France Dental Burs Market Size, Share, and COVID-19 Impact Analysis, By Material (Diamond Burs, Stainless Steel, and Carbide), By Application (Oral Surgery, Implantology, Orthodontics, and Others), and France Dental Burs Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareFrance Dental Burs Market Insights Forecasts to 2035

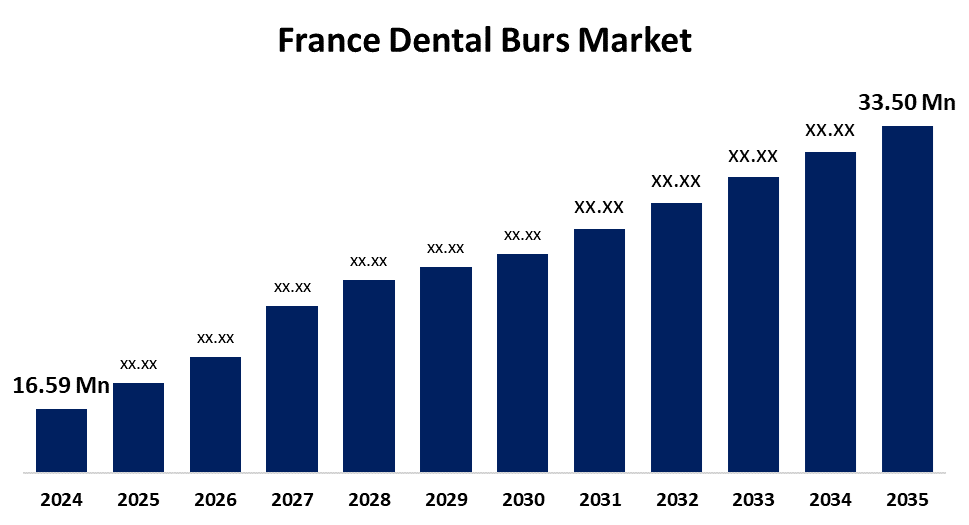

- The France Dental Burs Market Size Was Estimated at USD 16.59 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.60% from 2025 to 2035

- The France Dental Burs Market Size is Expected to Reach USD 33.50 Million by 2035

Get more details on this report -

The France Dental Burs Market Size is Snticipated to reach USD 33.50 Million by 2035, Growing at a CAGR of 6.60% from 2025 to 2035. The France dental burs market is primarily driven by advancements in dental technology, rising demand for cosmetic dentistry, and an aging population requiring specialized dental care. These factors collectively contribute to the market's growth and evolution.

Market Overview

The dental burs market in France involves the development, supply, and utilization of precision rotary tools designed for dental applications such as tooth shaping, cavity removal, and surface finishing. These tools, known as dental burs, come in various materials like tungsten carbide, stainless steel, and industrial-grade diamond, tailored to different treatment needs. French dental practices, clinics, and laboratories rely on these instruments for accurate and efficient dental work across general dentistry and specialized fields. The market includes both disposable and reusable options, aligned with clinical protocols and hygiene standards. With a structured distribution network, including dental suppliers, wholesalers, and online platforms, dental burs are widely accessible throughout the country. The industry is characterized by continuous innovation in design and performance, ensuring high precision and durability. Both domestic companies and multinational manufacturers contribute to a competitive and quality-driven environment, reinforcing France’s position as a key player in the European dental instruments sector.

Report Coverage

This research report categorizes the market for the France dental burs market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France dental burs market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France dental burs market.

France Dental Burs Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 16.59 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 16.59 |

| 2035 Value Projection: | USD 33.50 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Material, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Septodont, Dentsply Sirona, COLTENE Inc., SHOFU INC., MANI, Inc., Brasseler USA, Komet Dental, Envista Holdings Corporation (Kerr Corporation) and others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Technological advancements in dental tools have enhanced the precision and efficiency of procedures, increasing demand for high-quality burs. A growing emphasis on aesthetic dentistry and minimally invasive treatments has further boosted market growth. The aging population in France, requiring more frequent dental care, also contributes significantly. Additionally, increased awareness of oral health and rising dental tourism are expanding the patient base. Government support for healthcare infrastructure and a steady rise in the number of dental clinics and professionals further support the ongoing expansion of the dental burs market.

Restraining Factors

High costs associated with advanced dental burs can limit adoption, especially in smaller clinics. Strict regulatory requirements and approval processes may delay product launches and increase compliance costs. Additionally, the availability of low-cost alternatives and counterfeit products can undermine market growth.

Market Segmentation

The France dental burs market share is classified into material and application.

- The diamond burs segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The France dental burs market is segmented by material into diamond burs, stainless steel, and carbide. Among these, the diamond burs segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The growth is owing to their superior cutting efficiency, durability, and precision in dental procedures. Their ability to maintain sharpness over extended use makes them highly preferred for both restorative and cosmetic treatments.

- The implantology segment held a significant market share in 2024 and is expected to grow at a substantial CAGR during the forecast period.

The France dental burs market is segmented by application into oral surgery, implantology, orthodontics, and others. Among these, the implantology segment held a significant market share in 2024 and is expected to grow at a substantial CAGR during the forecast period. The segment is driven by the increasing number of dental implant procedures and the rising prevalence of tooth loss, especially among the aging population. Dental burs play a critical role in implant placement, requiring precision and reliability.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France dental burs market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Septodont

- Dentsply Sirona

- COLTENE Inc.

- SHOFU INC.

- MANI, Inc.

- Brasseler USA

- Komet Dental

- Envista Holdings Corporation (Kerr Corporation)

- Others

Recent Developments:

- In February 2024, Kerr Dental launched the SimpliCut line, introducing pre-sterilized, single-patient-use diamond burs designed to eliminate the need for cleaning and sterilization, enhancing clinic efficiency.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France dental burs market based on the below-mentioned segments:

France Dental Burs Market, By Material

- Diamond Burs

- Stainless Steel

- Carbide

France Dental Burs Market, By Application

- Oral Surgery

- Implantology

- Orthodontics

- Others

Need help to buy this report?