Germany Commercial Property Insurance Market Size, Share, and COVID-19 Impact Analysis, By Coverage (Open Perils and Named Perils), By Distribution Channels (Agents and Brokers and Direct Response), and Germany Commercial Property Insurance Market Insights, Industry Trend, Forecasts to 2033

Industry: Banking & FinancialGermany Commercial Property Insurance Market Insights Forecasts to 2033

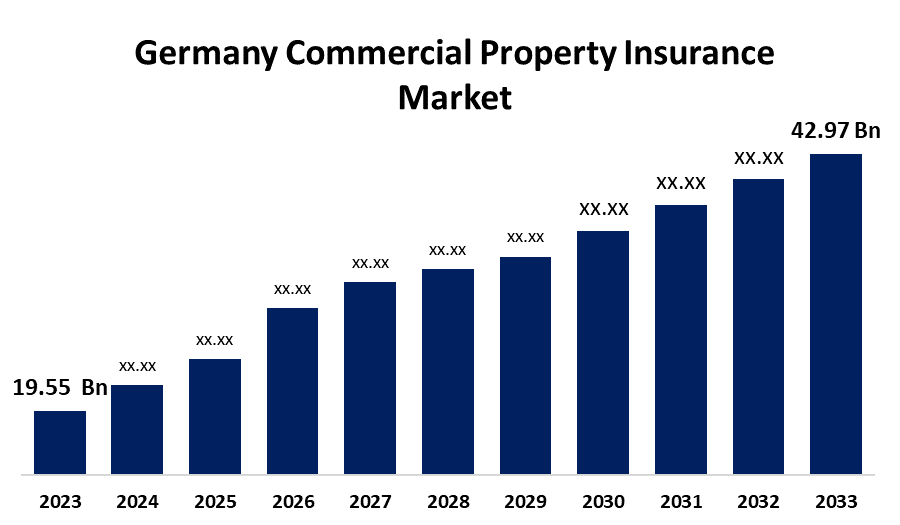

- The Germany Commercial Property Insurance Market Size was valued at USD 19.55 Billion in 2023.

- The Market Size is Growing at a CAGR of 8.19% from 2023 to 2033

- The Germany Commercial Property Insurance Market Size is Expected to Reach USD 42.97 Billion by 2033

Get more details on this report -

The Germany Commercial Property Insurance Market Size is Anticipated to Reach USD 42.97 Billion by 2033, Growing at a CAGR of 8.19% from 2023 to 2033.

Market Overview

The German commercial property insurance market is a vital segment of the nation’s broader insurance sector, projected to grow significantly due to advancements in digital technologies like AI, IoT, and big data, enhancing risk assessment and underwriting. The market offers coverage against risks such as natural disasters, theft, and operational disruptions, but faces challenges from climate-related events, highlighting a protection gap, with only 52% of buildings covered for natural hazards. Government initiatives aimed at reducing climate risks, such as stricter building regulations and public-private partnerships for disaster loss sharing, are driving market resilience. Additionally, policies promoting sustainable construction and climate risk assessments are shaping the future of the market, presenting both opportunities and challenges for insurers and businesses in adapting to evolving risk landscapes.

Report Coverage

This research report categorizes the Germany commercial property insurance market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany commercial property insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany commercial property insurance market.

Germany Commercial Property Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 19.55 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.19% |

| 2033 Value Projection: | USD 42.97 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | By Coverage, By Distribution Channels and COVID-19 Impact Analysis |

| Companies covered:: | Allianz Se, R+V Versicherung, Axa Group, Leeb Versicherungsmakler Gmbh, Factory Mutual Insurance Company (Fm Global), Assicurazioni Generali S.P.A, American International Group Inc. (Aig), Adcubum Ag, Everest Group, Ltd, Zurich Insurance Group, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The increasing frequency of natural disasters, such as floods and storms, has heightened the demand for robust property coverage, pushing businesses to seek comprehensive protection. The government’s focus on climate risk mitigation through policies like stricter building regulations and incentives for sustainable construction also drives market growth. Moreover, the rising need for businesses to secure their assets against operational disruptions and the growing trend of digitalization within the insurance sector further contribute to the market's expansion.

Restraining Factors

One significant challenge is the increasing frequency and severity of climate-related events, such as floods and storms, which lead to higher insurance claims and rising premiums, making coverage less affordable for some businesses.

Market Segmentation

The Germany commercial property insurance market share is classified into coverage and distribution channels.

- The open perils segment accounted for the largest share in 2023 and is expected to grow at a substantial CAGR during the forecast period.

The Germany commercial property insurance market is segmented by coverage into open perils and named perils. Among these, the open perils segment accounted for the largest share in 2023 and is expected to grow at a substantial CAGR during the forecast period. The segment growth is driven as open perils policies provide broader coverage, protecting against all risks unless specifically excluded, making them an attractive option for businesses seeking comprehensive protection.

- The agents and brokers segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

The Germany commercial property insurance market is segmented by distribution channels into agents and brokers and direct response. Among these, the agents and brokers segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period. The segment dominance can be attributed to the personalized services offered by agents and brokers, who play a key role in providing tailored insurance solutions and guiding businesses through complex insurance policies. Their expertise in risk assessment, claims management, and navigating the regulatory landscape makes them the preferred choice for many businesses seeking commercial property coverage.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany commercial property insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Allianz Se

- R+V Versicherung

- Axa Group

- Leeb Versicherungsmakler Gmbh

- Factory Mutual Insurance Company (Fm Global)

- Assicurazioni Generali S.P.A

- American International Group Inc. (Aig)

- Adcubum Ag, Everest Group, Ltd

- Zurich Insurance Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2021, to increase openness and safeguard consumers, the French government recently enacted new regulations for insurance brokers. Insurance brokers must now better inform customers about their insurance options and be more open about their fees and commissions under the new regulations.

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Germany commercial property insurance market based on the below-mentioned segments:

Germany Commercial Property Insurance Market, By Coverage

- Open Perils

- Named Perils

Germany Commercial Property Insurance Market, By Distribution Channels

- Agents and Brokers

- Direct Response

Need help to buy this report?