Germany Animal Feed Market Size, Share, and COVID-19 Impact Analysis, By Type (Swine Animal Feed, Poultry Animal Feed, Ruminant Feed, Aquatic Feed, Others), By Product (Fodder, Forage, Others), and Germany Animal Feed Market Insights Forecasts to 2033

Industry: AgricultureGermany Animal Feed Market Insights Forecasts to 2033

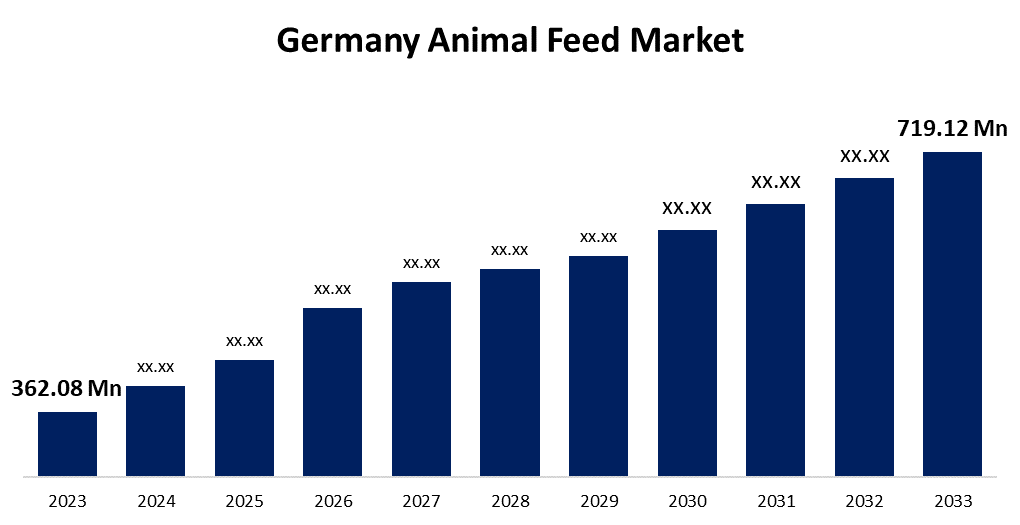

- The Germany Animal Feed Market Size was valued at USD 362.08 Million in 2023.

- The Market Size is Growing at a CAGR of 7.10% from 2023 to 2033.

- The Germany Animal Feed Market Size is Expected to Reach USD 719.12 Million by 2033.

Get more details on this report -

The Germany Animal Feed Market Size is Expected to reach USD 719.12 Million by 2033, at a CAGR of 7.10% during the forecast period 2023 to 2033.

Market Overview

Animal feed is essentially food prepared for the consumption of livestock and poultry. These products are carefully produced and blended with a variety of nutritional ingredients that are essential for animal health. Some of the most common feeds include pasture grasses, cereal grains, hay and silage crops, and other food crops byproducts such as pineapple bran, brewers' grains, and sugar beet pulp. The animal feed industry includes a variety of sectors such as cattle, poultry, and aquaculture. Germany is one of Europe's largest animal feed markets, with rising consumption of raw and processed meat, as well as rising consumer health consciousness, driving demand in the country. Swine feed is the largest segment in the German feed industry, accounting for approximately 70% of the market, and is expected to maintain its dominance throughout the forecast period. As humans become more accustomed to animal-derived products, the animal feed market will be driven by a desire for high nutritional value. Dairy products are expected to grow during the projection period due to their associated health benefits and diverse applications. Cattle are the primary source of dairy products such as milk, cream, butter, and cheese, among others, so there has been a sudden increase in cattle farming in various regions, resulting in an increase in product demand.

Report Coverage

This research report categorizes the market for the Germany animal feed market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany animal feed market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany animal feed market.

Germany Animal Feed Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 362.08 Million |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 7.10% |

| 2032 Value Projection: | USD 719.12 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 168 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Product and COVID-19 Impact Analysis. |

| Companies covered:: | Deutsche Tiernahrung Cremer, Nestle (Purina-Pet Feed), ForFarmers, HaGe Kiel, Agravis Raiffeisen AG, GS Agri, Fleming & Wendeln, Rothkötter, Mars GmbH and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising demand for animal-derived products in Germany has resulted in a surge in the demand for high-quality animal feed, emphasizing the importance of the agricultural and livestock industries. The rising demand for poultry products in Germany is causing a significant increase in the demand for high-quality animal feed, establishing a critical link between consumer preferences and the agricultural value chain. Furthermore, the growing consumer emphasis on natural and sustainable practices in agriculture and livestock has boosted demand for natural feed additives in Germany, resulting in a significant increase in overall demand for animal feed. Moreover, technological advancements in the agricultural and animal feed industries are driving a significant increase in demand for animal feed in Germany. Automation, precision farming, and data-driven technologies are transforming the way farmers manage livestock, increasing efficiency and productivity.

Restraining Factors

Raw material prices will continue to fluctuate, as will fat and oil labeling and safety concerns, limiting the growth of the animal feed market over the projection period. In contrast, the significant capital investments required for extraction will stifle growth.

Market Segment

- In 2023, the poultry animal feed segment accounted for the largest revenue share over the forecast period.

Based on the type, the Germany animal feed market is segmented into swine animal feed, poultry animal feed, ruminant feed, aquatic feed, and others. Among these, the poultry animal feed segment has the largest revenue share over the forecast period. This is attributed to the increasing demand for poultry products. As Germans consume more meat and dairy products. Farm chickens, geese, and other domestic birds eat poultry feed. In addition to whole maize and cottonseed cake, poultry feeds contain maize germ, soybeans, sunflowers, and fish meal. Modern poultry feeds contain a wide range of nutrients, proteins, minerals, vitamins, and soybean oil meal, which has fueled market growth and increased the global animal feed market.

- In 2023, the fodder segment accounted for the largest revenue share over the forecast period.

Based on the product, the Germany animal feed market is segmented into fodder, forage, and others. Among these, the fodder segment has the largest revenue share over the forecast period. This dominance can be attributed to fodder's comprehensive nutritional content, which includes essential vitamins, minerals, and fiber, all of which contribute to animal health and productivity. Furthermore, fodder is carefully formulated to meet the dietary needs of various livestock species, resulting in optimal growth and development. Its versatility extends beyond its use in the diet fodder can be processed into various forms such as pellets or powders, making it more convenient for farmers and livestock keepers. Fodder's long shelf life and ease of storage contribute to its popularity over forage and other feed options.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany animal feed market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Deutsche Tiernahrung Cremer

- Nestle (Purina-Pet Feed)

- ForFarmers

- HaGe Kiel

- Agravis Raiffeisen AG

- GS Agri

- Fleming & Wendeln

- Rothkötter

- Mars GmbH

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2023, Evonik introduced an improved version of its Biolys product for animal feed. The updated Biolys formulation contains 62.4% L-lysine, which is an 80 percent ratio to Lysine HCl. This is an improvement over the current version, which contains 60% L-lysine and 77% Lysine HCl. Furthermore, the new product contains valuable components derived from the fermentation process, such as extra nutrients and energy, which provide additional benefits to livestock like swine and poultry.

Market Segment

This study forecasts country revenue from 2020 to 2033. Spherical Insights has segmented the Germany animal feed market based on the below-mentioned segments:

Germany Animal Feed Market, By Type

- Swine Animal Feed

- Poultry Animal Feed

- Ruminant Feed

- Aquatic Feed

- Others

Germany Animal Feed Market, By Product

- Fodder

- Forage

- Others

Need help to buy this report?