Germany Automotive Adhesives and Sealants Market Size, Share, and COVID-19 Impact Analysis, By Resin (Acrylic, Cyanoacrylate, Epoxy, Polyurethane, Silicone, and VAE/EVA), By Technology (Hot Melt, Reactive, Sealants, Solvent-borne, UV Cured Adhesives, and Water-borne), and Germany Automotive Adhesives and Sealants Market Insights, Industry Trend, Forecasts to 2035.

Industry: Automotive & TransportationGermany Automotive Adhesives and Sealants Market Insights Forecasts to 2035

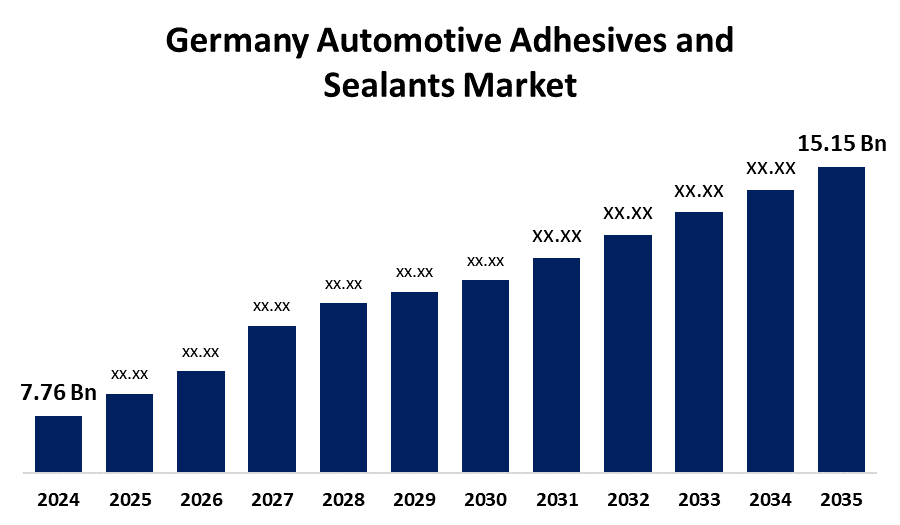

- The Germany Automotive Adhesives and Sealants Market Size was estimated at USD 7.76 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.27% from 2025 to 2035

- The Germany Automotive Adhesives and Sealants Market Size is Expected to Reach USD 15.15 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Germany Automotive Adhesives And Sealants Market Size is anticipated to reach USD 15.15 Billion by 2035, growing at a CAGR of 6.27% from 2025 to 2035. The Germany automotive adhesives and sealants market is driven by the stricter emission regulations around the world. Additionally, to lower greenhouse gas emissions, automakers are typically required by emission regulations to produce lighter, more fuel-efficient vehicles.

Market Overview

The Germany automotive adhesives and sealants market is the sector where adhesives and sealants are used for bonding, sealing, heat resistance, and vehicle weight reduction. From tiny parts like sensors to larger parts like vehicle chassis, automotive adhesives and sealants are widely used. Since they lighten vehicles and improve fuel economy, they are typically used in place of welding. Technology breakthroughs and sustainability initiatives are driving a major transformation in the automotive sector. Furthermore, to increase fuel efficiency and lessen their impact on the environment, major automakers are putting more and more emphasis on lightweight vehicle construction. The sophisticated bonding solutions are widely used in place of more conventional mechanical fastening techniques. Moreover, the market for automotive adhesives and sealants is seeing significant innovation driven by the electric vehicle (EV). Additionally, automotive structural adhesives with exceptional electrical insulation qualities and the ability to endure particular stress conditions are required for these applications.

Report Coverage

This research report categorizes the market for Germany automotive adhesives and sealants market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany automotive adhesives and sealants market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany automotive adhesives and sealants market.

Germany Automotive Adhesives and Sealants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 7.76 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.27% |

| 2035 Value Projection: | USD 15.15 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 228 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Resin (Acrylic, Cyanoacrylate, Epoxy, Polyurethane, Silicone, and VAE/EVA), By Technology (Hot Melt, Reactive, Sealants, Solvent-borne, UV Cured Adhesives, and Water-borne) |

| Companies covered:: | H.B. Fuller Company, Sika AG, PPG Industries, Inc., Dow, Jowat SE, Permabond, Hernon Manufacturing Inc., Evonik Industries AG, Solvay, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

In Germany, the market for automotive adhesives and sealants is seeing a significant increase in the use of epoxy-based products for manufacturing various car components. Furthermore, manufacturers are now dedicated to crafting adhesives that can meet the tough demands of today’s automotive electronics while ensuring they last for the long haul. This surge is largely due to their impressive bonding strength and excellent moisture resistance. On top of that, these adhesives are known for their durability, flexibility, and strong impact resistance. Additionally, find epoxy-based adhesives and sealants being utilized in the production of signal lights, headlights, and for bonding bumpers in vehicles. As one of the largest producers and exporters of automobiles, Germany is expected to keep experiencing a rise in the use of epoxy adhesives in the coming years.

Restraining Factors

The challenges for producers in the German automotive adhesives and sealants market is the ever-changing prices of raw materials. The costs of the materials used in adhesives and sealants can be quite unpredictable. Producers have to keep a close eye on these fluctuating prices, as they directly affect what customers expect to pay. At the same time, they need to find ways to protect their profit margins from the impact of these price swings.

Market Segmentation

The Germany automotive adhesives and sealants market share is classified by resin and technology.

- The polyurethane segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Germany automotive adhesives and sealants market is segmented by resin into acrylic, cyanoacrylate, epoxy, polyurethane, silicone, and VAE/EVA. Among these, the polyurethane segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth is driven by the superior durability, high flexibility, and a variety of substrates. Furthermore, they can be used in place of conventional mechanical fasteners; polyurethane automotive structural adhesives and sealants are especially popular because they reduce vehicle weight and increase fuel efficiency. The growing need for these materials in the production of electric vehicles, where they are essential for battery assembly and thermal management systems, is another factor propelling the segment's expansion.

- The reactive segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The Germany automotive adhesives and sealants market is segmented by technology into hot melt, reactive, sealants, solvent-borne, UV cured adhesives, and water-borne. Among these, the reactive segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth is attributed to the automotive industry uses reactive adhesives for a variety of tasks, including thread-locking and assembly and repair. Its versatility in bonding various substrates, including metals, plastics, composites, and glass, further solidifies the segment's dominance and makes it indispensable for the production of modern vehicles. Additionally, strong adhesion and flexibility in automotive applications are provided by reactive automotive adhesive sealant technologies, which are especially prized for their capacity to cure when applied through air moisture.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany automotive adhesives and sealants market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- H.B. Fuller Company

- Sika AG

- PPG Industries, Inc.

- Dow

- Jowat SE

- Permabond

- Hernon Manufacturing Inc.

- Evonik Industries AG

- Solvay

- Others

Recent Developments:

- In January 2023, Saint-Gobain has just rolled out its OneBond brand, launched a wide array of adhesives and sealants specifically designed for the automotive assembly and repair industries. This product range features solutions for everything from windscreen replacements to body and mechanical repairs.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany automotive adhesives and sealants market based on the below-mentioned segments:

Germany Automotive Adhesives and Sealants Market, By Resin

- Acrylic

- Cyanoacrylate

- Epoxy

- Polyurethane

- Silicone

- VAE/EVA

Germany Automotive Adhesives and Sealants Market, By Technology

- Hot Melt

- Reactive

- Sealants

- Solvent-borne

- UV Cured Adhesives

- Water-borne

Need help to buy this report?