France Health Insurance Market Size, Share, And COVID-19 Impact Analysis, By Provider (Public, Private), By Age Groups (0-14 Years, 15-24 Years, 25-54 Years, More than 54 Yrs), By Areas (Urban, Rural), and France Health Insurance Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareFrance Health Insurance Market Insights Forecasts to 2033

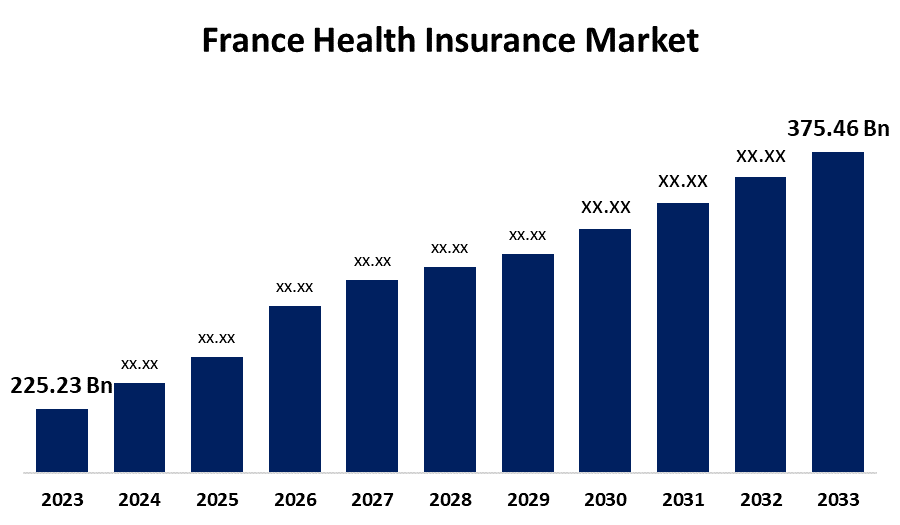

- The France Health Insurance Market Size was valued at USD 225.23 Billion in 2023.

- The France Health Insurance Market Size is expected to Grow at a CAGR of around 5.24% from 2023 to 2033.

- The France Health Insurance Market Size is expected to Reach USD 375.46 Billion by 2033.

Get more details on this report -

The France Health Insurance Market Size is predicted to Grow from USD 472.78 Billion in 2023 to USD 375.46 Billion by 2033 at a CAGR of 5.24% during the forecast period. The market growth is driven by strong government support and growing awareness among the locals about healthy welfare.

Market Overview

The French health insurance market refers to the business that supports the healthcare industry by introducing a form of coverage that covers the insured person's medical and surgical expenses. It is a contract between the insurance company and the policyholder, or the individual who purchases insurance. The insurance provider promises to protect the policyholder's finances by paying for certain medical services and treatments in return for recurring premium payments. The main drivers of the growth are the aging population, government laws, technical breakthroughs, including the adoption of digital health, and rising healthcare expenditures. The French government has imposed strict healthcare laws that mandate health insurance for its inhabitants. This policy has undoubtedly made health insurance a must for everyone residing in France. Alternatively, businesses that provide mutuelle policies cover all or part of the costs of medical care that the public healthcare system does not cover. Besides, a development news such as in September 2024, a meeting in Paris marked an important step in the collaboration between Egypt and the Agence Française de Développement (AFD). The Egyptian Deputy Prime Minister for Human Development and the Minister of Health and Population joined AFD representatives to reaffirm their joint commitment to technical and financial support for universal health coverage in Egypt.

Report Coverage

This research report categorizes the France health insurance market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the France health insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the France health insurance market.

France Health Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 225.23 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.24% |

| 2033 Value Projection: | USD 375.46 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Provider (Public, Private), By Age Groups (0-14 Years, 15-24 Years, 25-54 Years, More than 54 Yrs), By Areas (Urban, Rural) |

| Companies covered:: | AXA, Allianz, Credit Agricole Assurances, CNP Assurances, BNP Paribas Cardif, Generali, Natixis Assurances, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The health insurance market in France has been expanding significantly due to government organizations actively working to raise awareness of the value of health insurance in many nations. The market is benefiting from this, as well as the rise in serious traffic accidents, which has led to more surgeries being performed. Additionally, major participants in the market offer a wide variety of health insurance plans, enabling policyholders to select the best coverage for their particular requirements and preferences. Furthermore, the rise of mobile applications for health insurance that leverage cutting-edge technologies like artificial intelligence (AI), the internet of things (IoT), big data analytics, and predictive analysis to expedite the claims procedure and policy administration is giving the market for health insurance a promising future.

Restraints & Challenges

The French health insurance market expansion is being constrained by some barriers, such as high cost of premiums, claim reimbursement, strict government restrictions, and false insurance claims.

Market Segmentation

The France health insurance market share is classified into providers, age groups, and areas.

- The public segment dominated the France health insurance market in 2023 and is expected to grow at a notable CAGR over the forecast period.

Based on providers, the France health insurance market is classified into public, and private. Among these, the public segment dominated the France health insurance market in 2023 and is expected to grow at a notable CAGR over the forecast period. This is because of the country's health insurance program. Moreover, the national health insurance program in France covers 70–100% of the cost of necessary medical care, including hospital stays and doctor visits, with complete coverage.

- The 25-54 years segment accounted for the highest share of the France health insurance market in 2023 and is expected to grow at a significant CAGR over the forecast period.

Based on age groups, the France health insurance market is divided into 0-14 years, 15-24 years, 25-54 years, and more than 54 years. Among these, the 25-54 years segment accounted for the highest share of the France health insurance market in 2023 and is expected to grow at a significant CAGR over the forecast period. This is because of prone to disease and health issues. Further, doctor visits, hospital stays, prescription medications, and diagnostic tests are among the healthcare services.

- The rural segment held a significant share of the France health insurance market in 2023 and is projected to grow at a rapid pace during the forecast period.

Based on the areas, the France health insurance market is segmented into urban, and rural. Among these, the rural segment held a significant share of the France health insurance market in 2023 and is projected to grow at a rapid pace during the forecast period. This is due to increasing awareness about healthcare insurance, government initiatives, rising healthcare costs, and increasing availability of health insurance options. Further, the rise of digital media and internet penetration in rural areas is making customers more aware of the benefits of health insurance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France health insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AXA

- Allianz

- Credit Agricole Assurances

- CNP Assurances

- BNP Paribas Cardif

- Generali

- Natixis Assurances

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Key Market Developments

- In April 2025, Alan, a French insurtech unicorn, expanded to Canada, aiming to disrupt the country's health insurance market. The company offered digital group health insurance tailored for tech startups and small businesses, promising lower costs and easier access compared to traditional insurers. Alan's service allowed employers to manage health insurance entirely online, without brokers or hidden fees, at 15%, half the cost of the average incumbent insurer.

- In May 2022, AXA France collaborated with its Indian insurance partners, is preparing to introduce India’s first-ever mental health insurance coverage within its group policies. This initiative aimed to address the growing demand for mental health support and promote accessibility to professional care. A person familiar with the development shared that this launch could be a significant step in normalizing mental health care in corporate environments.

Market Segment

This study forecasts revenue at France, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the France health insurance market based on the below-mentioned segments:

France Health Insurance Market, By Provider

- Public

- Private

France Health Insurance Market, By Age Group

- 0-14 Years

- 15-24 Years

- 25-54 Years

- More than 54 Yrs

France Health Insurance Market, By Areas

- Urban

- Rural

Need help to buy this report?