France Fluoroelastomer Market Size, Share, and COVID-19 Impact Analysis, By Type (Fluorocarbon, Fluorosilicone, and Perfluoroelastomer), By End-use (Automotive, Aerospace, Chemicals, Oil & Gas, Energy & Power), and France Fluoroelastomer Market Insights, Industry Trend, Forecasts to 2035

Industry: Specialty & Fine ChemicalsFrance Fluoroelastomer Market Insights Forecasts to 2035

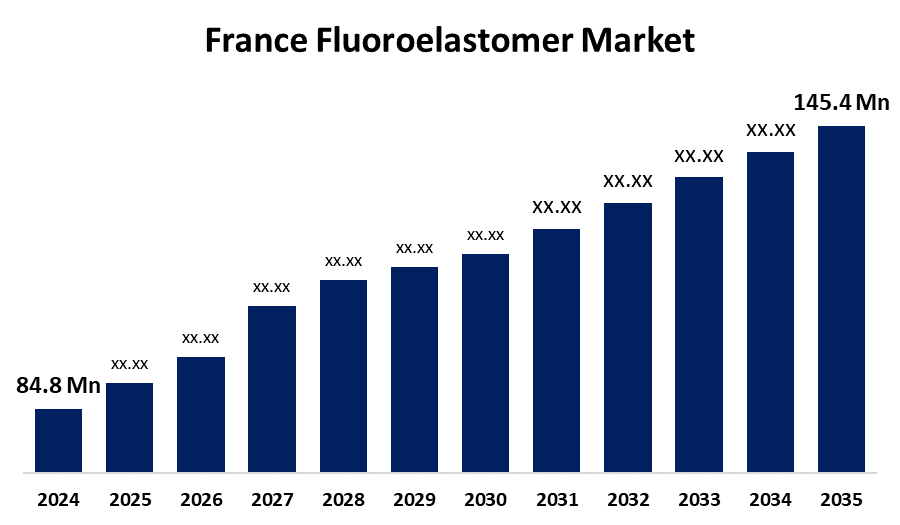

- The France Fluoroelastomer Market Size Was Estimated at USD 84.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.02% from 2025 to 2035

- The France Fluoroelastomer Market Size is Expected to Reach USD 145.4 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the France Fluoroelastomer Market Size is anticipated to reach USD 145.4 Million by 2035, Growing at a CAGR of 5.02% from 2025 to 2035. The growing need for high-performance sealing solutions in the automotive and aerospace industries, as well as their growing application in chemical processing because of their exceptional chemical and heat resistance, are driving the France fluoroelastomer market.

Market Overview

The France fluoroelastomers market represents the total national production, supply, and consumption of fluoroelastomers, which are synthetic rubbers made from fluoropolymer materials and used in part due to their high degree of resistance to heat, chemicals, and oil. Fluoroelastomers, usually referred to as FKM, are highly beneficial for automotive, aerospace, and chemical processing applications since fluoroelastomers can provide high performance in extreme environmental conditions. The growing adoption of electric vehicles (EVs) and stricter regulations for emissions have also improved the prospects for the market to grow. The fluoroelastomer market is growing with the demanding performance specifications in automotive and aerospace applications, which require high-temperature and chemical resistance. Specifically, the high-performance turbocharged engines and battery systems of electric vehicles (EVs) require seals and gaskets that contain fluoroelastomers to provide resistance to aggressive fluids and heat, such as lithium-ion battery electrolytes. Aerospace has fuel systems and O-rings in commercial jet engines that require fluid sealing elastomers that work under very stringent conditions. This is because of these demanding applications, companies such as DuPont and 3M have developed specialty grades of fluoroelastomer and are progressing in the market.

Report Coverage

This research report categorizes the market for the France fluoroelastomer market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France fluoroelastomer market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France fluoroelastomer market.

France Fluoroelastomer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 84.8 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.02% |

| 2035 Value Projection: | USD 145.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 184 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Type, By End-use and COVID-19 Impact Analysis |

| Companies covered:: | DAIKIN INDUSTRIES, Ltd., Shin-Etsu Chemical Co., Ltd., Solvay, DuPont, 3M and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The France fluroelestaomer market is growing as different types of automotive automobile manufacturers are revising their vehicle designs and considering weight savings by replacing materials to respond to the increasing consumer interest in significantly more fuel-efficient vehicles. In addition to reducing powertrain, engine, and engine compartment size, the vehicle manufacturers are also offering an advanced air management system to improve fuel efficiency. All of these result in similar issues, such as thermal exposure, exposure to corrosive fluids, and fumes. These factors shorten service life for elastomer components, such as o-rings, gaskets, seals, and flexible hoses.

Restraining Factors

The France fluoroelastomer market is restricted by environmental sustainability is one of the primary concerns for the fluoroelastomers industry. Fluoroelastomers are non-biodegradable chemicals because an essential part of their molecular structure is the fluorine atom. Fluoroelastomers' high level of resistance to moisture, heat, and almost every common chemical has provided industry performance benefits.

Market Segmentation

The France fluoroelastomer market share is classified into type and end-use.

- The fluorocarbon segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France fluoroelastomer market is segmented by type into fluorocarbon, fluorosilicone, and perfluoroelastomer. Among these, the fluorocarbon segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. These elastomers are perfect for use in automotive, aerospace, and industrial applications because of their remarkable resistance to a variety of chemicals, oils, fuels, solvents, and high temperatures (up to 250°C). These are the most widely used kind of fluoroelastomers because of their affordable price and adaptable performance traits.

- The automotive segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France fluoroelastomer market is segmented by end-use into automotive, aerospace, chemicals, oil & gas, and energy & power. Among these, the automotive segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. Fluoroelastomers are widely used in the automotive industry because of their superior resistance to heat, chemicals, and fuels. In engines, fuel systems, and transmissions, where long-term performance and durability are essential in harsh environments, these materials are frequently utilized in seals, gaskets, hoses, and O-rings.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France fluoroelastomer market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- DAIKIN INDUSTRIES, Ltd.

- Shin-Etsu Chemical Co., Ltd.

- Solvay

- DuPont

- 3M

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France Fluoroelastomer Market based on the below-mentioned segments:

France Fluoroelastomer Market, By Type

- Fluorocarbon

- Fluorosilicone

- Perfluoroelastomer

France Fluoroelastomer Market, By End-use

- Automotive

- Aerospace

- Chemicals

- Oil & Gas

- Energy & Power

Need help to buy this report?