France Human Insulin Market Size, Share, and COVID-19 Impact Analysis, By Device (Pens, Syringes, and Others), By Indication (Type 1 Diabetes, Type 2 Diabetes, and Gestational Diabetes), and France Human Insulin Market Insights, Industry Trend, Forecasts to 2033.

Industry: HealthcareThe France Human Insulin Market Insights Forecasts to 2033

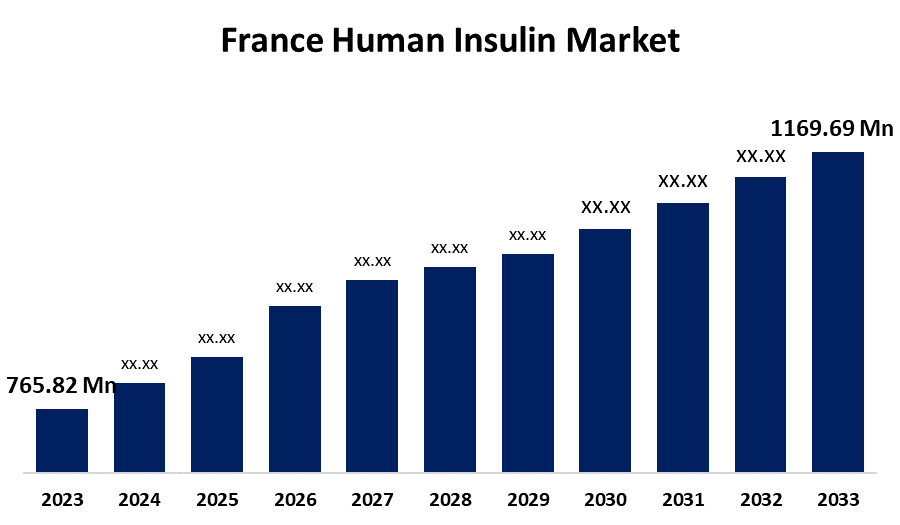

- The France Human Insulin Market Size Was Valued at around USD 765.82 Million in 2023.

- The France Human Insulin Market Size is Expected to Grow at a CAGR of 4.33% from 2023 to 2033.

- The France Human Insulin Market Size is Expected to Reach USD 1169.69 Million by 2033.

Get more details on this report -

The France Human Insulin Market Size is Predicted to grow from USD 765.82 Million in 2023 to USD 1169.69 Million by 2033 at a CAGR of 4.33% during the forecast period. The French human insulin market has been growing with considerable momentum, influenced by a range of factors that mirror the changing healthcare scenario, technological development, and demographic shifts.

Market Overview

The France human insulin market is defined as the industry involving the production, formulation, and distribution of insulin drugs and related delivery equipment in France. The market is central to diabetes management, which is a common chronic ailment in France. Additionally, the France human insulin market is dominated by the increasing number of diabetes cases, rising awareness regarding early treatment and diagnosis, and increased usage of insulin therapy in diabetic patients. Government support through diabetes management and enhanced healthcare facilities also propels market growth. The growing elderly population and changes in lifestyle, such as physical inactivity and poor diets, also contribute to the growing incidence of diabetes, driving insulin demand. Pharmaceutical developments in insulin drug delivery systems, including insulin pumps and pens, improve patient compliance and are influencing market trends. There is also a shift in the market towards biosynthetic human insulin from animal-derived insulin as a result of better safety and efficacy profiles.

Report Coverage

This research report categorizes the France human insulin market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the France human insulin market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the France human insulin market.

France Human Insulin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 765.82 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.33% |

| 2033 Value Projection: | USD 1169.69 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Device, By Indication and COVID-19 Impact Analysis |

| Companies covered:: | Novo Nordisk A/S, Pfizer, Wockhardt, Biocon, Lupin, Tonghua Dongbao Pharmaceutical Co, Eli Lilly and Company, Ypsomed, PerkinElmer France, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Increased cases of diabetes in France continue to be one of the most critical drivers of the human insulin market. For example, the International Diabetes Federation (IDF) estimates that there are more than 4.1 million French adults with diabetes, and increasing prevalence is predicted to continue. With the aging of the population and changes in living habits, ever more people become diabetic, triggering an increased demand for efficient solutions to control this condition, and insulin therapy forms part of the solution. Human insulin is the foundation of anti-diabetic drug treatment, and with the increasingly large diabetic community, the market for insulin preparations grows proportionately.

Restraints & Challenges

The affordability of insulin therapy continues to be a problem, restricting access for certain patients even with healthcare subsidies. In addition, the emergence of biosimilar insulin products is driving competition, impacting the market share of conventional insulin brands.

Market Segmentation

The France human insulin market share is classified into device and indication.

- The pens segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on device, the France human insulin market is classified into pens, syringes, others. Among these the pens segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. Insulin pens have become very popular because they are easy to use, accurate, and convenient and are the favorite among most diabetic patients. These pens provide more precise dosage and have become standard in home care as well as in clinical use. Insulin syringes, though less popular than pens, are still available for a few patients, especially those who like a traditional form of administration.

- The type 1 diabetes segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on indication, the France human insulin market is classified into type 1 diabetes, type 2 diabetes, and gestational diabetes. Among these, the type 1 diabetes segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. Type 1 diabetes patients, whose pancreas cannot generate insulin and thus need to receive insulin continuously throughout their lives, are a major market share. The group is described by a demand for accurate and ongoing insulin administration, which translates into a greater need for sophisticated insulin delivery systems such as pumps and pens.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France human insulin market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Novo Nordisk A/S

- Pfizer

- Wockhardt

- Biocon

- Lupin

- Tonghua Dongbao Pharmaceutical Co

- Eli Lilly and Company

- Ypsomed

- PerkinElmer France

- Others

Key Market Developments

- In April 2025, Pfizer had halted development of danuglipron, its oral once-daily GLP-1 receptor agonist for obesity and type 2 diabetes, following a case of drug-induced liver injury and after considering clinical and regulatory feedback. This move had stopped further clinical development for both obesity and diabetes indications.

Market Segment

This study forecasts revenue at France, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the France human insulin market based on the below-mentioned segments:

France Human Insulin Market, By Device

- Pens

- Syringes

- Others

France Human Insulin Market, By Indication

- Type 1 Diabetes

- Type 2 Diabetes

- Gestational Diabetes

Need help to buy this report?