France Foil Insulation Market Size, Share, and COVID-19 Impact Analysis, By Application (Roof Insulation, Wall Insulation, and Others), By End Use (Residential and Non-residential), and France Foil Insulation Market Insights, Industry Trend, Forecasts to 2035

Industry: Advanced MaterialsFrance Foil Insulation Market Insights Forecasts to 2035

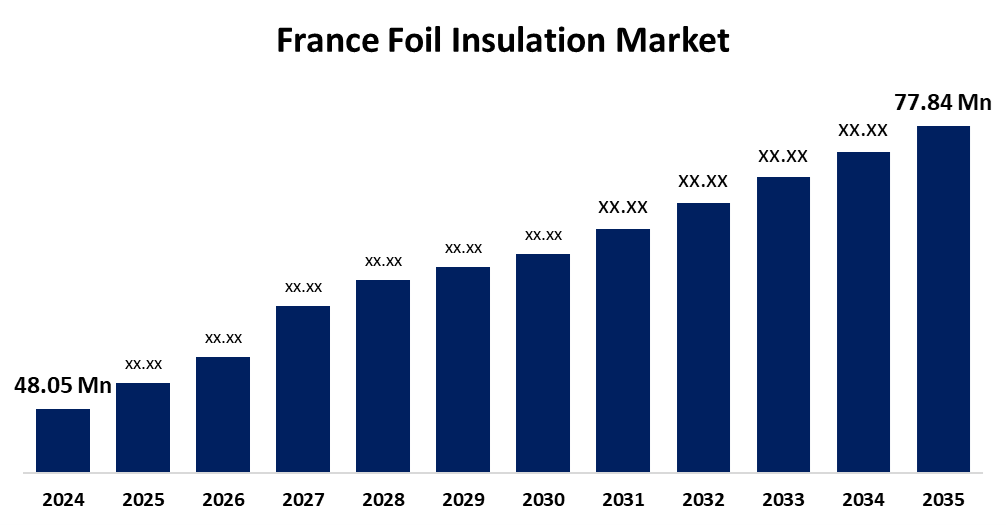

- The France Foil Insulation Market Size was Estimated at USD 48.05 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.48% from 2025 to 2035

- The France Foil Insulation Market Size is Expected to Reach USD 77.84 Million by 2035

Get more details on this report -

The France Foil Insulation Market Size is anticipated to reach USD 77.84 Million by 2035, Growing at a CAGR of 4.48% from 2025 to 2035. The foil insulation market in France is growing because of strict energy-saving rules, government support for building upgrades, and a rising demand for eco-friendly and affordable insulation.

Market Overview

Foil insulation, also known as reflective insulation, is a material used in buildings to reduce heat transfer by reflecting radiant heat. It typically consists of layers of foil combined with other materials like foam or bubble wrap to improve thermal resistance. In France, foil insulation is used across residential, commercial, and industrial sectors to improve energy efficiency and indoor comfort. It is especially effective in regulating indoor temperatures by reflecting heat in the summer and retaining warmth in the winter. This type of insulation is lightweight, easy to install, and suitable for use in walls, roofs, and floors. The French market for foil insulation includes a range of products tailored for different building types and performance requirements. As construction and renovation standards continue to emphasize better thermal performance, foil insulation remains a widely used and reliable option. Its versatility and practical benefits make it an important component in modern building insulation systems in France.

Report Coverage

This research report categorizes the market for the France foil insulation market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France foil insulation market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France foil insulation market.

France Foil Insulation Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 48.05 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.48% |

| 2035 Value Projection: | USD 77.84 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Application, By End Use |

| Companies covered:: | Saint-Gobain, Knauf Insulation, Owens Corning, URSA France, ROCKWOOL Group, Isover (a subsidiary of Saint-Gobain), Kingspan Group, BASF SE, Armacell, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The France foil insulation market is driven by rising demand for energy-efficient buildings, increasing environmental awareness, and strict building regulations promoting thermal performance. Government incentives for green renovations and sustainable construction further support market growth. Additionally, the need to reduce energy costs in residential and commercial buildings boosts the adoption of foil insulation. Its lightweight, easy installation, and effectiveness in diverse climates also make it a preferred choice, contributing to its growing use across various construction and renovation projects in France.

Restraining Factors

High initial installation costs deter budget-conscious consumers and small-scale builders. Additionally, limited awareness about its long-term energy-saving benefits and performance in extreme climates may restrict adoption. Competition from alternative insulation materials like fiberglass and foam further intensifies the market landscape.

Market Segmentation

The France foil insulation market share is classified into application and end use.

- The roof insulation segment held a leading revenue share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The France foil insulation market is segmented by application into roof insulation, wall insulation, and others. Among these, the roof insulation segment held a leading revenue share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven due to the crucial role roofs play in regulating indoor temperatures and the high efficiency of foil insulation in reflecting radiant heat. With growing concerns over energy consumption and the need to enhance thermal comfort, there has been a significant increase in the use of foil insulation in roofing across both residential and commercial buildings.

- The residential segment held a major market share in 2024 and is expected to grow at a substantial CAGR during the forecast period.

The France foil insulation market is segmented by end use into residential and non-residential. Among these, the residential segment held a major market share in 2024 and is expected to grow at a substantial CAGR during the forecast period. The segment is fueled by the increasing demand for energy-efficient housing and widespread adoption of insulation materials in new home construction and renovation projects. Homeowners increasingly opt for foil insulation to reduce energy costs and improve indoor comfort.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France foil insulation market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Saint-Gobain

- Knauf Insulation

- Owens Corning

- URSA France

- ROCKWOOL Group

- Isover (a subsidiary of Saint-Gobain)

- Kingspan Group

- BASF SE

- Armacell

- Others

Recent Developments:

- In January 2024, Saint-Gobain announced plans to build a new polyurethane (PU) insulation plant at Sausheim, near Mulhouse, with an investment of €50 million. The plant is expected to commence production in 2026, complementing existing facilities and serving regions including Grand Est, Austria, Germany, and Switzerland.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France foil insulation market based on the below-mentioned segments:

France Foil Insulation Market, By Application

- Roof Insulation

- Wall Insulation

- Others

France Foil Insulation Market, By End Use

- Residential

- Non-residential

Need help to buy this report?