France Endodontic Devices Market Size, Share, and COVID-19 Impact Analysis, By Type (Instruments and Endodontic Consumables), By End Use (Dental Hospitals and Dental Clinics), and France Endodontic Devices Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareFrance Endodontic Devices Market Insights Forecasts to 2035

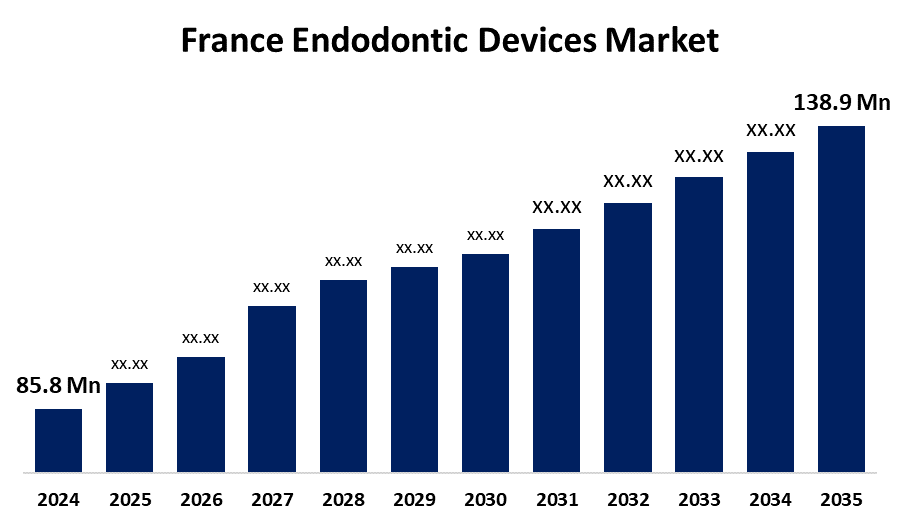

- The France Endodontic Devices Market Size was estimated at USD 85.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.48% from 2025 to 2035

- The France Endodontic Devices Market Size is Expected to Reach USD 138.9 Million by 2035

Get more details on this report -

The France Endodontic Devices Market Size is anticipated to reach USD 138.9 Million by 2035, growing at a CAGR of 4.48% from 2025 to 2035. Rising demand for advanced dental treatments, technological innovations in root canal procedures, and increased awareness about oral health are key factors driving the France endodontic devices market.

Market Overview

The France endodontic devices market includes a variety of tools and technologies used in endodontic procedures, primarily for treating tooth infections and damage, such as root canal therapy. Key devices in this market include rotary instruments, apex locators, obturators, and irrigators, which help improve the precision and efficiency of these treatments. As dental care continues to advance, these devices are becoming more sophisticated, incorporating features that enhance patient comfort and treatment outcomes. With a strong healthcare system and a well-established dental care infrastructure, the French market for endodontic devices benefits from a steady demand for high-quality, reliable tools. These devices are essential for improving the success rates of endodontic procedures, enabling faster recovery times, and supporting overall oral health. The market is expected to continue growing as dental professionals increasingly adopt innovative technologies and techniques in their practices.

Report Coverage

This research report categorizes the market for the France endodontic devices market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France endodontic devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France endodontic devices market.

France Endodontic Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 85.8 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 4.48% |

| 2035 Value Projection: | USD 138.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 266 |

| Tables, Charts & Figures: | 106 |

| Segments covered: | By Type and By End Use |

| Companies covered:: | Septodont, Micro-Mega, Neolix SAS, Dentsply Sirona, Envista Holdings Corporation, 3M, Planmeca, Carestream Dental, Straumann Group, and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The France endodontic devices market is fueled by the rising popularity of advanced dental technologies and the increasing incidence of dental conditions requiring root canal treatments. An aging demographic with greater dental care needs and a shift toward minimally invasive treatments are key contributors. Additionally, the growing focus on cosmetic dentistry and heightened public awareness of oral health drive the demand for precision tools, prompting continuous innovation in endodontic devices to improve treatment efficacy and patient satisfaction.

Restraining Factors

High device costs and the need for specialized training create barriers to widespread adoption in dental practices. Additionally, limited reimbursement options and a preference for conventional treatment methods can slow the transition to newer technologies. These factors, along with concerns over procedure complexity, restrain market expansion.

Market Segmentation

The France endodontic devices market share is classified into type and end use.

- The endodontic consumables segment held the largest revenue share in 2024 and is expected to grow at a substantial CAGR during the forecast period.

The France endodontic devices market is segmented by type into instruments and endodontic consumables. Among these, the endodontic consumables segment held the largest revenue share in 2024 and is expected to grow at a substantial CAGR during the forecast period. The growth can be attributed to the increasing demand for disposable products such as obturators, endodontic files, and irrigants, which offer convenience, cost-effectiveness, and enhanced treatment efficiency in root canal procedures.

- The dental clinics segment held the highest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France endodontic devices market is segmented by end use into dental hospitals and dental clinics. Among these, the dental clinics segment held the highest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth segment is driven by the increasing number of private dental clinics, their accessibility, and the rising preference for outpatient care, which encourages the use of advanced endodontic devices for more efficient and effective treatments.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France endodontic devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Septodont

- Micro-Mega

- Neolix SAS

- Dentsply Sirona

- Envista Holdings Corporation

- 3M

- Planmeca

- Carestream Dental

- Straumann Group

- Others

Recent Developments:

- In September 2024, Dentsply Sirona launched the X-Smart Pro+ endodontic motor, featuring an integrated apex locator and delivering up to 7.5 N·cm torque and 3,000 rpm speed. This device is designed for optimal performance with both reciprocating and continuous rotation file systems, including Reciproc Blue, which allows for shaping root canals without an initial glide path in most cases.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France endodontic devices market based on the below-mentioned segments:

France Endodontic Devices Market, By Type

- Instruments

- Endodontic Consumables

France Endodontic Devices Market, By End Use

- Dental Hospitals

- Dental Clinics

Need help to buy this report?