France Organic Beverages Market Size, Share, and COVID-19 Impact Analysis, By Product (Non-dairy Beverages, Fruit Beverages, Coffee & Tea, and Beer & Wine), By Distribution Channel (Offline and Online), and France Organic Beverages Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsFrance Organic Beverages Market Insights Forecasts to 2035

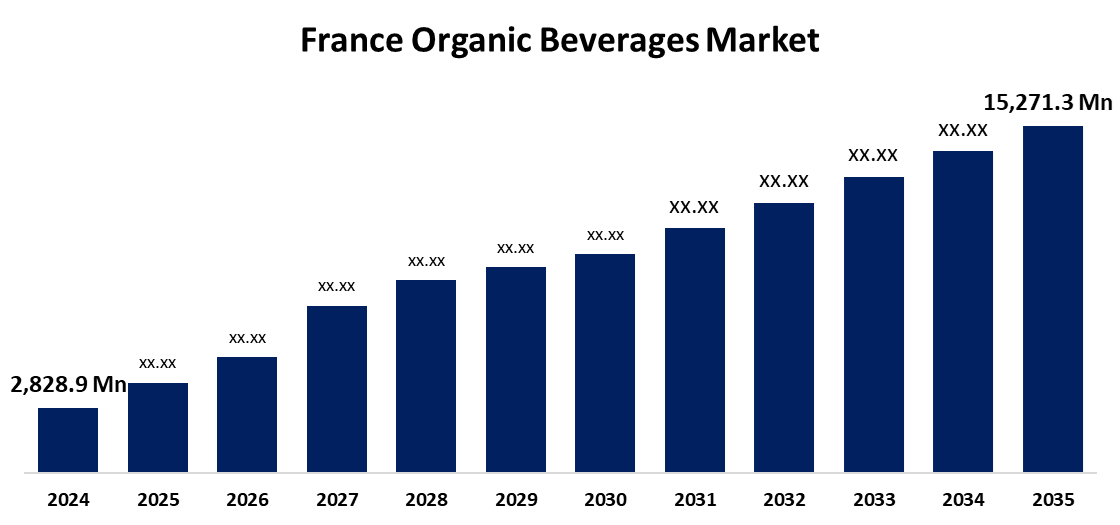

- The France Organic Beverages Market Size Was Estimated at USD 2,828.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 16.57% from 2025 to 2035

- The France Organic Beverages Market Size is Expected to Reach USD 15,271.3 Million by 2035

Get more details on this report -

The France Organic Beverages Market Size is Anticipated to reach USD 15,271.3 Million by 2035, Growing at a CAGR of 16.57% from 2025 to 2035. The France organic beverages market is driven by increasing health awareness, demand for clean-label products, and sustainable consumption trends.

Market Overview

The France organic beverages market refers to the segment of the beverage industry that includes products made from organically certified ingredients, produced without synthetic chemicals, pesticides, or genetically modified organisms. This market includes a wide range of drinks such as organic fruit juices, herbal teas, soft drinks, dairy and non-dairy alternatives, and alcoholic beverages like organic wine and beer. The sector is supported by a well-defined regulatory framework in France and the European Union, ensuring product authenticity and transparency through certification and labeling. France, known for its culinary and agricultural traditions, has seen a steady rise in organic beverage offerings across retail outlets, online platforms, and specialized organic stores. Organic beverages are generally perceived as high-quality, environmentally friendly options, contributing to their popularity. The market is composed of both domestic producers and international brands, offering diverse choices to consumers. France’s strong organic culture continues to support the growth and diversification of this market.

Report Coverage

This research report categorizes the market for the France organic beverages market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France organic beverages market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France organic beverages market.

France Organic Beverages Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2,828.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 16.57% |

| 2035 Value Projection: | USD 15,271.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 165 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Product, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | Fruité Entreprises SA, Lavazza France Sarl, Groupe Léa Nature, Danone S.A., Nestlé France S.A., Carrefour, La Vie Claire SA, Biocoop SA Coop, Galec - Centre Distributeur Edouard Leclerc, Auchan France and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Rising consumer awareness about health and wellness is leading many to choose natural, chemical-free drink options. Environmental concerns and a growing preference for sustainable agriculture also support the demand for organic beverages. Government initiatives and EU certifications promote organic farming and instill consumer confidence in product authenticity. Additionally, increasing the availability of organic drinks in supermarkets, specialty stores, and online platforms enhances accessibility. Innovations in product development, such as new flavors and functional health benefits, further attract consumers, while changing lifestyles and dietary habits continue to shape market preferences.

Restraining Factors

Supply chain complexities, including sourcing organic ingredients and maintaining product integrity, further complicate operations. Consumer perceptions and taste preferences may also pose obstacles, as some individuals may not favor the flavors or characteristics of organic beverages.

Market Segmentation

The France organic beverages market share is classified into product and distribution channel.

- The non-dairy beverages segment held the highest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The France organic beverages market is segmented by product into non-dairy beverages, fruit beverages, coffee & tea, and beer & wine. Among these, the non-dairy beverages segment held the highest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by increasing consumer demand for plant-based and lactose-free alternatives. This trend reflects a broader shift toward vegan and health-conscious lifestyles. Non-dairy options such as almond, soy, oat, and rice-based drinks are gaining popularity due to their perceived health benefits and environmental sustainability.

- The offline segent held a major market share in 2024 and is expected to grow at a substantial CAGR during the forecast period.

The France organic beverages market is segmented by distribution channel into offline and online. Among these, the offline segment held a major market share in 2024 and is expected to grow at a substantial CAGR during the forecast period. The segment is fueled by the strong presence of supermarkets, hypermarkets, organic specialty stores, and health food retailers across the country. French consumers often prefer purchasing organic products in physical stores where they can verify product authenticity and quality firsthand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France organic beverages market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Fruité Entreprises SA

- Lavazza France Sarl

- Groupe Léa Nature

- Danone S.A.

- Nestlé France S.A.

- Carrefour

- La Vie Claire SA

- Biocoop SA Coop

- Galec - Centre Distributeur Edouard Leclerc

- Auchan France

- Others

Recent Developments:

- In July 2021, Lifeway Foods expanded into the French market with its first kefir distribution at Costco France, featuring 250ml mango Lifeway Kefir bottles.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France organic beverages market based on the below-mentioned segments:

France Organic Beverages Market, By Product

- Non-dairy Beverages

- Fruit Beverages

- Coffee & Tea

- Beer & Wine

France Organic Beverages Market, By Distribution Channel

- Offline

- Online

Need help to buy this report?