France Offshore Wind Energy Market Size, Share, And COVID-19 Impact Analysis, By Technology (Floating Turbines, Fixed Bottom Turbines, and Hybrid Systems), By Installation Type (Installed Capacity, Grid-Connected, and Non-Grid-Connected), By Turbine Size (Small-Scale, Medium-Scale, and Large-Scale), And France Offshore Wind Energy Market Insights, Industry Trend, Forecasts To 2035.

Industry: Energy & PowerFrance Offshore Wind Energy Market Insights Forecasts to 2035

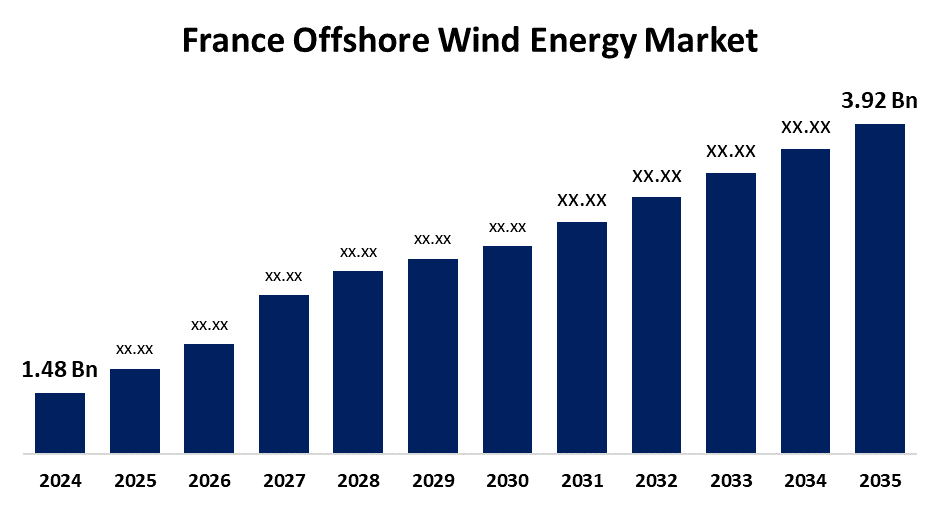

- The France Offshore Wind Energy Market Size Was Estimated at USD 1.48 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.26% from 2025 to 2035

- The France Offshore Wind Energy Market Size is Expected to Reach USD 3.92 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The France Offshore Wind Energy Market Size is anticipated to reach USD 3.92 Billion by 2035, growing at a CAGR of 9.26% from 2025 to 2035. The France offshore wind energy market is driven by national energy transition policies, floating wind innovation, and strong public-private partnerships to achieve net-zero targets

Market Overview:

Offshore wind power is the production of electricity from wind turbines that have been installed in the seas or oceans. Offshore wind power is one of the strategic pillars for the French national renewable energy mix. The extensive maritime areas along the Atlantic, Channel, and Mediterranean coastlines of France offer a good environment for fixed-bottom and floating wind technology. State-supported tenders and the establishment of offshore wind hubs have driven activity. Floating offshore wind is also picking up speed, with France emerging as a European pioneer in this new market. The hosting of offshore wind power in the national grid and local industry involvement in turbine production and naval logistics are building a well-fed context for additional growth.

Report Coverage:

This research report categorizes the France offshore wind energy market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France offshore wind energy market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France offshore wind energy market.

France Offshore Wind Energy Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.48 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 9.26% |

| 2035 Value Projection: | USD 3.92 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 232 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Technology, By Installation Type, By Turbine Size |

| Companies covered:: | EDF Renewables, Siemens Gamesa, Engie, Iberdrola, EDP Renewables, Nordex, TotalEnergies, GE Vernova, Prysmian Group, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factor

Offshore wind power projects that are based on renewable energy are greatly desired by the French government. The aim of the Energy Transition for Green Growth Act is to increase the share of renewable energy in France's energy consumption. As part of its future energy plan, France plans to put in place as much as 40 gigawatts of offshore wind by 2030, double the amount in the past, backed by a policy reducing greenhouse gas emissions by 40%. This commitment comes in addition to the European Union's general climate ambition and the construction of a positive regulatory framework to invest in the French offshore wind market sector.

Restraining Factor

The time-consuming authorization procedures, environmental issues, and grid connection limitations. Complex authorisation procedures, including communities, naval authorities, and environmental studies, will be required for offshore wind farms, which could cause delays of several years. Sea life protection and coastal visual impact also give rise to resistance from fishermen and residents.

Market Segmentation

The France offshore wind energy market share is classified into technology, installation type, and turbine size.

- The fixed bottom turbines segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period

The France offshore wind energy market is segmented by technology into floating turbines, fixed bottom turbines, and hybrid systems. Among these, the fixed bottom turbines segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Fixed-bottom turbines are well established and commonly used for shallow-water installation, especially off the northern and western coast of France. Their tried design, cost-effectiveness, and compatibility with prevailing offshore construction techniques have made them the first choice for early large-scale wind farms.

- The grid-connected segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period

The France offshore wind energy market is segmented by installation type into installed capacity, grid-connected, and non-grid-connected. Among these, the grid-connected segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Integrating offshore wind energy into the current energy infrastructure, facilitating effective energy distribution to consumers, and lowering carbon emissions are all made possible by the grid-connected category.

- The large-scale segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period

The France offshore wind energy market is segmented by turbine size into small-scale, medium-scale, and large-scale. Among these, the large-scale segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental expansion can be attributed to producing a significant amount of electricity, which supports France's objectives of expanding its capacity for renewable energy to fulfill its climate targets. This division serves the overall goal of raising the proportion of renewable energy in the national grid while also improving the adaptability of wind farm designs.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France offshore wind energy market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- EDF Renewables

- Siemens Gamesa

- Engie

- Iberdrola

- EDP Renewables

- Nordex

- TotalEnergies

- GE Vernova

- Prysmian Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France offshore wind energy market based on the below-mentioned segments:

France Offshore Wind Energy Market, By Technology

- Floating Turbines

- Fixed Bottom Turbines

- Hybrid Systems

France Offshore Wind Energy Market, By Installation Type

- Installed Capacity

- Grid-Connected

- Non-Grid-Connected

France Offshore Wind Energy Market, By Turbine Size

- Small-Scale

- Medium-Scale

- Large-Scale

Need help to buy this report?