France Personal Loans Market Size, Share, and COVID-19 Impact Analysis, By Provider Type (Banks, Non-Banking Financial Companies, and Others), By Interest Rate (Fixed and Floating), and France Personal Loans Market Insights, Industry Trend, Forecasts to 2035

Industry: Banking & FinancialFrance Personal Loans Market Insights Forecasts to 2035

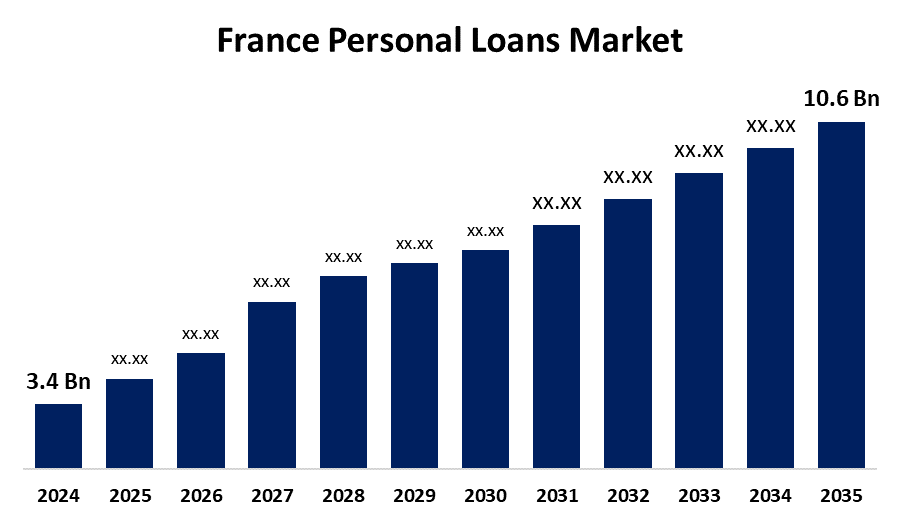

- The France Personal Loans Market Size was Estimated at USD 3.4 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.89% from 2025 to 2035

- The France Personal Loans Market Size is Expected to Reach USD 10.6 Billion by 2035

Get more details on this report -

According to a Research Report published by Spherical Insights & Consulting, the France Personal Loans Market Size is Anticipated to Reach USD 10.6 Billion by 2035, Growing at a CAGR of 10.89% from 2025 to 2035. Expanding consumer financial literacy, growing demand for flexible financing, and rising digital adoption. Younger borrowers and underserved segments are being drawn in by fintech innovations, streamlined loan approval processes, and customized lending solutions, which are fostering long-term market growth.

Market Overview

The France personal loans market refers to the ecosystem of financial institutions and platforms that provide unsecured credit to people for personal purposes, such as debt consolidation, travel, education, or home improvement, is referred to as the France personal loan market. Additionally, the loan market in France is quickly adopting digital platforms, which is radically changing conventional lending methods. Due to easier access and user-friendly interfaces, online applications and approvals are on the rise, especially among tech-savvy borrowers. By delivering individualized loan solutions and expedited procedures, fintech companies are driving innovation and upending traditional banking models. With a focus on mobile-first experiences and competitive terms, neobanks and digital banking subsidiaries are becoming more and more popular. Automation improves efficiency for both borrowers and lenders by cutting down on paperwork and approval times. More accurate risk assessment and customized loan offerings are made possible by data-driven lending. Regulatory agencies are adjusting to this digital revolution by striking a balance between consumer protection and innovation. The French loan market is becoming more open, effective, and customer-focused as a result of this digital revolution.

Report Coverage

This research report categorizes the market for the France personal loans market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France personal loans market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France personal loans market.

France Personal Loans Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.4 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 10.89% |

| 2035 Value Projection: | USD 10.6 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Provider Type, By Interest Rate and COVID-19 Impact Analysis. |

| Companies covered:: | Younited Credit, FairMoney, Societe Generale, Advans Microfinance Network, Crédit Logement, Cofidis and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The French personal loan market is being greatly impacted by the financial sector's adoption of cutting-edge technologies. Consumers can now obtain personal loans more easily given to the proliferation of digital financial services like online loan applications and mobile banking. An increase in loan applications through digital channels has resulted from a 34% growth in digital banking services over the past three years, according to a report by the French Financial Markets Authority (AMF). Customers prefer quick and easy financial solutions, so these technological advancements are improving user experience and expediting the loan approval process, which will ultimately contribute to market growth.

Restraining Factors

The market for personal loans in France is constrained by stringent regulatory compliance, increased default risks, and restricted credit availability for low-income borrowers. Growth is also hampered by uncertain economic conditions and cautious lending practices, particularly among conventional banks and risk-averse financial institutions.

Market Segmentation

The France personal loans market share is classified into provider type into interest rate.

- The bank segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France personal loans market is segmented by provider type into banks, non-banking financial companies, and others. Among these, the bank segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The French loan market gave them a strong base for their lending operations because of its well-established networks, which included many branches and enduring client relationships. French consumers frequently sought loans from well-known and reputable sources because they had a great deal of faith in these organizations. Additionally, traditional banking models have historically been supported by the regulatory environment, which has strengthened their market dominance.

- The fixed segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France personal loans market is segmented by interest rate into fixed and floating. Among these, the fixed segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The desire for financial stability in the face of economic volatility is what drives the fixed interest rate segment of personal loans in France. By providing consistent monthly payments, fixed-rate loans protect borrowers from future rate increases and encourage long-term budgeting. The expansion of fixed-rate offerings by banks and NBFCs has also been aided by favorable lending conditions and regulatory clarity. The growth of this market segment is also driven by rising demand for debt consolidation, school financing, and home remodeling.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France personal loans market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Younited Credit

- FairMoney

- Societe Generale

- Advans Microfinance Network

- Crédit Logement

- Cofidis

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France Personal Loans Market based on the below-mentioned segments:

France Personal Loans Market, By Provider Type

- Banks

- Non-Banking Financial Companies

- Others

France Personal Loans Market, Interest Rate

- Fixed

- Floating

Need help to buy this report?