France Energy Storage Systems Market Size, Share, And COVID-19 Impact Analysis, By Technology (Lithium-Ion Batteries, Flow Batteries, and Others), By Application (Grid Services, Residential, Commercial & Industrial, EV Charging Infrastructure), And France Energy Storage Systems Market Insights, Industry Trend, Forecasts To 2035.

Industry: Energy & PowerFrance Energy Storage Systems Market Insights Forecasts to 2035

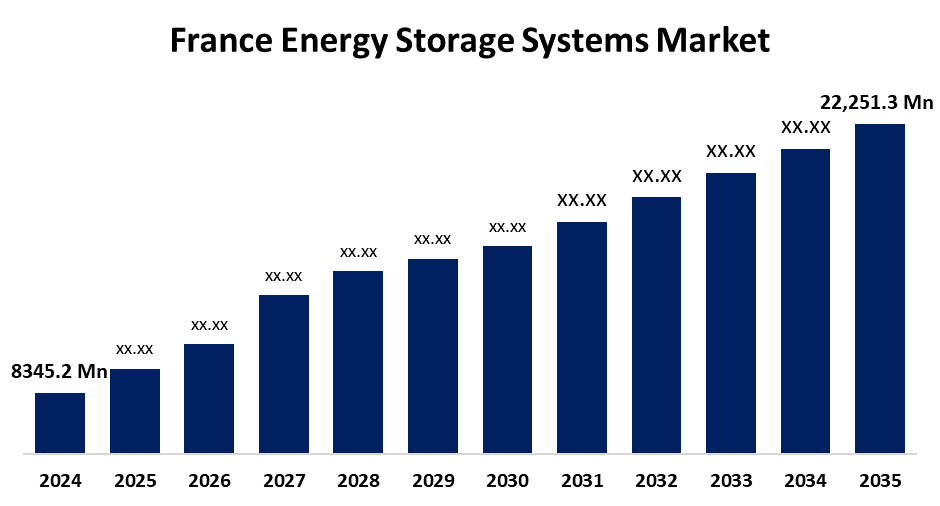

- The France Energy Storage Systems Market Size Was Estimated at USD 8345.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.33% from 2025 to 2035

- The France Energy Storage Systems Market Size is Expected to Reach USD 22,251.3 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The France Energy Storage Systems Market Size is anticipated to reach USD 22,251 Million by 2035, growing at a CAGR of 9.33% from 2025 to 2035. The France energy storage systems market is driven by the rapid expansion of renewable energy sources such as solar and wind, which require efficient storage solutions to balance supply and demand.

Market Overview:

Hardware known as energy storage systems (ESS) helps balance supply and demand, integrate renewable energy sources, and improve power stability by storing heat energy or electricity for later use. Storage is becoming more and more crucial in France to provide grid stability and energy security, even as domestic decarbonisation programmes boost solar and wind capacities. The country is constructing a variety of novel storage technologies, including flow and thermal systems, pumped hydro, and lithium-ion batteries. Utilities like EDF and grid managers such as RTE are testing large-scale battery storage schemes and hybrid solar-storage facilities. ESS installation is also increasing in commercial and residential markets owing to increasing energy prices, feed-in tariff policies, and self-consumption bonuses. Underpinned by the finance from the EU and conducive regulation schemes under the French Energy Code, the market will continue to evolve over the long run.

Report Coverage:

This research report categorizes the France energy storage systems market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France energy storage systems market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France energy storage systems market.

France Energy Storage Systems Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 8345.2 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 9.33% |

| 2035 Value Projection: | USD 22,251.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 234 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Technology, By Application |

| Companies covered:: | Ocean Power Technologies, Inc., Eco Wave Power, CorPower Ocean, Mocean Energy, Nova Innovation Ltd., Minesto AB, Carnegie Clean Energy, Aqua-Magnetics, Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factor

The increasing use of alternative sources of energy, like solar and wind, in France has led to an enormous demand for energy storage systems for the proper utilization of intermittent power supplies. According to data announced by the French Environment and Energy Management Agency, the use of renewable energy as a part of the electricity usage system passed 26% in 2022, registering a colossal push towards green energy sources. The imperative to balance out this push with a steady supply of power is one of the inspirations behind the France energy storage market. This not only supports grid resilience but also other European Union targets towards a 2050 carbon-neutral economy, and that is extremely fertile ground for the development and investment in energy storage.

Restraining Factor

Large capital expenditures upfront, regulatory risks, and technical integration constraints. Although the cost of lithium-ion batteries has declined, large storage projects entail enormous investment and design-provoking long payback times. Delays in connecting to the grid, uncertain regulations regarding storing compensation, and blocking access to capacity markets restrict commercial take-up.

Market Segmentation

The France energy storage systems market share is classified into technology and application.

- The lithium-ion batteries segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period

The France energy storage systems market is segmented by technology into lithium-ion batteries, flow batteries, and others. Among these, the lithium-ion batteries segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The high energy density, quick response times, and falling costs of lithium-ion battery systems are making them more popular for grid-connected and behind-the-meter energy storage applications. The technology is being used in France for backup power, time-of-use energy optimisation, and renewable integration in residential, commercial, and utility-scale applications. Lithium-ion battery sales are rapidly expanding across the nation thanks to government-sponsored pilot programmes and allowing feed-in regulatory changes.

- The grid services segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period

The france energy storage systems market is segmented by application into grid services, residential, commercial & industrial, and EV charging infrastructure. Among these, the grid services segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Grid storage is crucial for improving power distribution networks' resilience and dependability, particularly when it comes to integrating variable renewable energy sources like solar and wind.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France energy storage systems market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Eaton

- Areva

- ENGIE

- Neoen

- GreenYellow

- EDF

- TotalEnergies

- RTE

- Baker Hughes

- TotalEnergies

- Others

Recent Development

- In September 2023, Eaton announced a partnership with SMA Solar Technology to develop integrated energy solutions aimed at enhancing grid stability and efficiency.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France energy storage systems market based on the below-mentioned segments:

France Energy Storage Systems Market, By Technology

- Lithium-Ion Batteries

- Flow Batteries

- Other

France Energy Storage Systems Market, By Application

- Grid Services

- Residential

- Commercial & Industrial

- EV Charging Infrastructure

Need help to buy this report?