France Hospital Bed Market Size, Share, and COVID-19 Impact Analysis, By Type (Acute Care, Long-Term Care, Psychiatric Bariatric Care, and Others), By Power (Electric, Semi-Electric, and Manual), and France Hospital Bed Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareFrance Hospital Bed Market Insights Forecasts to 2035

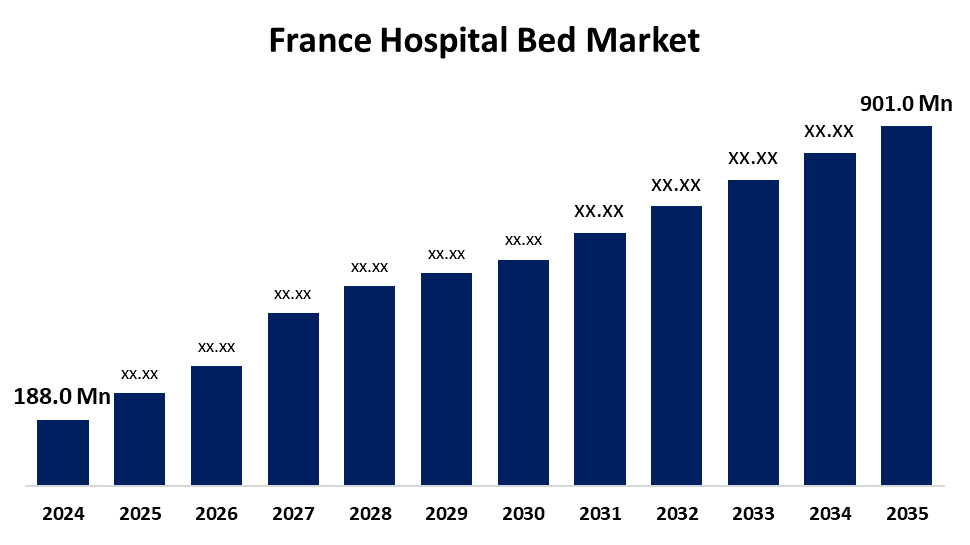

- The France Hospital Bed Market Size was Estimated at USD 188.0 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 15.31% from 2025 to 2035

- The France Hospital Bed Market Size is Expected to Reach USD 901.0 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the France Hospital Bed Market Size is Anticipated to reach USD 901.0 Million by 2035, Growing at a CAGR of 15.31% from 2025 to 2035. Growing rates of chronic illnesses, aging populations, and increased hospital admissions. Government investments in healthcare infrastructure, along with a shift toward homecare and outpatient services, are driving up demand for sophisticated electric beds with smart monitoring features.

Market Overview

The France hospital bed market refers to the industry that designs, manufactures, distributes, and installs beds for use in medical facilities throughout France is known as the "France Hospital Bed Market." In hospitals, clinics, and homecare settings, these beds are critical for medical procedures, patient care, and recuperation. Additionally, opportunities for telemedicine and home healthcare solutions are especially appealing in the French market. There is a growing demand for homecare bed solutions that provide hospital-level support as more patients receive treatment at home or in outpatient settings. The demand for hospital beds that can be converted for residential use may rise as a result of the French government's expressed interest in enhancing at-home care services. The potential for smart beds that link to telehealth systems and give caregivers access to real-time patient data is also made possible by advancements in digital health technology. There has been a shift in recent years, with producers using sustainable practices and environmentally friendly materials in the production of beds.

Report Coverage

This research report categorizes the market for the France hospital bed market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France hospital bed market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France hospital bed market.

France Hospital Bed Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 188.0 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 15.31% |

| 2035 Value Projection: | USD 901.0 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Type, By Power and COVID-19 Impact Analysis. |

| Companies covered:: | Harmonie Médical Service, Centre Hospitalier Avranches-Granville, MY HOSPITEL, Centre Hospitalier Chalon-sur-Saône, Hôpital Aix-Pertuis and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing healthcare sector is driving a number of significant developments in the French hospital bed market. The increasing demand for better hospital beds that put patient safety and comfort first is one of the main factors driving the market. As France's population ages and the prevalence of chronic illnesses rises, medical facilities are giving technology enabled beds with features like adjustable settings and monitoring capabilities top priority. Additionally, the need to control infections has prompted hospitals to install beds with antimicrobial surfaces and basic sanitization features, which is consistent with public health goals aimed at reducing hospital-acquired infections.

Restraining Factors

The market for hospital beds in France is constrained by factors like high maintenance and procurement costs, lax reimbursement regulations, and a lack of staff in public hospitals. The need for conventional inpatient beds is also decreased by the move toward outpatient care and home-based therapies, and market growth is further hampered by complicated regulations and a sluggish uptake of smart technologies.

Market Segmentation

The France hospital bed market share is classified into type and power.

- The acute care segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France hospital bed market is segmented by type into acute care, long-term care, psychiatric bariatric care, and others. Among these, the acute care segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Acute care beds make up a sizable percentage, mainly serving patients in need of critical care and immediate medical attention, underscoring their crucial function in emergency rooms and critical care units.

- The electric segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France hospital bed market is segmented by power into electric, semi-electric, and manual. Among these, the electric segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Electric beds are becoming more and more popular because they are simple to use and require little effort on the part of healthcare professionals to adjust, increasing patient mobility and overall care efficiency.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France hospital bed market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Harmonie Médical Service

- Centre Hospitalier Avranches-Granville

- MY HOSPITEL

- Centre Hospitalier Chalon-sur-Saône

- Hôpital Aix-Pertuis

- Others

Recent Developments:

- In November 2024, A report by DREES reveals that over 43,000 full hospitalisation beds have been closed across France over the past decade, marking a 10.5% decline since 2013. This reduction is largely due to the “ambulatory shift” policy, which promotes outpatient care to reduce costs and leverage advances in surgery and anesthesia. At the same time, partial hospitalisation beds used for day treatments without overnight stays have increased by 31%, reflecting a broader shift in healthcare delivery

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France Hospital Bed Market based on the below-mentioned segments:

France Hospital Bed Market, By Type

- Acute Care

- Long-Term Care

- Psychiatric Bariatric Care

- Others

France Hospital Bed Market, By Power

- Electric

- Semi-Electric

- Manual

Need help to buy this report?