Germany Agricultural Tractor Market Size, Share, and COVID-19 Impact Analysis, By Type (Orchard Tractors and Row Crop Tractors), By Horsepower (Lesser than 40 HP, 40 HP to 99 HP, 100 HP to 150 HP, and 151 HP to 200 HP), and Germany Agricultural Tractor Market Insights, Industry Trend, Forecasts to 2035.

Industry: Automotive & TransportationGermany Agricultural Tractor Market Insights Forecasts to 2035

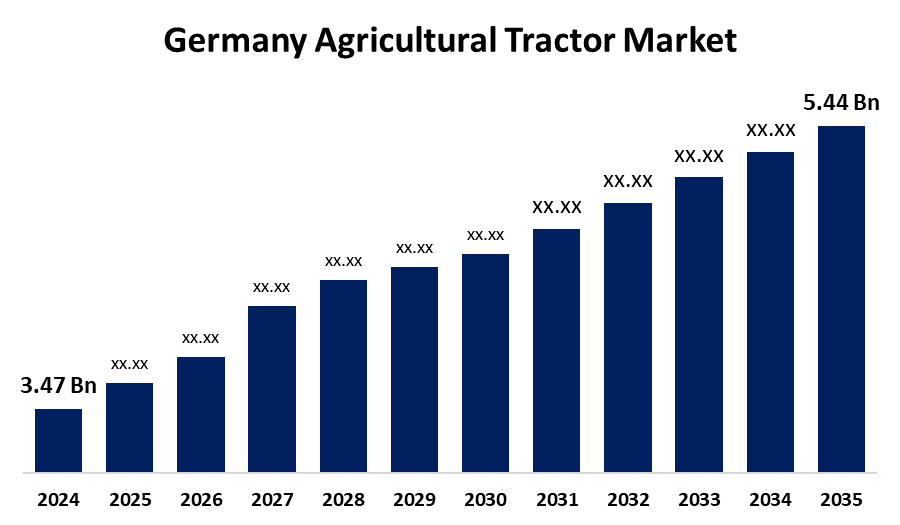

- The Germany Agricultural Tractor Market Size was estimated at USD 3.47 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.17% from 2025 to 2035

- The Germany Agricultural Tractor Market Size is Expected to Reach USD 5.44 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Germany Agricultural Tractor Market Size is Anticipated to reach USD 5.44 Billion By 2035, Growing at a CAGR of 4.17% from 2025 to 2035. The Germany agricultural tractor market is driven by the rising demand for food and farming produce is propelling. Additionally, with an increasing population and growing food demand, there is a greater need for effective farming methods.

Market Overview

The Germany agricultural tractor market is crucial farm equipment in contemporary agriculture, utilized for numerous tasks to enhance productivity and efficiency. They are mainly deployed for land preparation, including plowing, harrowing, and cultivating, aimed at fragmenting the soil, destroying weeds, and making the ground as ideal as possible for planting crops. More fuel-efficient and less emission-spewing tractors satisfy legal demands as well as emerging customer demand for sustainably grown food, hastening the uptake of more environmentally friendly new tractors. Additionally, government subsidies and regulations in Germany are supporting the agricultural sector, leading to more tractor sales. The government of Germany offers a range of subsidies and monetary incentives to promote mechanization in farms, such as subsidies on the purchase of new, environmentally friendly equipment. Moreover, the incentives, combined with the dense agricultural heritage of the nation and well-established infrastructure, make both the tractor manufacturers and farmers comfortable, thus accelerating the growth of the agricultural tractor market.

Report Coverage

This research report categorizes the market for Germany agricultural tractor market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany agricultural tractor market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany agricultural tractor market.

Germany Agricultural Tractor Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.47 Billion |

| Forecast Period: | 2025 - 2035 |

| Forecast Period CAGR 2025 - 2035 : | 4.17% |

| 2035 Value Projection: | USD 5.44 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Type, By Horsepower and COVID-19 Impact Analysis |

| Companies covered:: | Claas KGaA mbH, Deutz-Fahr, Fendt GmbH, Amazone H. Dreyer GmbH & Co. KG, Horsch Maschinen GmbH,, Lemken GmbH & Co. KG, SAME Deutz-Fahr Deutschland GmbH, Weidemann GmbH, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the Germany agricultural tractor market is driven mainly by technological growth in farming and increased use of mechanized forms of farming. Tractors are being increasingly used by farmers who are powered by modern technologies like GPS systems, auto-steer technology, and precision farming tools to satisfy the increasing demand for more output from crops and farm productivity. These advances in technology enhance production, reduce labor expenses, and enable more efficient use of resources, thus making mechanization a critical step in the German process of modernizing agriculture. Furthermore, an important factor influencing market growth is the demand for environmentally friendly methods of farming. With rising environmental pressures and regulations, farmers in Germany are adopting more energy-saving tractors, including electric and hybrid, to reduce carbon emissions.

Restraining Factors

The very high initial expense of new tractors with cutting-edge technology like GPS, automation, and environmental friendliness greatly affects the growth of the German agricultural tractor market. Additionally, new tractors with cutting-edge technology such as GPS, automation, and environmental friendliness offer significant advantages in terms of efficiency and productivity, their cost may prove to be a limitation, particularly for small farms or those with limited budgets.

Market Segmentation

The Germany agricultural tractor market share is classified into type and horsepower.

- The row crop tractors segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

The Germany agricultural tractor market is segmented by type into orchard tractors and row crop tractors. Among these, the row crop tractors segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth is driven by the necessity for more efficiency and productivity in mass farming. With Germany having a greatly industrialized agricultural industry with major emphasis on crop cultivation, row crop tractors are necessary for carrying out multiple tasks like planting, cultivating, and harvesting with high accuracy. In addition, GPS technology, auto-steering, and precision farm equipment are all common equipment on new row crop tractors, which support crop management and efficiency in resource use.

- The 40 HP to 99 HP segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The Germany agricultural tractor market is segmented by horsepower into lesser than 40 HP, 40 HP to 99 HP, 100 HP to 150 HP, and 151 HP to 200 HP. Among these, the 40 HP to 99 HP segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth is attributed to their perfect balance of power, affordability, and flexibility. These tractors are strong enough to perform a range of medium-scale farming operations, including plowing, planting, cultivating, and harvesting, yet are not excessively costly. Furthermore, tractors within this horsepower range tend to be more efficient and less maintenance-intensive than more powerful models.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany agricultural tractor market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Claas KGaA mbH

- Deutz-Fahr

- Fendt GmbH

- Amazone H. Dreyer GmbH & Co. KG

- Horsch Maschinen GmbH,

- Lemken GmbH & Co. KG

- SAME Deutz-Fahr Deutschland GmbH

- Weidemann GmbH

- Others

Recent Developments:

- In August 2023, VST launched its Series 9 Range of Compact Tractors: a series of six new models, between 18HP and 36HP, all designed, developed, and produced at its Hosur Plant.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany agricultural tractor market based on the below-mentioned segments

Germany Agricultural Tractor Market, By Type

- Orchard Tractors

- Row Crop Tractors

Germany Agricultural Tractor Market, By Horsepower

- 40 HP to 99 HP

- 100 HP to 150 HP

- 151 HP to 200 HP

Need help to buy this report?