralized management, drive the demand for property management software among this user group.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany commercial real estate software market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Yardi Systems

- MRI Software

- CBRE Germany

- ImmobilienScout24

- Accruent

- Altus Group

- CoStar Group

- Oracle

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany commercial real estate software market based on the below-mentioned segments:

Germany Commercial Real Estate Software Market, By Functionality

- Risk Management

- Portfolio Management

- Transaction Management

- Operations Management

- Others

Germany Commercial Real Estate Software Market, By End-User

- Real Estate Agents,Brokers

- Property Owners,Investors

- Property Managers

Need help to buy this report?