Germany Auto Loan Market Size, Share, and COVID-19 Impact Analysis, By Loan Type (New Vehicle Loans, Used Vehicle Loans, Lease Buyout Loans, and Refinancing Loans), By Loan Term (Short-Term Loans (Up to 3 Years), Medium-Term Loans (3-5 Years), Long-Term Loans (Above 5 Years)), and Germany Auto Loan Market Insights, Industry Trend, Forecasts to 2035

Industry: Banking & FinancialGermany Auto Loan Market Insights Forecasts to 2035

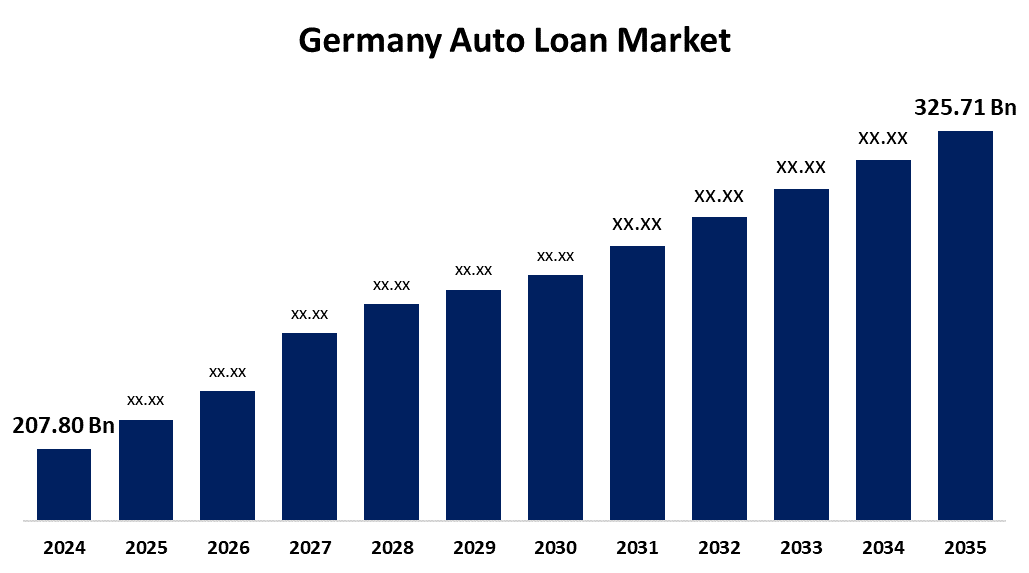

- The Germany Auto Loan Market Size was Estimated at USD 207.80 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.17% from 2025 to 2035

- The Germany Auto Loan Market Size is Expected to Reach USD 325.71 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Germany Auto Loan Market Size is anticipated to reach USD 325.71 Billion by 2035, Growing at a CAGR of 4.17% from 2025 to 2035. The Germany auto loan market is driven by the proliferation of government incentives and positive financing options, an increased demand for electric vehicles and sustainable transport solutions is also likely to help accelerate the growth of the Germany auto loan market.

Market Overview

The Germany auto loan market refers to loans from banks, credit unions, and institutions that allow businesses and individuals to buy vehicles over time with a payment structure. Generally, these loans are secured on the financed vehicle, which gives the lender a way to repossess the asset in the event of default. The continuing increase in the use of digital lending platforms has positively impacted the efficiency and accessibility of auto loans in Germany. Furthermore, using advanced technologies, including artificial intelligence and machine learning, is making way for full automation of credit assessments and approvals through digital lending systems. Moreover, the use of user-friendly systems to initiate loans with less documentation required has given consumers an effortless borrowing process. Digital lenders are driving growth through collaboration with traditional lenders or leveraging fintech start-ups as a key enabler of the industry's evolution. Through greater transparency of loans and payback structures, confidence in consumers has grown, and that has helped to increase loans delivered positively.

Report Coverage

This research report categorizes the market for Germany auto loan market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany auto loan market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany auto loan market.

Germany Auto Loan Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 207.80 Billion |

| Forecast Period: | 2025 - 2035 |

| Forecast Period CAGR 2025 - 2035 : | 4.17% |

| 2035 Value Projection: | USD 325.71 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 188 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Loan Type, By Loan Term, and COVID-19 Impact Analysis |

| Companies covered:: | Auto Empire Trading GmbH, Banque PSA Finance S.A., Deutsche Bank AG, Mercedes-Benz Bank AG, Nordfinanz GmbH, Santander Consumer Bank AG, Smava GmbH, Volkswagen Bank GmbH, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Germany has one of the highest vehicle ownership rates in Europe. A large automotive culture and a tendency to rely on personal mobility, rather than public transportation, drive this vehicle ownership. Germany's strong automotive ecosystem, including global manufacturers like Volkswagen, BMW, and Mercedes-Benz, is a major driver of demand for new and used vehicles. Several consumers and businesses prefer automotive financing, leasing options, and loans, rather than outright purchasing vehicles, generating demand for automotive financing. Moreover, automotive loans are in a highly competitive financing market, including banks, automotive finance includes automotive finance, banks, automotive finance companies, and fintech companies that are offering a wide variety of loan products.

Restraining Factors

Strict government policies and constantly changing compliance regulations have been posing challenges for Germany-based lenders serving the auto loan market. Financial institutions have restricted loans to subprime borrowers in order to comply with tighter credit evaluation standards to minimize the risk of loan defaults. Acceptance rates for loans have been impacted by increased scrutiny of affordability assessments and debt-to-income ratios.

Market Segmentation

The Germany auto loan market share is classified into loan type and loan term.

- The new vehicle loans segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Germany auto loan market is segmented by loan type into new vehicle loans, used vehicle loans, lease buyout loans, and refinancing loans. Among these, the new vehicle loans segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth is driven by the strong preference consumers have for the newest vehicle model, and advancements in automotive technology have greatly driven that demand. Furthermore, financing options continue to be attractive as banks and financial institutions offer lower interest rates and longer repayment options that help make it easier for consumers to afford the purchases.

- The long-term loans (above 5 years) segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany auto loan market is segmented by loan term into short-term loans (up to 3 years), medium-term loans (3–5 years), and long-term loans (above 5 years). Among these, the long-term loans (above 5 years) segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is due to the increasing demand is based on the consumer need for lower monthly payments and flexibility with repayment terms. Moreover, long-term stable interest rates are attracting consumers with long-term commitments. Longer-term financing often includes leases and balloon payments, all creating flexibility for borrowers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany auto loan market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Auto Empire Trading GmbH

- Banque PSA Finance S.A.

- Deutsche Bank AG

- Mercedes-Benz Bank AG

- Nordfinanz GmbH

- Santander Consumer Bank AG

- Smava GmbH

- Volkswagen Bank GmbH

- Others

Recent Developments:

- In June 2022, NEWARK, Calif.Lucid Group, Inc, which sets standards with the longest-range and fastest-charging electric car on the market, announced the launch of Lucid Financial Services, a new digital platform that offers Lucid Air customers a flexible, fast, and easy financing process that includes lease and loan purchase options.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany auto loan market based on the below-mentioned segments:

Germany Auto Loan Market, By Loan Type

- New Vehicle Loans

- Used Vehicle Loans

- Lease Buyout Loans

- Refinancing Loans

Germany Auto Loan Market, By Loan Term

- Short-Term Loans (Up to 3 Years)

- Medium-Term Loans (3–5 Years)

- Long-Term Loans (Above 5 Years)

Need help to buy this report?