France Polyphthalamide Market Size, Share, and COVID-19 Impact Analysis, By Product (Unfilled, Mineral Filled, Glass Fiber Filled, and Carbon Fiber Filled), By Application (Automotive and Electronics & Electrical), and France Polyphthalamide Market Insights, Industry Trend, Forecasts to 2035.

Industry: Chemicals & MaterialsFrance Polyphthalamide Market Insights Forecasts to 2035

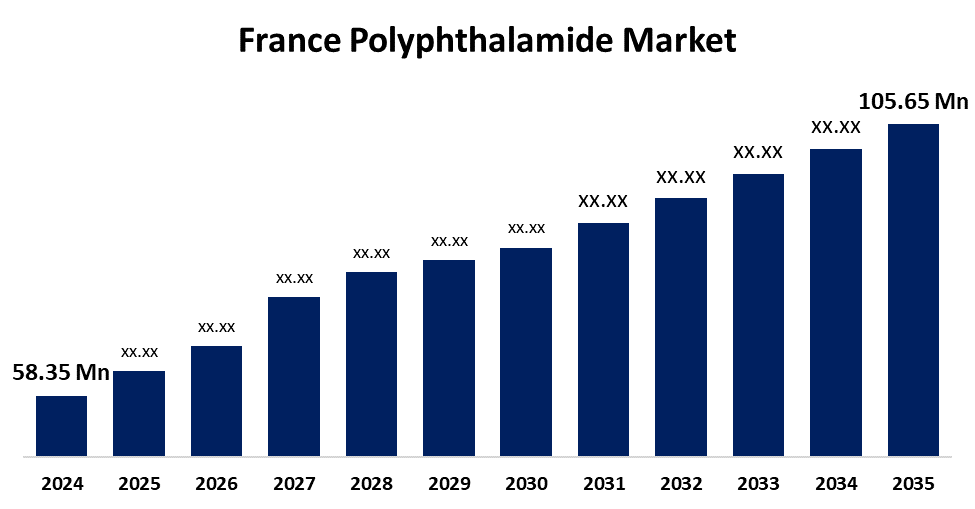

- The France Polyphthalamide Market Size was estimated at USD 58.35 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.55% from 2025 to 2035

- The France Polyphthalamide Market Size is Expected to Reach USD 105.65 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The France Polyphthalamide Market Size is Anticipated to reach USD 105.65 Million By 2035, Growing at a CAGR of 5.55% from 2025 to 2035. The France polyphthalamide market is driven by growing demand for high-performance materials in the automotive, electronics, and aerospace industries.

Market Overview

The France polyphthalamide (PPA) market is an integral part of the high-performance plastics sector, focused on materials that offer superior strength, heat resistance, and durability. Polyphthalamide is a semi-crystalline, high-temperature polyamide used in a variety of demanding applications, particularly in the automotive, aerospace, electronics, and industrial sectors. It is highly valued for its ability to perform under extreme conditions, such as high temperatures, chemical exposure, and mechanical stress. In automotive manufacturing, PPA is usually used in engine components, electrical connectors, and other under-the-hood parts. The material is also utilized in electronics for components that require enhanced electrical insulation and thermal management. As industries continue to prioritize performance and efficiency, polyphthalamide remains a critical material in applications requiring advanced properties. The market for PPA in France is expected to grow as technology evolves and demand for high-performance materials increases across various industries.

Report Coverage

This research report categorizes the market for the France polyphthalamide market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France polyphthalamide market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France polyphthalamide market.

France Polyphthalamide Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 58.35 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.55% |

| 2035 Value Projection: | USD 105.65 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Solvay S.A., BASF SE, DSM Engineering Plastics, Evonik Industries AG, Lanxess AG, Mitsubishi Chemical Corporation, Arkema S.A., DuPont de Nemours, Inc., UBE Industries, Ltd., Royal DSM N.V., and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The France polyphthalamide market is influenced by the increasing demand for advanced materials capable of withstanding extreme conditions. PPA’s unique properties, such as high thermal stability and mechanical strength, make it essential in high-performance applications like automotive, electronics, and aerospace. Additionally, the shift toward more durable, long-lasting materials for manufacturing processes and the growing trend of replacing metals with polymers to reduce weight and cost are fueling its adoption. This material’s versatility continues to drive innovation across various sectors.

Restraining Factors

High production costs and limited availability of raw materials are key restraints in the polyphthalamide market. Additionally, the complex processing requirements for PPA, which demand specialized equipment, can hinder its widespread adoption. Environmental concerns over plastic waste and recycling further limit its use in certain industries.

Market Segmentation

The France polyphthalamide market share is classified into product and application.

- The unfilled segment held the largest revenue share in 2024 and is expected to grow at a substantial CAGR during the forecast period.

The France polyphthalamide market is segmented by product into unfilled, mineral filled, glass fiber filled, and carbon fiber filled. Among these, the unfilled segment held the largest revenue share in 2024 and is expected to grow at a substantial CAGR during the forecast period. The growth is driven by its wide application across industries, particularly in automotive and electronics, where high-performance materials are essential. Unfilled PPA offers versatility and is favored for its balance of properties such as strength, durability, and processability.

- The automotive segment held the highest revenue share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The France polyphthalamide market is segmented by application into automotive and electronics & electrical. Among these, the automotive segment held the highest revenue share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The growth is driven by the increasing demand for lightweight, high-performance materials in automotive manufacturing, where polyphthalamide is used for engine components, electrical connectors, and under-the-hood parts that require exceptional heat resistance and durability.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France polyphthalamide market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Solvay S.A.

- BASF SE

- DSM Engineering Plastics

- Evonik Industries AG

- Lanxess AG

- Mitsubishi Chemical Corporation

- Arkema S.A.

- DuPont de Nemours, Inc.

- UBE Industries, Ltd.

- Royal DSM N.V.

- Others

Recent Developments:

- In April 2021, Solvay introduced Amodel PPA Supreme and Amodel PPA BIOS, both engineered for high-performance applications. The PPA BIOS variant is bio-based, aligning with sustainability trends and is ideal for e-mobility components. These innovations underscore the industry's shift towards eco-friendly materials without compromising on performance.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France polyphthalamide market based on the below-mentioned segments

France Polyphthalamide Market, By Product

- Unfilled

- Mineral Filled

- Glass Fiber Filled

- Carbon Fiber Filled

France Polyphthalamide Market, By Application

- Automotive

- Electronics & Electrical

Need help to buy this report?