France Energy-Efficient Motor Market Size, Share, And COVID-19 Impact Analysis, By Type (Super Premium-IE4, Premium-IE3, High-IE2, and Standard-IE1), By Product Type (AC Motor and DC Motor), By Application (Pumps, Fans, Compressed Air, Refrigeration, Material Handling, and Material Processing), and France Energy-Efficient Motor Market Insights, Industry Trend, Forecasts To 2035

Industry: Energy & PowerFrance Energy Efficient Motor Market Size Insights Forecasts to 2035

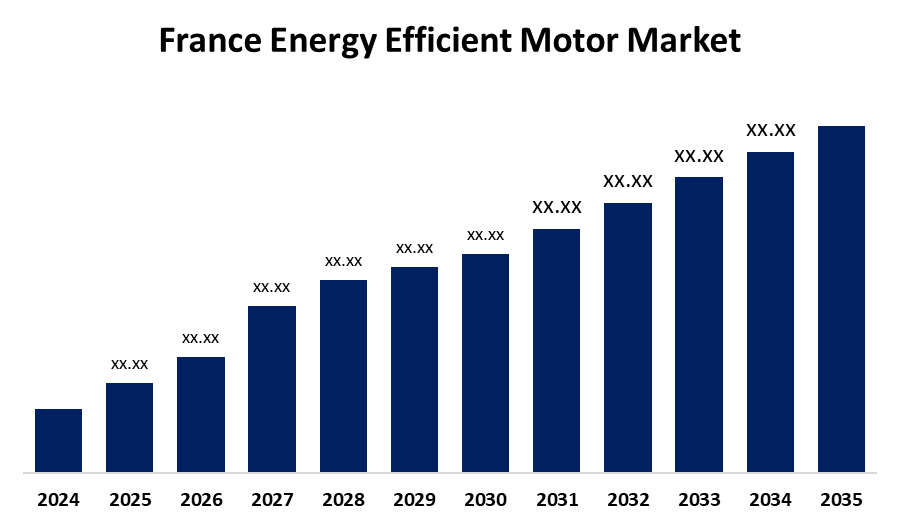

- The France Energy-Efficient Motor Market Size is Expected to Grow at a CAGR of around 6.1% from 2025 to 2035

- The France Energy-Efficient Motor Market Size is Expected to Hold a Significant Share by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the France Energy-Efficient Motor Market Size is anticipated to hold a significant share by 2035, growing at a CAGR of 6.1% from 2025 to 2035. The France energy-efficient motor market is driven by rising industrialization, increasing adoption of automation and robotics, and government regulations promoting energy efficiency.

Market Overview:

Electric motors are made to use less energy than standard motors. The economy for certain types of motors is known as the global energy-efficient motor market. As these motors have been made to save maximum energy and minimize energy loss, they use less energy and produce less pollution for the environment. They are also cheap to operate. There are various industries and applications, including HVAC equipment, industrial machinery, automotive, aerospace, consumer goods, and so on. All these applications employ energy-efficient motors. With remote working and supply chain disruptions becoming the norm, companies realized the need for effective motor systems to save energy and reduce operational expenses. Increasing demand for energy-efficient motors meant new and existing companies had to adapt their ways and expand their products.

Report Coverage:

This research report categorizes the France energy-efficient motor market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France energy-efficient motor market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France energy-efficient motor market.

France Energy-Efficient Motor Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.1% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 148 |

| Tables, Charts & Figures: | 124 |

| Segments covered: | By Type, By Product Type, By Application And COVID-19 Impact Analysis |

| Companies covered:: | ABB, Siemens, Schneider Electric, Eaton, Honeywell, Nidec, WEG, Emerson, Rockwell Automation, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factor

The power to require minimum efficiency levels for motor manufacturers to produce motors that exceed or meet set levels of efficiency. Minimum efficiency standards can drive the industry in the direction of more affordable and efficient motors. In order to make more people aware of the benefits of high-efficiency motors and how they could be employed in a range of industries, government also provides educational and outreach programs. This would be in the way of public awareness campaigns to promote the use of energy-efficient motors and training programs for engineers and technicians on their installation and maintenance.

Restraining Factor

Energy-efficient motors are sometimes made using better materials, new manufacturing methods, and added testing and certification to make them efficient. This can increase production costs for the companies producing them, which gets passed on as an added cost to the end user. In general, energy-efficient motors would be 20% higher in cost than regular motors, but this would be based on the particular company making the motor and how much competition exists in their market.

Market Segmentation

The France energy-efficient motor market share is classified into type, product type, and application.

- The premium-IE3 segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period

The France energy-efficient motor market is segmented by type into super premium-IE4, premium-IE3, high-IE2, and standard-IE1. Among these, the premium-IE3 segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The motors are more appealing to companies that prioritise sustainability and cost reduction since they offer enhanced energy efficiency, lower functional costs, and environmentally beneficial features.

- The DC motor segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period

The France energy-efficient motor market is segmented by product type into AC motor and DC motor. Among these, the DC motor segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental expansion can be attributed to their quicker reaction times and more consistent torque and speed levels. DC motors are perfect for use in vacuums, fabrication and manufacturing equipment, elevators, and material handling equipment.

- The fans segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period

The France energy-efficient motor market is segmented by application into pumps, fans, compressed air, refrigeration, material handling, and material processing. Among these, the fans segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental expansion can be attributed to the current strict rules and growing environmental consciousness, fans are increasingly using efficient motor technologies. These motors reduce greenhouse gas emissions while using less electricity.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France energy-efficient motor market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ABB

- Siemens

- Schneider Electric

- Eaton

- Honeywell

- Nidec

- WEG

- Emerson

- Rockwell Automation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France energy-efficient motor market based on the below-mentioned segments:

France Energy-Efficient Motor Market, By Type

- Super Premium-IE4

- Premium-IE3

- High-IE2

- Standard-IE1

France Energy-Efficient Motor Market, By Product Type

- AC Motor

- DC Motor

France Energy-Efficient Motor Market, By Application

- Pumps

- Fans

- Compressed Air

- Refrigeration

- Material Handling

- Material Processing

Need help to buy this report?