France Veterinary Parasiticides Market Size, Share, and COVID-19 Impact Analysis, By Animal Type (Production and Companion), By Product (Ectoparasiticides, Endoparasiticides, and Endectocides), and France Veterinary Parasiticides Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareFrance Veterinary Parasiticides Market Insights Forecasts to 2035

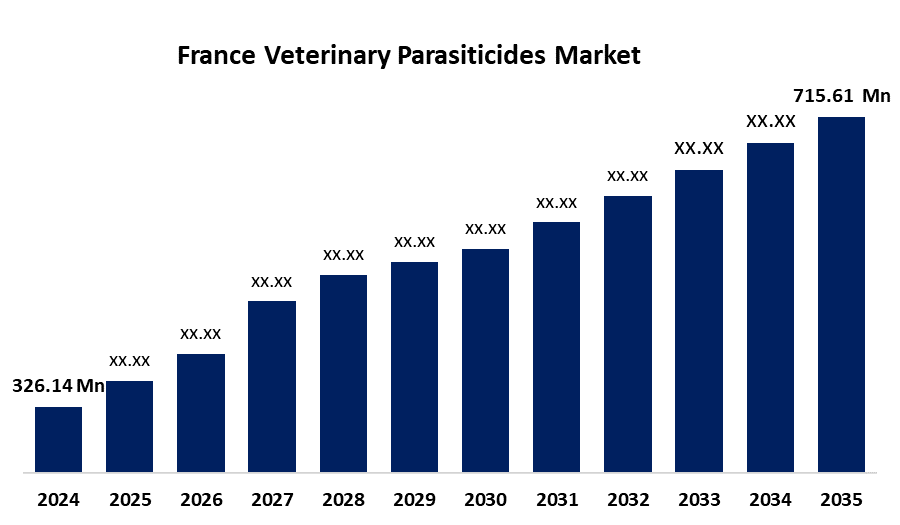

- The France Veterinary Parasiticides Market Size was estimated at USD 326.14 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.41% from 2025 to 2035

- The France Veterinary Parasiticides Market Size is Expected to Reach USD 715.61 Million by 2035

Get more details on this report -

The France Veterinary Parasiticides Market is anticipated to reach USD 715.61 million by 2035, growing at a CAGR of 7.41% from 2025 to 2035. Surging demand for preventive pet care, innovative parasiticide formulations, and France’s robust veterinary infrastructure drive market expansion.

Market Overview

The France veterinary parasiticides market encompasses products used to treat and prevent parasitic infections in animals, including ectoparasites like fleas and ticks, as well as endoparasites such as worms. These parasiticides are essential for maintaining animal health, supporting both companion animal care and livestock management. The market includes a range of formulations such as oral tablets, topical solutions, sprays, and injectables, targeting various species and parasite types. Veterinary parasiticides are regulated to ensure efficacy and safety, and their use is integrated into regular veterinary care protocols across the country. The French veterinary sector includes a combination of public and private services, with pharmacies, clinics, and agricultural supply chains distributing parasiticide products. The market structure involves local manufacturers as well as global pharmaceutical companies, contributing to a competitive and diverse landscape. Overall, the veterinary parasiticides market in France plays a vital role in animal health management and aligns with the broader goals of veterinary medicine.

Report Coverage

This research report categorizes the market for the France veterinary parasiticides market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France veterinary parasiticides market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France veterinary parasiticides market.

France Veterinary Parasiticides Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 326.14 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.41% |

| 2035 Value Projection: | USD 715.61 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 125 |

| Segments covered: | By Animal Type, By Product and COVID-19 Impact Analysis |

| Companies covered:: | Virbac, Vetoquinol, Ceva Santé Animale, Zoetis, Boehringer Ingelheim, Merck Animal Health, Bayer Animal Health, Intas Pharmaceuticals, Perrigo Company, Others. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The livestock sector demands effective parasite control to ensure animal productivity and food safety. Advancements in parasiticide formulations, offering a broader spectrum and longer-lasting protection, are fueling market growth. Additionally, strong government regulations and support for animal health initiatives contribute to market expansion. The presence of well-established veterinary infrastructure and growing awareness among pet owners and farmers further boost demand for high-quality parasiticidal treatments across France.

Restraining Factors

Regulatory hurdles and stringent approval processes may delay product launches. Concerns over drug resistance due to overuse or misuse of parasiticides also pose challenges. Additionally, limited awareness in rural areas and potential side effects of chemical treatments can reduce adoption.

Market Segmentation

The France veterinary parasiticides market share is classified into animal type and product.

- The production segment held the largest market share in 2024 and is expected to grow at a substantial CAGR during the forecast period.

The France veterinary parasiticides market is segmented by animal type into production and companion. Among these, the production segment held the largest market share in 2024 and is expected to grow at a substantial CAGR during the forecast period. This is primarily due to the significant need for effective parasite control in livestock, such as cattle, sheep, and pigs, to maintain animal health, enhance productivity, and ensure the safety of animal-derived food products. Parasitic infections in production animals can lead to severe economic losses through reduced weight gain, lower milk yield, and increased veterinary costs.

- The ectoparasiticides segment held a leading revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France veterinary parasiticides market is segmented by product into ectoparasiticides, endoparasiticides, and endectocides. Among these, the ectoparasiticides segment held a leading revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The dominance is largely due to the widespread prevalence of external parasites such as ticks, fleas, and mites, which pose significant health risks to both companion and production animals. Ectoparasiticides are commonly used in preventive care routines and are available in various user-friendly forms, including spot-ons, sprays, collars, and shampoos, enhancing their adoption among pet owners and livestock handlers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France veterinary parasiticides market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Virbac

- Vetoquinol

- Ceva Santé Animale

- Zoetis

- Boehringer Ingelheim

- Merck Animal Health

- Bayer Animal Health

- Intas Pharmaceuticals

- Perrigo Company

- Others

Recent Developments:

- In May 2024, Petmedica launched Atrevia 360, a new chewable tablet for dogs that offers protection against fleas, ticks, mites, roundworms, lungworms, and heartworms.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France veterinary parasiticides market based on the below-mentioned segments:

France Veterinary Parasiticides Market, By Animal Type

- Production

- Companion

France Veterinary Parasiticides Market, By Product

- Ectoparasiticides

- Endoparasiticides

- Endectocides

Need help to buy this report?