France Insulin Pens Market Size, Share, and COVID-19 Impact Analysis, By Type (Reusable Insulin Pens and Disposable Insulin Pens), By End-use (Hospitals & Clinics, Homecare, and Others), and France Insulin Pens Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareFrance Insulin Pens Market Insights Forecasts to 2035

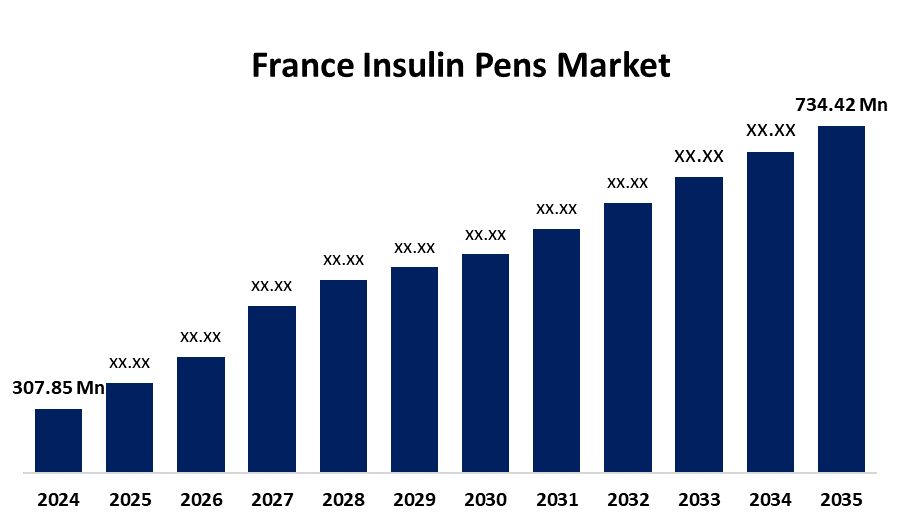

- The France Insulin Pens Market Size was estimated at USD 307.85 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.23% from 2025 to 2035

- The France Insulin Pens Market Size is Expected to Reach USD 734.42 Million by 2035

Get more details on this report -

The France Insulin Pens Market Size is anticipated to reach USD 734.42 Million by 2035, Growing at a CAGR of 8.23% from 2025 to 2035. The France insulin pens market is fueled by rising diabetes rates, innovations in insulin delivery technology, and growing patient preference for convenient self-injection methods.

Market Overview

The France insulin pens market encompasses the use of insulin delivery devices designed for individuals with diabetes. Insulin pens are compact, easy-to-use instruments that provide accurate doses of insulin, making them a preferred choice over traditional syringes for many patients. These pens are widely used by those with Type 1 and Type 2 diabetes to manage their condition more effectively and comfortably. Insulin pens are available in both prefilled and reusable forms, with options that cater to varying patient needs. The increasing adoption of insulin pens is linked to their convenience, portability, and ability to offer consistent doses, contributing to better disease management. In addition, advancements in insulin pen technology, including the development of smart pens that can track doses and connect to mobile apps, are enhancing the patient experience. The French healthcare system, known for its accessibility and high standards, supports the widespread use of insulin pens across the population.

Report Coverage

This research report categorizes the market for the France insulin pens market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France insulin pen market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France insulin pens market.

France Insulin Pens Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 307.85 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.23% |

| 2035 Value Projection: | USD 734.42 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 113 |

| Segments covered: | By Type, By End-use and COVID-19 Impact Analysis |

| Companies covered:: | Novo Nordisk, Sanofi, Boehringer Ingelheim, Becton, Dickinson and Company (BD), Eli Lilly and Company, Ypsomed, Gerresheimer, Mylan (a Viatris company), Owen Mumford, Medtronic, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

Innovations in pen technology, such as smart pens, prefilled options, and adjustable dosing, are improving accuracy and ease of use. Patients increasingly favor insulin pens over syringes for their convenience, portability, and discretion. Furthermore, greater awareness about the importance of effective diabetes management, alongside France's well-established healthcare infrastructure, is driving market growth. These factors together contribute to a surge in demand for insulin pens, reshaping the landscape of diabetes care in the country.

Restraining Factors

The potential for device-related errors, such as improper dosage or malfunction, poses a concern. Lastly, the preference for traditional insulin syringes in some patient groups may hinder the wider adoption of insulin pens, slowing market growth.

Market Segmentation

The France insulin pens market share is classified into type and end-use.

- The reusable insulin pens segment held a major revenue share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The France insulin pens market is segmented by type into reusable insulin pens and disposable insulin pens. Among these, the reusable insulin pens segment held a major revenue share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. Reusable insulin pens offer cost-effectiveness and sustainability, as they can be used multiple times with replaceable insulin cartridges, making them a preferred choice among patients in the long term. Their convenience, coupled with their environmental benefits, contributes to their growing popularity.

- The hospitals & clinics segment held the highest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France insulin pens market is segmented by end-use into hospitals & clinics, homecare, and others. Among these, the hospitals & clinics segment held the highest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Hospitals and clinics continue to be key settings for insulin pen use due to the availability of specialized medical supervision, better access to healthcare resources, and a higher volume of diabetes patients requiring consistent insulin therapy. As healthcare infrastructure evolves, this segment is likely to maintain its dominance in the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France insulin pens market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Novo Nordisk

- Sanofi

- Boehringer Ingelheim

- Becton, Dickinson and Company (BD)

- Eli Lilly and Company

- Ypsomed

- Gerresheimer

- Mylan (a Viatris company)

- Owen Mumford

- Medtronic

- Others

Recent Developments:

- In March 2023, Diabeloop announced a collaboration with Novo Nordisk to pursue its interoperability strategy with connected insulin pens – A dedicated clinical program would assess the efficacy of the combined technologies.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France insulin pens market based on the below-mentioned segments:

France Insulin Pens Market, By Type

- Reusable Insulin Pens

- Disposable Insulin Pens

France Insulin Pens Market, By End-use

- Hospitals & Clinics

- Homecare

- Others

Need help to buy this report?