Global Generator Rental Market Size, Share, and COVID-19 Impact Analysis, By Power Rating (Below 100 kVA, 100 kVA -500 kVA, 501 kVA -1000 kVA, and Above 1000 kVA), By Fuel Type (Diesel, Natural Gas, and Others), By Application (Continuous Load, Standby Load, and Peak Load Shaving), By End-Use (Utilities, Oil & Gas, Mining, Construction, Events, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032.

Industry: Energy & PowerGlobal Generator Rental Market Insights Forecasts to 2032

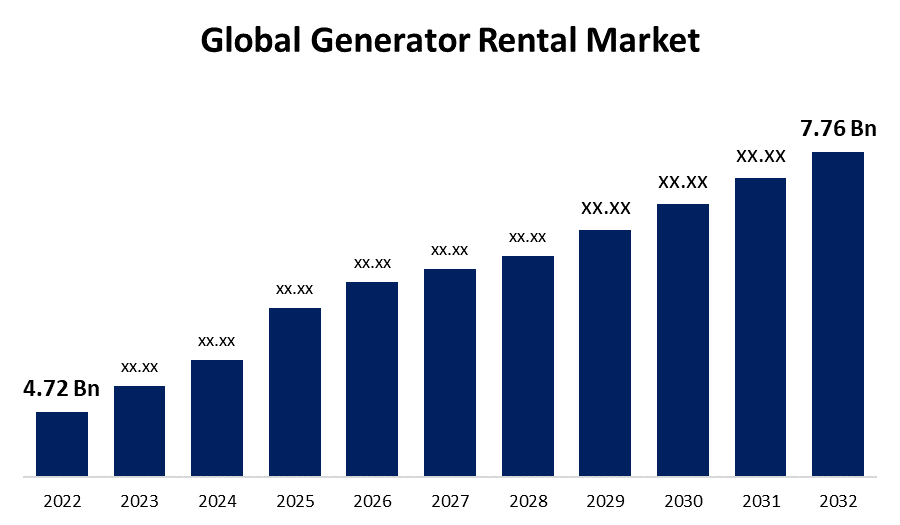

- The Global Generator Rental Market Size was valued at USD 4.72 Billion in 2022.

- The Market Size is Growing at a CAGR of 5.1% from 2022 to 2032

- The Worldwide Generator Rental Market Size is expected to reach USD 7.76 Billion by 2032

- Asia-Pacific is expected to grow the higher during the forecast period

Get more details on this report -

The Global Generator Rental Market Size is expected to reach USD 7.76 Billion by 2032, at a CAGR of 5.1% during the forecast period 2022 to 2032.

Market Overview

Generator rental is a service that offers temporary power solutions to individuals, businesses, and events. It provides a convenient and flexible option for situations where a reliable and independent power source is required. Whether it's due to power outages, remote locations, construction projects, or outdoor events, generator rental companies offer a range of generator sizes and capacities to suit diverse needs. These generators are typically powered by diesel, gas, or propane, ensuring efficient and uninterrupted power supply. Rental providers also offer additional services like delivery, installation, and maintenance to ensure hassle-free operations. By opting for generator rental, customers can avoid the upfront costs of purchasing a generator, enjoy customized power solutions, and have access to expert support throughout the rental period.

Report Coverage

This research report categorizes the market for generator rental market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the generator rental market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the generator rental market.

Global Generator Rental Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022 : | USD 4.72 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 5.1% |

| 2032 Value Projection: | USD 7.76 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Power Rating, By Fuel Type, By Application, By End-Use, By Region |

| Companies covered:: | Cummins Inc., Caterpillar Inc., Himoinsa S.L., AKSA Power Generation, Atlas Copco AB, Aggreko PLC, Kohler Co., United Rentals, Inc., AGCO Corporation, APR Energy, Herc Rentals Inc., Ashtead Group PLC, Wartsila, Generac Holdings Inc., Cooper Equipment Co |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The generator rental market is driven by several factors such as increasing frequency of power outages, both due to natural disasters and aging infrastructure, creates a strong demand for temporary power solutions. Additionally, the growing number of construction projects, particularly in remote or off-grid locations, necessitates reliable on-site power. The rise in outdoor events, such as festivals, concerts, and sports competitions, also boosts the demand for generators. Moreover, the cost-effectiveness and flexibility of renting generators instead of purchasing them outright appeal to businesses looking to optimize their budgets. The generator rental market has witnessed advancements in generator technology, leading to more efficient and eco-friendly solutions. Manufacturers are developing generators with improved fuel efficiency, reduced emissions, and advanced monitoring and control systems. These technological advancements enhance the performance and reliability of generator rentals, driving their adoption in various industries. Overall, advancements in generator technology, including improved fuel efficiency and reduced emissions, contribute to the market growth as companies seek sustainable power options.

Restraining Factors

The generator rental market faces certain restraints that impact its growth such as the availability of alternative power sources, such as renewable energy options like solar and wind, poses a challenge to the demand for generator rentals. Additionally, stringent environmental regulations and emissions standards may limit the use of traditional fuel-powered generators. Economic downturns and fluctuations in construction and event industries can also affect the demand for generator rentals. Moreover, logistical challenges, including transportation and installation complexities, can hinder market expansion. Overall, the high maintenance and operational costs associated with generator rentals can be a deterrent for some businesses, especially those with limited budgets.

Market Segmentation

- In 2022, the diesel segment accounted for around 73.2% market share

On the basis of the fuel type, the global generator rental market is segmented into diesel, natural gas, and others. The diesel segment has emerged as the dominant force in the generator rental market, capturing the largest market share. Several factors contribute to the prominence of diesel generators, the diesel generators are known for their robustness, durability, and high-power output, making them suitable for a wide range of applications. They are highly reliable and can provide consistent power for extended durations. The diesel fuel is more widely available and accessible compared to other fuel options, ensuring a steady supply for rental providers and end-users. Additionally, diesel generators offer cost advantages in terms of fuel efficiency and maintenance requirements, making them an economical choice for many businesses and industries. Furthermore, the versatility of diesel generators allows them to be used across various sectors, including construction, manufacturing, events, and emergency backup power. While there is an increasing interest in alternative fuel options, such as natural gas and propane, the diesel segment continues to dominate the market due to its reliability, availability, and cost-effectiveness.

- In 2022, the utilities segment dominated with more than 31.7% market share

Based on the type of end-use, the global generator rental market is segmented into utilities, oil & gas, mining, construction, events, and others. The utilities segment has firmly established itself as the dominant player in the generator rental market, claiming the largest market share. This is primarily due to several key factors, the utilities, such as power plants and electric companies, require a reliable backup power source to ensure uninterrupted electricity supply to their customers. Generator rentals offer a flexible and efficient solution during planned maintenance, grid outages, or peak demand periods. The utilities often operate in remote or off-grid locations where access to a stable power grid is limited. In such cases, renting generators becomes indispensable to meet the power demands of these facilities. Moreover, the utilities sector prioritizes compliance with environmental regulations, and rental companies provide a range of generators that meet emission standards and align with sustainability goals. With a strong emphasis on uninterrupted power supply and environmental consciousness, the utilities segment continues to dominate the generator rental market, driving its growth and expansion.

Regional Segment Analysis of the Generator Rental Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia-Pacific dominated the market with more than 54.5% revenue share in 2022.

Get more details on this report -

Based on region, Asia-Pacific has emerged as the region with the largest market share in the generator rental industry. Several factors contribute to this dominance due to the rapid industrialization and urbanization in countries like China, India, and Southeast Asian nations have led to a substantial increase in construction projects, creating a strong demand for temporary power solutions. Additionally, the region is prone to natural disasters like typhoons, earthquakes, and floods, resulting in frequent power outages and the need for reliable backup power. Moreover, Asia-Pacific is home to a vibrant event and entertainment industry, including festivals, concerts, and sporting events, which rely heavily on temporary power sources. The growing awareness and adoption of generator rental services in the region, along with a strong focus on infrastructure development, have further fueled the market's growth in Asia-Pacific.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global generator rental market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Cummins Inc.

- Caterpillar Inc.

- Himoinsa S.L.

- AKSA Power Generation

- Atlas Copco AB

- Aggreko PLC

- Kohler Co.

- United Rentals, Inc.

- AGCO Corporation

- APR Energy

- Herc Rentals Inc.

- Ashtead Group PLC

- Wartsila, Generac Holdings Inc.

- Cooper Equipment Co.

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2023, Caterpillar introduced the Cat XQ330 portable diesel generator set, which complies with the U.S. EPA Tier 4 Final emission standards. This new power solution is designed for both standby and prime power applications. This new offering from Caterpillar exemplifies their commitment to sustainable solutions and their dedication to meeting customer needs for dependable power generation in a variety of applications.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global generator rental market based on the below-mentioned segments:

Generator Rental Market, By Power Rating

- Below 100 kVA

- 100 kVA -500 kVA

- 501 kVA -1000 kVA

- Above 1000 kVA

Generator Rental Market, By Fuel Type

- Diesel

- Natural Gas

- Others

Generator Rental Market, By Application

- Continuous Load

- Standby Load

- Peak Load Shaving

Generator Rental Market, By End-Use

- Utilities

- Oil & Gas

- Mining

- Construction

- Events

- Others

Generator Rental Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?