Germany Chemical Distribution Market Size, Share, and COVID-19 Impact Analysis, By Specialty Chemicals (Pharmaceuticals, Textiles, Consumer Goods, Industrial Manufacturing, Agriculture, Constructions, and Automotive & Transportation), By End-User (Industrial Manufacturing, Electrical & Electronics, Automotive & Transportation, Textiles, Downstream Chemicals, and Other), and Germany Chemical Distribution Market Insights, Industry Trend, Forecasts to 2035.

Industry: Chemicals & MaterialsGermany Chemical Distribution Market Insights Forecasts to 2035

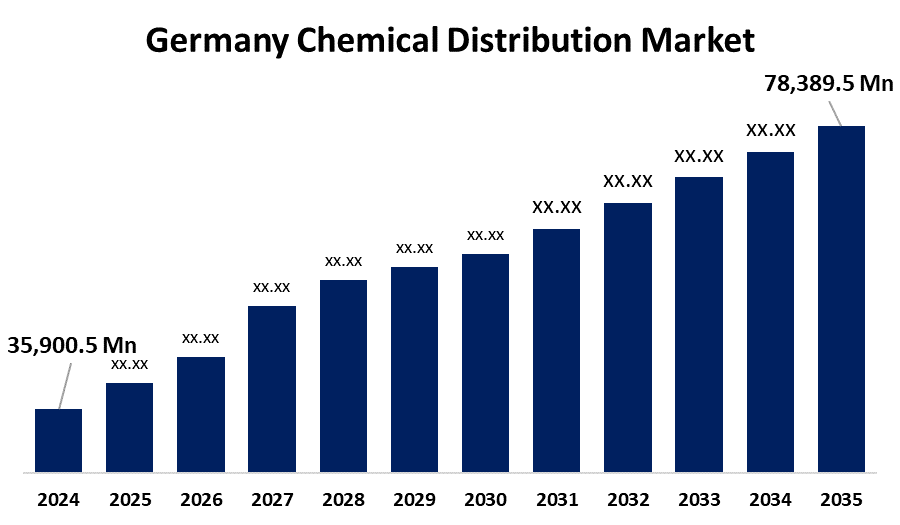

- The Germany Chemical Distribution Market Size was estimated at USD 35,900.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.36% from 2025 to 2035

- The Germany Chemical Distribution Market Size is Expected to Reach USD 78,389.5 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Germany Chemical Distribution Market Size is anticipated to reach USD 78,389.5 Million by 2035, growing at a CAGR of 7.36% from 2025 to 2035. The Germany chemical distribution market is driven by growing tourism, higher disposable income, desire for immersive and themed experiences, and advances in technology like virtual reality and interactive rides. Seasonal attractions and family entertainment also increase year-round visitor activity and revenue growth.

Market Overview

The Germany chemical distribution market is the sector that includes businesses that purchase, store, and distribute chemicals to a range of sectors, including manufacturing, pharmaceuticals, and agriculture. Distributors provide services like logistics, packaging, blending, and regulatory support, serving as a bridge between chemical manufacturers and end users. The market for chemical distribution in Germany demonstrates inclusive trends, including the rise in demand, especially from the personal care and pharmaceutical industries. This increased demand is fueled by ongoing advancements in pharmaceutical research and development. Furthermore, the need for a wide variety of chemicals in the formulation of medications and the production of personal care products is driven by a greater emphasis on health and hygiene.

Report Coverage

This research report categorizes the market for Germany chemical distribution market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany chemical distribution market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany chemical distribution market.

Germany Chemical Distribution Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 35,900.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.36% |

| 2035 Value Projection: | USD 78,389.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 212 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Specialty Chemicals (Pharmaceuticals, Textiles, Consumer Goods, Industrial Manufacturing, Agriculture, Constructions, and Automotive & Transportation), By End-User (Industrial Manufacturing, Electrical & Electronics, Automotive & Transportation, Textiles, Downstream Chemicals, and Other) |

| Companies covered:: | Univar Solutions Inc, HELM AG, Brenntag SE, Barentz, Azelis Group NV, Safic-Alcan, Caldic BV, ICC Industries In, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The German chemical distribution market is driven by the expanding demand from the personal care and pharmaceutical industries. This increase demonstrates how responsive the market is to developments in pharmaceuticals as well as growing health and hygiene consciousness. The market is also undergoing a significant change as a result of the increasing use of online platforms. Furthermore, chemical procurement procedures are now more efficient and globally accessible thanks to the shift from conventional distribution methods to online platforms, which expands the distribution sphere.

Restraining Factors

The raw material price fluctuations and uncertainties are introduced into the supply chain by fluctuating raw material prices, which impact distributors' expenses and profit margins. Adopting sound risk management techniques and putting strong strategies into action are essential to overcoming this obstacle.

Market Segmentation

The Germany chemical distribution market share is classified into specialty chemicals and end-user.

- The industrial manufacturing segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Germany chemical distribution market is segmented by specialty chemicals into pharmaceuticals, textiles, consumer goods, industrial manufacturing, agriculture, construction, and automotive & transportation. Among these, the industrial manufacturing segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth is driven by the nation's sophisticated production systems, high-performance specialty chemical demand, and robust industrial base. Moreover, specialty chemicals that adhere to stringent environmental regulations are used more frequently in Germany because of its dedication to sustainability and innovation.

- The electrical & electronics segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany chemical distribution market is segmented by end-user into industrial manufacturing, electrical & electronics, automotive & transportation, textiles, downstream chemicals, and others. Among these, the electrical & electronics segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is due its dependence on high-performance chemicals used in the production of electronics and semiconductors. Moreover, the growing demand for smart devices and electric cars, and government-supported initiatives for digital transformation.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany chemical distribution market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Univar Solutions Inc

- HELM AG

- Brenntag SE

- Barentz

- Azelis Group NV

- Safic-Alcan

- Caldic BV

- ICC Industries In

- Others

Recent Developments:

- In March 2025, By June 2025, OQ Chemicals plans to start producing heptanoic acid in Oberhausen, Germany. The objective of this strategic investment is to improve supply chain security and diversify its portfolio of carboxylic acids. Performance materials, energy solutions, consumer goods, and aviation are just a few of the industries that use hexanoic acid.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany chemical distribution market based on the below-mentioned segments:

Germany Chemical Distribution Market, By Specialty Chemicals

- Pharmaceutical

- Textiles

Consumer Goods - Industrial Manufacturing

- Agriculture

- Constructions

- Automotive & Transportation

- Others

Germany Chemical Distribution Market, By End-User

- Commodity Chemicals

- Industrial Manufacturing

- Electrical & Electronics

- Automotive & Transportation

- Textiles

- Downstream Chemicals

- Other

Need help to buy this report?