Germany Building Integrated Photovoltaics Market Size, Share, and COVID-19 Impact Analysis, By Technology (Crystalline Silicon, Thin Film), By Application (Roof, Glass, Facade, Wall) and Germany Building Integrated Photovoltaics Market Insights, Industry Trend, Forecasts to 2035

Industry: Construction & ManufacturingGermany Building Integrated Photovoltaics Market Insights Forecasts to 2035

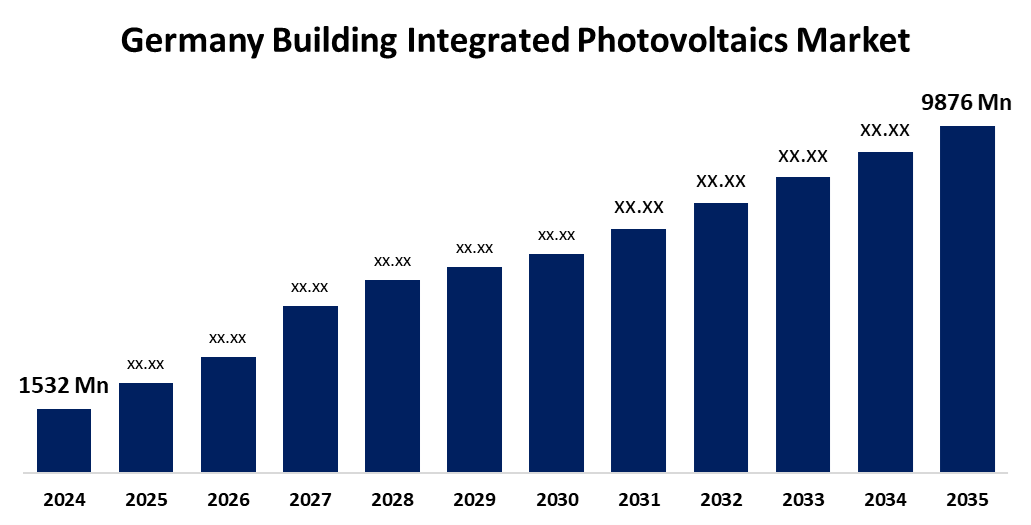

- The Germany Building Integrated Photovoltaics Market Size Was Estimated at USD 1532 Million in 2024.

- The Market Size is Expected to Grow at a CAGR of around 18.46% from 2025 to 2035.

- The Germany Building Integrated Photovoltaics Market Size is Expected to Reach USD 9876 Million by 2035.

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Germany Building Integrated Photovoltaics Market Size is Expected to Grow from USD 1532 Million in 2024 to USD 9876 Million by 2035, Growing at a CAGR of 18.46% during the forecast period 2025-2035. The market is driven by supportive government policies, technological advancements, and a growing focus on sustainability.

Market Overview

The German Building Integrated Photovoltics (BIPV) refers to the area within the market Germany, focused on integrating the solar photovoltaic (PV) technique in building components such as roofs, aspects and windows, and essentially converts these structures into an electric generator. This approach combines energy production with building construction, which offers both beauty and functional benefits. The German Building Integrated Photovoltics (BIPV) provides strong opportunities due to growing renewable energy and permanent construction practices. The decrease in carbon emissions combined with Germany's commitment to Green Building Certificate and progress in BIPV technology has increased significant growth in the market. The German government is actively supporting the building integrated photovoltics (BIPV) market through various schemes and policies including "Climate Action Program 2030", "Renewable Energy Source Act (EEG)", and Green Building Certification. These initiatives aim to increase adoption of BIPVs in new and existing buildings, contributing to Germany's energy transition goals and reducing greenhouse gas emissions.

Report Coverage

This research report categorizes the market for the Germany building integrated photovoltaics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany building integrated photovoltaics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany building integrated photovoltaics market.

Germany Building Integrated Photovoltaics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1532 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 18.46% |

| 2035 Value Projection: | USD 9876 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Technology, By Application |

| Companies covered:: | AGC Inc., Heliatek GmbH, AVANCIS GmbH, Hanergy Thin Film Power Group Europe, Ertex Solar, ISSOL sa, Onyx Solar, SUNOVATION GmbH, BELECTRIC, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The German building integrated photovoltaic (BIPV) market is experiencing development due to several factors, including a strong focus on subsidiary government policies, technological progresses and stability. In particular, Germany's commitment to reduce greenhouse gas emissions and promote renewable energy is a major driver. In addition, the declining costs of BIPV technology and the increasing demand for energy-efficient buildings are contributing to the expansion of the market.

Restraining Factors

The primary preventive factor for the German building integrated photovoltaic (BIPV) market is the lack of high early costs, integration complexity and easily available cost-profit analysis. While BIPV provides long -term energy savings and beauty benefits, important upfront can prevent investment developers and property owners, especially on tight budget.

Market Segmentation

The Germany building integrated photovoltaics market share is classified into technology and application.

- The crystalline silicon segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany building integrated photovoltaics market is segmented by technology into crystalline silicon, thin film. Among these, the crystalline silicon segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is dominated due to its higher efficiency, longer lifespan, and established manufacturing processes.

- The roof segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany building integrated photovoltaics market is segmented by application into roof, glass, facade, and wall. Among these, the roof segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Rooftop BIPV systems have been the most prevalent due to the ample space available and the established nature of roof-mounted solar installations. They are also favored for their potential to improve energy efficiency and aesthetic appeal.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany Building integrated photovoltaics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AGC Inc.

- Heliatek GmbH

- AVANCIS GmbH

- Hanergy Thin Film Power Group Europe

- Ertex Solar

- ISSOL sa

- Onyx Solar

- SUNOVATION GmbH

- BELECTRIC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany building integrated photovoltaics market based on the below-mentioned segments:

Germany Building Integrated Photovoltaics Market, By Technology

- Crystalline Silicon

- Thin Film

Germany Building Integrated Photovoltaics Market, By Application

- Roof

- Glass

- Façade

- Wall

Need help to buy this report?