Germany Cigarette Market Size, Share, and COVID-19 Impact Analysis, By Flavored (Flavored and Non- Flavored), By Size (Slim, Super Slim, King-size, Regular), By Distribution Channel (Offline Stores, Online Sales), and Germany Cigarette Market Insights, Industry Trend, Forecasts to 2035.

Industry: Consumer GoodsGermany Cigarette Market Insights Forecasts to 2033

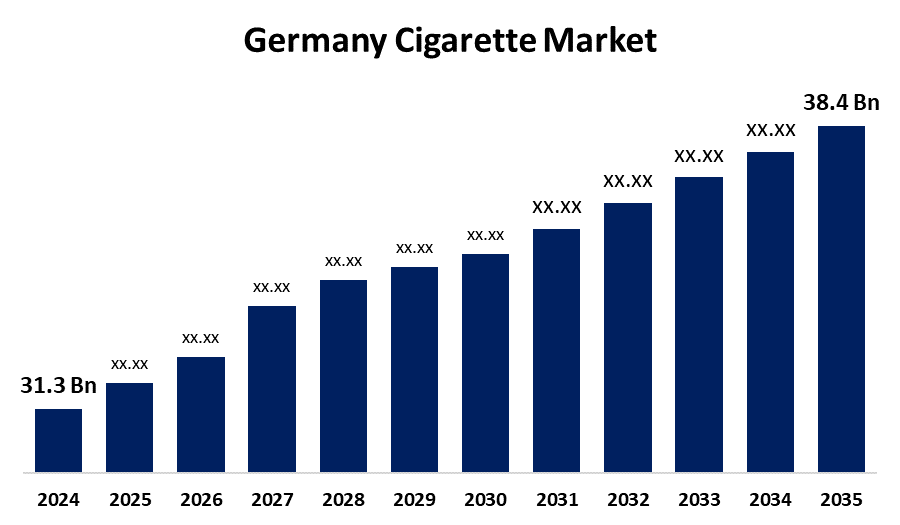

- The Germany Cigarette Market Size Was Estimated at USD 31.3 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 1.87% from 2025 to 2035

- The Germany Cigarette Market Size is Expected to Reach USD 38.4 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Germany Cigarette Market Size is Anticipated to reach USD 38.4 Billion By 2035, growing at a CAGR of 1.87% from 2025 to 2035. The market for cigarette is being driven by marketing strategy of rising disposable incomes, urbanization, and increasing demand for premium and flavored cigarettes. The market is also influenced by strong distribution networks and changing consumer preferences.

Market Overview:

The Germany cigarette industry market includes those individuals and corporations who are involved in the production, preparation for sale, exportation, advertisement, and distribution of cigarette and cigarette-associated goods. It is commonly used for smoking, in which tobacco is ignited and the smoke drawn from the filtered or unfiltered end. It is highly utilized as a tobacco product that is addictive depending on whether or not it contains nicotine. Smoking cigarettes is a long-standing practice in many cultures and has attained social popularity as well as condemnation. Consequently, it is increasingly on the rise everywhere. Moreover, the market is mainly propelled by the increasing demand for the product by consumers. Secondly, the addictive property of nicotine in cigarettes generates a steady demand among current users of cigarettes, thereby impacting market growth. Nicotine generates a strong combination of physical and psychological dependence, thereby generating a long-term demand for tobacco among its current consumers. One key reason the market remains resilient is the huge worldwide consumer base. Even with growing knowledge of the health hazards of the use of the product, there are still many millions of individuals across the world who decides to initiate smoking or find it difficult to quit. This massive consumer base gives a reliable demand for tobacco products. The introduction of a new line of tobacco products indicates a moderate rise in the number of people who smoke and the number of people who experiment with the new products. The application of a number of interesting techniques in the marketing approach has led to significant developments and has been a way of staying competitive and maintaining market leadership. Marlboro, Newport, and Camel, whose marketing campaigns targeted the youth specifically, were the highest marketing spenders. Consequently, these were the most preferred brand by the youth. Tobacco has been a major component of many people's lives, throughout the past decade.

Report coverage:

This research report categorizes the market for the Germany cigarette market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany cigarette market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany cigarette market.

Germany Cigarette Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 31.3 Billion |

| Forecast Period: | 2025 - 2035 |

| Forecast Period CAGR 2025 - 2035 : | 1.87% |

| 2035 Value Projection: | USD 38.4 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Flavored, By Size, By Distribution and COVID-19 Impact Analysis |

| Companies covered:: | Philip Morris International (PMI), British American Tobacco (BAT), Japan Tobacco International (JTI), Imperial Brands, Marlboro, L&M, Chesterfield, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Diving factors:

A number of drivers fuel the Germany cigarette business. Some drivers are growing populations of adults, world smoking behavior, and growth in retailing and e-commerce channels. Government policies, social norms, as well as economic trends, are also major factors. The existence of inelastic demand for cigarettes, even for taxes, drives the industry even further. The popularity of specific brands and the continuous investment in product innovation by manufacturers play a role in maintaining market position.

Restraining Factors:

The cigarette industry contains several obstacles, mainly restricted by government intervention and continuous public awareness. Some of the most important constraints are advertising and marketing bans, labeling packaging on products with health warnings, prohibiting smoking in sensitive locations such as hospitals, schools, public areas, etc., putting heavy taxes on cigarettes, and industry attempts to intervene in research and reduce the health effects of smoking. More taxation on tobacco can have the consequence of making prices higher, so cigarettes become less appealing and affordable, particularly among youth. The industry has been more than happy to downplay the health risks of smoking and the addicting nature of nicotine and created a public health epidemic.

Market Segmentation:

The Germany cigarette market share is classified into flavored, size, distribution channel.

- The non-flavored segment held a dominant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany cigarette market is segmented by product type into flavored and non- flavored. Among these, the non-flavored segment held a dominant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Non-flavored cigarettes are cigarettes with no added flavors or additives. They are normally produced with tobacco and do or do not contain filters. The main reason for demand of non-flavored cigarettes is that they are thought to be less harmful to health than flavored cigarettes. Non-flavored cigarettes are simpler to quit than flavored ones. This segment will grow significantly.

- The regular segment held a dominant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany cigarette market is segmented by size into slim, super slim, king-size, and regular. Among these, the regular segment held a dominant share in 2024 and is expected to grow at a significant CAGR during the forecast period. These are the classic, full-flavored cigarettes and are still the most sought-after form, particularly in most nations. Regular-sized cigarettes are popular due to a combination of factors like established customer preference, price, and heritage popularity. Smokers feel that regular-sized cigarettes provide a better experience than shorter ones. Moreover, the fact that they are most popular and their price make them continue to be in high demand.

- The offline stores segment held a dominant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany cigarette market is segmented by distribution channel into offline stores and online marketplace. Among these, the offline segment held a dominant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to reasons such as ubiquitous physical presence, instant access for customers, and several promotional tactics employed at the point of sale. Although online channels are expanding, offline retailing is still the main channel of distribution. Offline stores provide instant access and enable shoppers to visit and choose products, something that is a major benefit.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany cigarette market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies:

- Philip Morris International (PMI)

- British American Tobacco (BAT)

- Japan Tobacco International (JTI)

- Imperial Brands

- Marlboro

- L&M

- Chesterfield

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany cigarette market based on the below-mentioned segments:

Germany Cigarette Market, By Flavored Type:

- Flavored

- Non-flavored

Germany Cigarette Market, By Size:

- Slim

- Super slim

- King-size

- Regular

Germany Cigarette Market, By Distribution Channel:

- Online sales

- Offline shops

Global Cigarette Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?