France Orthopedic Devices Market Size, Share, and COVID-19 Impact Analysis, By Type (Trauma Fixation, Spinal Devices, Joint Replacement, Consumables Disposables, and Bone Repair), By Application (Spine, Trauma and Extremities, Knee, Hip, Foot and Ankle), and France Orthopedic Devices Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareFrance Orthopedic Devices Market Insights Forecasts to 2035

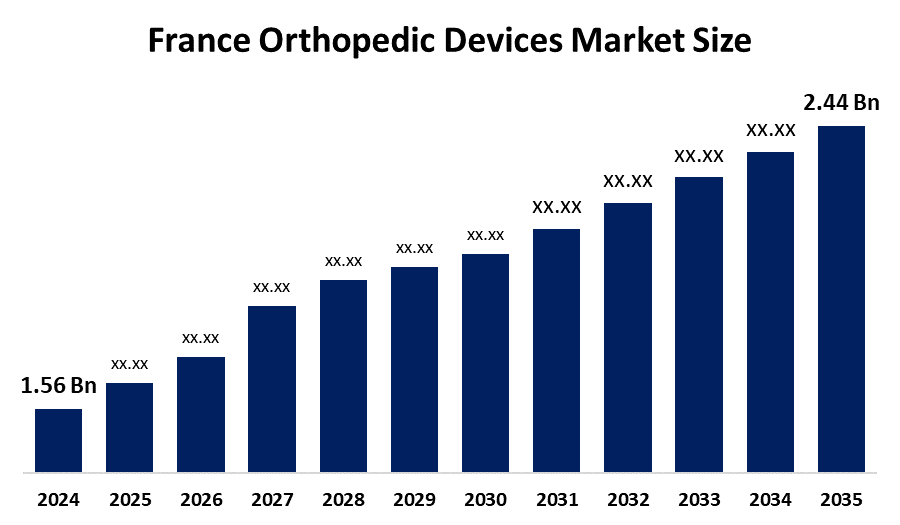

- The France Orthopedic Devices Market Size was Estimated at USD 1.56 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.15% from 2025 to 2035

- The France Orthopedic Devices Market Size is Expected to Reach USD 2.44 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The France Orthopedic Devices Market Size is anticipated to Reach USD 2.44 Billion by 2035, Growing at a CAGR of 4.15% from 2025 to 2035. since a growing number of musculoskeletal conditions, an aging population, and a growing need for spine and joint operations. The industry is growing even faster thanks to technological developments like customized implants and robotically assisted procedures as well as supporting healthcare regulations.

Market Overview

The market for orthopedic devices in France is the sector devoted to the creation, manufacturing, and distribution of medical devices for the treatment of musculoskeletal disorders and accidents. This includes devices designed to support, repair, or replace damaged bones and joints, enhance mobility, and improve patient outcomes. Additionally, opportunities in the French orthopedic device industry appear to be endless due to advancements in smart devices and tailored medicine. There is a chance to improve accuracy and recovery time in orthopedic procedures by incorporating robotic and artificial intelligence technologies. In the remote areas, where contemporary distribution techniques can increase patients' access to essential healthcare services, there is also an unmet need for better orthopedic treatment availability. In order to satisfy the demands of French patients, there has been a recent trend toward integration between suppliers and providers.

Report Coverage

This research report categorizes the market for the France orthopedic devices market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France orthopedic devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France orthopedic devices market.

France Orthopedic Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.56 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.15% |

| 2035 Value Projection: | USD 2.44 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 192 |

| Tables, Charts & Figures: | 114 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Amplitude, Clariance SAS, Corin France SAS, Cousin Surgery, Dedienne Sante, DJO France SAS, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The prevalence of sports-related injuries is rising along with the frequency of physical activity and sports engagement among the French population, which is driving the market for orthopedic devices in France. According to data from France's National Institute for Health and Medical Research (INSERM), there are about 3 million incidents of sports injuries there each year. Young consumers and older adults who are physically active are especially affected by this trend, which raises demand for orthopedic equipment including braces, splints, and surgical implants. The French Olympic Committee and other organizations that support sports and physical fitness will raise consumer awareness, which will fuel demand for orthopaedic procedures and equipment and propel market expansion.

Restraining Factors

The market for orthopedic devices in France is hampered by high device costs, difficult regulatory approvals, restricted access in rural areas, and reimbursement issues. Further impeding the quicker adoption of modern orthopaedic technologies are post-operative problems and the preference for non-surgical treatments.

Market Segmentation

The France orthopedic devices market share is classified into type and application.

- The joint replacement segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France orthopedic devices market is segmented by type into trauma fixation, spinal devices, joint replacement, consumables disposables, and bone repair. Among these, the joint replacement segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growing prevalence of osteoarthritis and the rising need for treatments among the elderly have led to a large increase in the joint replacement category, which reflects the dual emphasis on mobility solutions' strength and quality of life.

- The knee segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France orthopedic devices market is segmented by application into spine, trauma and extremities, knee, hip, foot and ankle. Among these, the knee segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Driven by the elderly population's growing need for revision and complete knee replacements. Developments in robotic-assisted surgery, implant materials, and minimally invasive methods that enhance recovery results all contribute to growth. Sustained market expansion is also facilitated by favorable reimbursement policies, rising obesity rates, and an increase in sports-related injuries.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France orthopedic devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Amplitude

- Clariance SAS

- Corin France SAS

- Cousin Surgery

- Dedienne Sante

- DJO France SAS

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France Orthopedic Devices Market based on the below-mentioned segments:

France Orthopedic Devices Market, By Type

- Trauma Fixation

- Spinal Devices

- Joint Replacement

- Consumables Disposables

- Bone Repair

France Orthopedic Devices Market, By Application

- Spine

- Trauma and Extremities

- Knee

- Hip

- Foot and Ankle

Need help to buy this report?