Germany Automotive Lead Acid Battery Market Size, Share, and COVID-19 Impact Analysis, By Battery Type (Flooded, SLI, Absorbent Glass Mat, and Enhanced Flooded Battery), By End-User (Passenger Cars, Light and Heavy Commercial Vehicles, and 2 & 3 Wheelers), and Germany Automotive Lead Acid Battery Market Insights, Industry Trend, Forecasts to 2035.

Industry: Automotive & TransportationGermany Automotive Lead Acid Battery Market Insights Forecasts to 2035

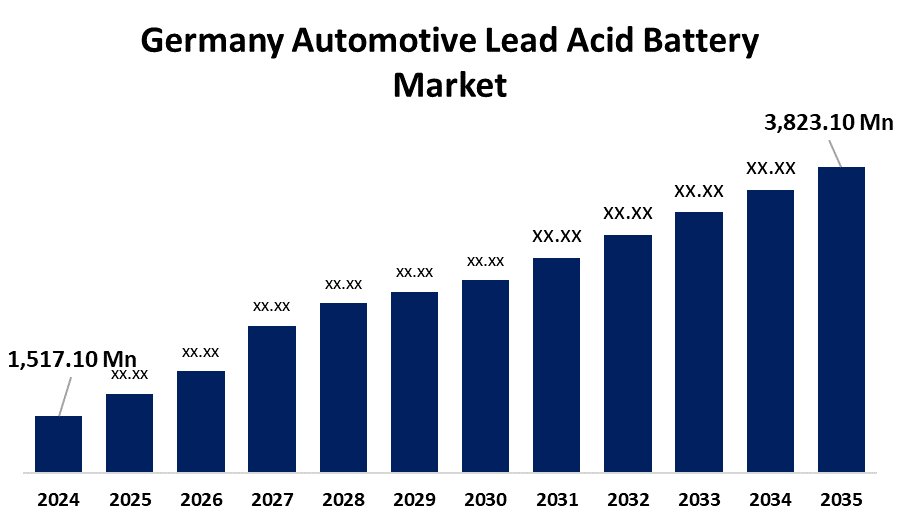

- The Germany Automotive Lead Acid Battery Market Size was estimated at USD 1,517.10 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.77% from 2025 to 2035

- The Germany Automotive Lead Acid Battery Market Size is Expected to Reach USD 3,823.10 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Germany Automotive Lead Acid Battery Market Size is anticipated to reach USD 3,823.10 Million by 2035, growing at a CAGR of 8.77% from 2025 to 2035. The Germany automotive lead acid battery market is driven by the growing market for hybrid and electric cars, which need dependable and effective battery solutions for ignition, lighting, and starting (SLI). Additionally, the automotive industry is encouraged to use lead-acid batteries by robust government policies that support sustainability initiatives and green technologies.

Market Overview

The Germany automotive lead acid battery market refers to the economic sector that is primarily focused on manufacturing and supplying lead acid batteries for use in automotive starting, lighting, and ignition (SLI) applications. These batteries are commonly found in two-wheelers, passenger cars, and commercial vehicles due to their affordability, reliability, and recyclable nature. The growing demand for hybrid and electric vehicles (EVs) is one important trend impacting the German automotive lead-acid battery market. As the automotive industry grows with a strong emphasis on sustainability and environmentally friendly transportation, there is a growing need for reliable and efficient battery solutions. Furthermore, lead-acid batteries are still necessary for auxiliary functions like starting, lighting, and ignition (SLI) in both conventional internal combustion engine (ICE) and hybrid vehicles, despite the growing popularity of lithium-ion batteries. The lead-acid battery market has a significant chance to prosper due to the continuous demand for SLI batteries, particularly as automakers look for dependable and reasonably priced alternatives.

Report Coverage

This research report categorizes the market for Germany automotive lead acid battery market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany automotive lead acid battery market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany automotive lead acid battery market.

Germany Automotive Lead Acid Battery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1,517.10 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.77% |

| 2035 Value Projection: | USD 3,823.10 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 222 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Battery Type (Flooded, SLI, Absorbent Glass Mat, and Enhanced Flooded Battery), By End-User (Passenger Cars, Light and Heavy Commercial Vehicles, and 2 & 3 Wheelers) |

| Companies covered:: | Banner Batteries, Clarios, Motive Power Batteries, Exide Industries Ltd., Johnson Controls, FNB Batteries, Robert Bosch LLC, GS Yuasa, ACDelco, East Penn Manufacturing, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing use of electric and hybrid vehicles in Germany is one of the primary factors driving the growth of the automotive lead-acid battery market in that nation. As the automotive industry shifts to more environmentally friendly options, electric and hybrid vehicles require batteries that support multiple functions, including starting, lighting, and ignition (SLI). Furthermore, automotive lead-acid batteries' performance and efficiency have been greatly enhanced by technological advancements, which have led to their ongoing market relevance. Moreover, lead-acid batteries are now a competitive option for automotive applications thanks to developments like improved energy density, longer lifespan, and improved charge retention.

Restraining Factors

The growing competition from cutting-edge battery technologies, especially lithium-ion batteries, is one of the main issues facing the German automotive lead-acid battery market. Many electric vehicles (EVs) and hybrid vehicles prefer lithium-ion batteries due to their superior energy density, longer lifespan, and faster charging capabilities, even though lead-acid batteries are more affordable and dependable.

Market Segmentation

The Germany automotive lead acid battery market share is classified into battery type and end-user.

- The SLI segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Germany automotive lead acid battery market is segmented by battery type into flooded, SLI, absorbent glass mat, and enhanced flooded battery. Among these, the SLI segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth is driven by their widespread use in a variety of automobiles, including both conventional and hybrid internal combustion engine (ICE) vehicles. Furthermore, these batteries are a popular option for both car manufacturers and end users due to their affordable performance, convenient availability, and dependable starting power.

- The passenger cars segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The Germany automotive lead acid battery market is segmented by end-user into passenger cars, light and heavy commercial vehicles, and 2 & 3 wheelers. Among these, the passenger cars segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth is attributed to the continued use of lead-acid batteries in cars, both hybrid and conventional. Moreover, these vehicles use SLI batteries to power essential functions like starting the engine, powering the lights, and sustaining electrical systems.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany automotive lead acid battery market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Banner Batteries

- Clarios

- Motive Power Batteries

- Exide Industries Ltd.

- Johnson Controls

- FNB Batteries

- Robert Bosch LLC

- GS Yuasa

- ACDelco

- East Penn Manufacturing

- Others

Recent Developments:

- In September, 2024, Cylib, a German battery recycling startup supported by Bosch and Porsche, started building its first industrial facility in Europe in Chempark Dormagen. The facility will be able to recycle 30,000 tons of end-of-life batteries a year when it starts operations in 2026.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany automotive lead acid battery market based on the below-mentioned segments:

Germany Automotive Lead Acid Battery Market, By Battery Type

- Flooded

- SLI

- Absorbent Glass Mat

- Enhanced Flooded Battery

Germany Automotive Lead Acid Battery Market, End-User

- Passenger cars

- Light and heavy commercial vehicles

- 2 & 3 Wheelers

Need help to buy this report?