France Gas Turbine Market Size, Share, and COVID-19 Impact Analysis, By Capacity (<=200 MW and >200 MW), By End-use (Industrial and Power & Utility), and France Gas Turbine Market Insights, Industry Trend, Forecasts to 2035.

Industry: Energy & PowerFrance Gas Turbine Market Insights Forecasts to 2035

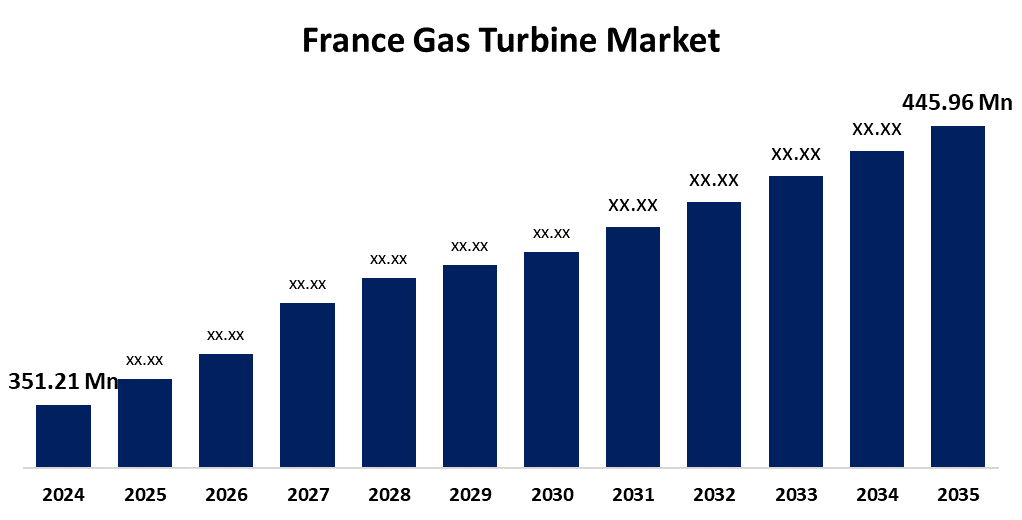

- The France Gas Turbine Market Size was estimated at USD 351.21 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 2.20% from 2025 to 2035

- The France Gas Turbine Market Size is Expected to Reach USD 445.96 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The France Gas Turbine Market Size is Anticipated to reach USD 445.96 Million By 2035, Growing at a CAGR of 2.20% from 2025 to 2035. The growth of the France gas turbine market is primarily driven by increasing demand for efficient, low-emission power generation and the need for energy security.

Market Overview

The France gas turbine market involves the production, installation, and maintenance of gas turbines, which are widely used for power generation and industrial applications. A gas turbine is a type of internal combustion engine that converts energy from natural gas or other fuels into mechanical energy, typically used to generate electricity or power mechanical equipment. In France, gas turbines are an essential part of the energy infrastructure due to their ability to provide flexible, efficient, and relatively low-emission power. The French energy sector is increasingly turning to gas turbines as a way to balance the grid and ensure a reliable energy supply while reducing carbon emissions. The market is characterized by both large-scale industrial applications and smaller, distributed energy systems, which are used in various sectors, including manufacturing, petrochemical, and transportation. Gas turbines in France are also being integrated into combined cycle power plants, which improve fuel efficiency by using the waste heat from turbines to generate additional electricity. As a result, the gas turbine market in France plays a crucial role in the country’s transition to a more sustainable energy system.

Report Coverage

This research report categorizes the market for the France gas turbine market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France gas turbine market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France gas turbine market.

France Gas Turbine Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 351.21 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 2.20% |

| 2035 Value Projection: | USD 445.96 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 255 |

| Tables, Charts & Figures: | 96 |

| Segments covered: | By Capacity, By End-use and COVID-19 Impact Analysis |

| Companies covered:: | Siemens Energy, General Electric (GE), Solar Turbines (Caterpillar), Ansaldo Energia, Alstom (now part of GE), Engie, EDF (Électricité de France), Vallourec, Technip Energies, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The France gas turbine market is primarily driven by the rising need for efficient, flexible power generation solutions in the transition to cleaner energy. Gas turbines provide a more environmentally friendly alternative to conventional coal and oil plants, aligning with France’s decarbonization targets. Technological advancements in turbine efficiency, coupled with supportive government policies and the growing reliance on intermittent renewable energy sources, further fuel the market’s expansion. Additionally, their role in ensuring grid stability and energy security boosts demand across various industries.

Restraining Factors

Challenges in the France gas turbine market include the substantial upfront costs and ongoing maintenance expenses, which can deter investment. Moreover, the country’s accelerated transition to renewable energy sources and stringent environmental regulations may lead to a reduced focus on fossil fuel-based power generation, posing a challenge to market expansion.

Market Segmentation

The France gas turbine market share is classified into capacity and end-use.

- The >200 MW segment held a significant revenue share in 2024 and is expected to grow at a substantial CAGR during the forecast period.

The France gas turbine market is segmented by capacity into <=200 MW and >200 MW. Among these, the >200 MW segment held a significant revenue share in 2024 and is expected to grow at a substantial CAGR during the forecast period. The growth is attributed to the increasing demand for large-scale, high-efficiency power generation, particularly in the context of France's evolving energy landscape, where larger turbines play a crucial role in meeting both industrial and grid stability needs.

- The power & utility segment held the leading revenue share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The France gas turbine market is segmented by end-use into industrial and power & utility. Among these, the power & utility segment held the leading revenue share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The growth is driven by the increasing demand for reliable and efficient power generation, particularly as France aims to enhance its energy security, integrate renewable sources, and reduce carbon emissions. The power & utility sector’s reliance on large-scale gas turbines for both base-load and peak-load power generation further supports its leading position in the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France gas turbine market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Siemens Energy

- General Electric (GE)

- Solar Turbines (Caterpillar)

- Ansaldo Energia

- Alstom (now part of GE)

- Engie

- EDF (Électricité de France)

- Vallourec

- Technip Energies

- Others

Recent Developments:

- In October 2023, HYFLEXPOWER project achieved a significant milestone by operating a Siemens SGT-400 industrial gas turbine on 100% renewable hydrogen at a combined heat and power (CHP) plant in Saillat-sur-Vienne, France. This demonstration, part of an EU-funded initiative, showcased the feasibility of using hydrogen as a flexible energy storage medium, converting excess renewable electricity into hydrogen and then back into power during peak demand.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France gas turbine market based on the below-mentioned segments

France Gas Turbine Market, By Capacity

- <=200 MW

- >200 MW

France Gas Turbine Market, By End-use

- Industrial

- Power & Utility

Need help to buy this report?