France surgical equipment Market Size, Share, and COVID-19 Impact Analysis, By Product (Surgical Sutures & Staplers, Handheld Surgical Devices [Forceps & Spatulas, Retractors, Dilators, Graspers, Auxiliary Instruments, Cutter Instruments, and Others], Electrosurgical Devices), By Application (Neurosurgery, Plastic & Reconstructive Surgery, Wound Closure, Obstetrics & Gynecology, Cardiovascular, Orthopedic, and Others), and France Surgical Equipment Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareFrance Surgical Equipment Market Insights Forecasts to 2035

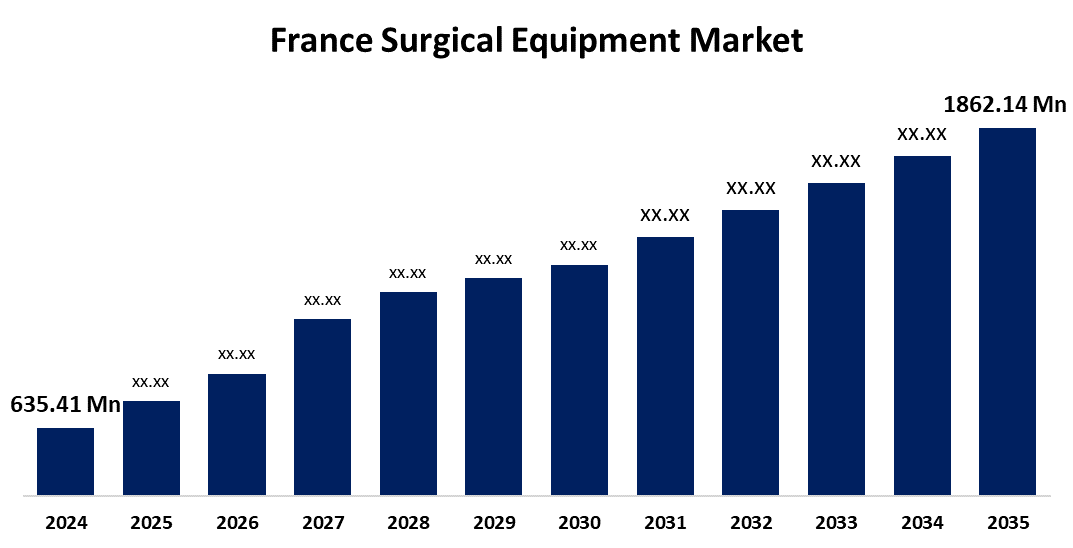

- The France Surgical Equipment Market Size was estimated at USD 635.41 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.27% from 2025 to 2035

- The France Surgical Equipment Market Size is Expected to Reach USD 1862.14 Million by 2035

Get more details on this report -

The France Surgical Equipment Market Size is Anticipated to reach USD 1862.14 Million By 2035, Growing at a CAGR of 10.27% from 2025 to 2035. The French market for surgical equipment is driven by factors such as novel technological integration, the rising demand for minimally invasive techniques, and strong government support.

Market Overview

The French surgical equipment market is the portion of the healthcare industry that focuses on the production and application of equipment or tools, and devices used in surgical or operational circumstances. Further, to perform operations safely, precisely, and effectively, there is a high need for surgical equipment. This includes handheld surgical instruments, electrosurgical devices, sutures, staplers, and robotic-assisted surgical systems. Also, the rising changes in lifestyle routines, specifically the acceptance of a sedentary lifestyle, lead to various diseases, which is driving the market growth. Besides, development news, like in September 2020, the Versius surgical robotic system, developed by CMR Surgical, was launched in France at Argenteuil Hospital, a leading public health center near Paris. This marked a significant step in making robotic-assisted surgery more accessible across the country. Versius was designed for minimally invasive surgery (MAS) and was expected to enhance procedures in urology and gynecology; such news showcases and boosts the market development across the country.

Report Coverage

This research report categorizes the market for the France surgical equipment market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France surgical equipment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France surgical equipment market.

France Surgical Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 635.41 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 10.27% |

| 2035 Value Projection: | USD 1862.14 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 198 |

| Tables, Charts & Figures: | 92 |

| Segments covered: | By Product, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Coloplast, Landanger, Systam, Thuasne, Air Liquide Medical Systems, Moria, Peters Surgical, Paul Hartmann, Proteor, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for French surgical equipment is primarily driven by the increasing aging population and the prevalence of chronic diseases. Besides, growth in the technological developments in surgical instruments and the increasing expenditures made by key market players propel the market expansion. Moreover, there is an increasing need for cutting-edge and creative surgical instruments that enable a minimally invasive treatment program across the healthcare industry. Additionally, the increasing frequency of surgeries on the French continent as a result of growing athletic engagement and errors during low-quality device failures from the past is also expected to raise the need for minute surgical supplies.

Restraining Factors

The increasing cost, complicated technology, and heightened regulatory compliance are some of the major obstacles impeding industry expansion across the country.

Market Segmentation

The French surgical equipment market share is classified into product and application.

- The electrosurgical devices segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period.

The France surgical equipment market is segmented by product into surgical sutures & staplers, handheld surgical devices [forceps & spatulas, retractors, dilators, graspers, auxiliary instruments, cutter instruments, and others], and electrosurgical devices. Among these, the electrosurgical devices segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period. This segment growth is driven by the need for minimally invasive surgery and its quick rise in public acceptance. Moreover, patients benefit from rapid healing and shorter hospital stays because minimally invasive operations make the procedure in a seamless environment. The development of numerous technological improvements is anticipated to drastically accelerate this segment's growth.

- The orthopedic segment held the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The France surgical equipment market is divided by application into neurosurgery, plastic & reconstructive surgery, wound closure, obstetrics & gynecology, cardiovascular, orthopedic, and others. Among these, the orthopedic segment held the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This is because of the high incidence of musculoskeletal problems and, rising demand for joint replacement surgeries. Additionally, development in the healthcare industry, especially for orthopedic surgical technology, holds the greatest proportion of the French surgical equipment market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France surgical equipment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Coloplast

- Landanger

- Systam

- Thuasne

- Air Liquide Medical Systems

- Moria

- Peters Surgical

- Paul Hartmann

- Proteor

- Others

Recent Developments:

- In March 2025, Zydus Lifesciences made a significant move in the MedTech sector by acquiring an 86% stake in Amplitude Surgical, a French medical device company specializing in orthopedic technologies. The deal, valued at €256.8 million ($280 million), marked Zydus’s expansion beyond pharmaceuticals into surgical technology.

- In February 2025, Eversheds Sutherland advised MicroAire Surgical Instruments on its acquisition of Neosyad, a French medical device company that specialized in adipose tissue engineering. This strategic acquisition strengthened MicroAire’s presence in the adipose tissue market, particularly in plastic and reconstructive surgery applications. The transaction was completed with the assistance of Eversheds Sutherland’s corporate/M&A team in Paris.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France surgical equipment Market based on the below-mentioned segments

France Surgical Equipment Market, By Product

- Surgical Sutures & Staplers

- Handheld Surgical Devices

- Forceps & Spatulas

- Retractors

- Dilators

- Graspers

- Auxiliary Instruments

- Cutter Instruments

- Others

- Electrosurgical Devices

France Surgical Equipment Market, By Application

- Neurosurgery

- Plastic & Reconstructive Surgery

- Wound Closure

- Obstetrics & Gynecology

- Cardiovascular

- Orthopedic

- Others

Need help to buy this report?