France Dental Anesthesia Market Size, Share, and COVID-19 Impact Analysis, By Product Type (lidocaine, mepivacaine, prilocaine, articaine, and others), By Technique (local infiltration, field block, and nerve block), and France Dental Anesthesia Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareFrance Dental Anesthesia Market Size Insights Forecasts to 2035

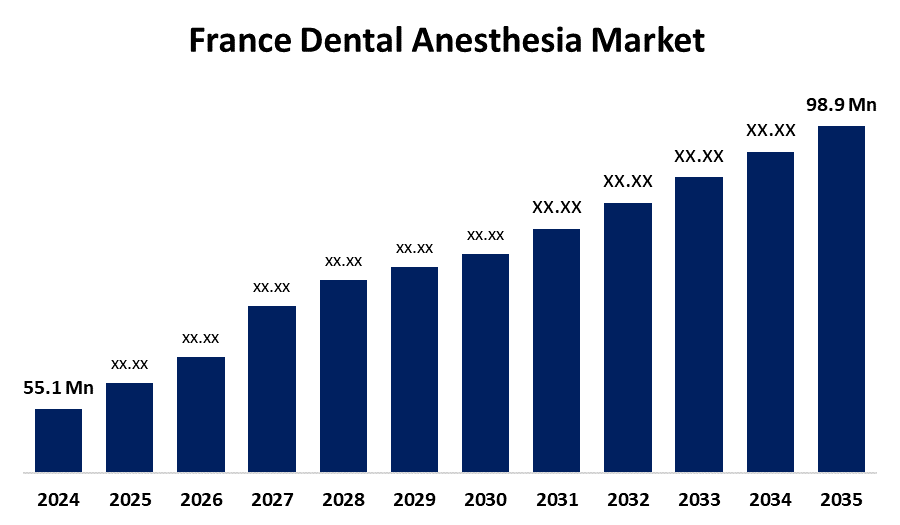

- The France Dental Anesthesia Market Size was estimated at USD 55.1 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.46% from 2025 to 2035

- The France Dental Anesthesia Market Size is Expected to Reach USD 98.9 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The France Dental Anesthesia Market Size is Anticipated to Reach USD 98.9 Million by 2035, Growing at a CAGR of 5.46% from 2025 to 2035. Growing awareness of oral health, an aging population needing more dental care, and an increase in demand for minimally invasive procedures.

Market Overview

The market for dental anesthesia in France is the industry devoted to the creation, application, and distribution of anesthetics and technologies that make dental procedures painless. Additionally, a discernible trend in the dental anesthesia market in France is the growing use of cutting-edge tools and technology. More advanced anesthesia techniques, like computer-controlled local anesthetic delivery systems, are being used by dentists due to the increased focus on patient comfort and safety. These systems offer accurate dosages and lessen patient anxiety, which is consistent with the French public's increasing desire for minimally invasive dental procedures. Further, there is growing interest in dental offices expanding their services by adding sedation dentistry, which enables patients to have a more comfortable experience. Along with growing awareness of dental hygiene, one factor driving the market's expansion is the French government's increased efforts to improve oral health in the country. The French Ministry of Health is able to expand the number of patients seeking dental care by consistently promoting preventive care. This, along with the fact that France's population is aging, is a major motivator because dental procedures, which necessitate proper anesthesia, are more common in older adults.

Report Coverage

This research report categorizes the market for the France dental anesthesia market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France dental anesthesia market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France dental anesthesia market.

France Dental Anesthesia Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 55.1 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.46% |

| 2035 Value Projection: | USD 98.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type, By Technique and COVID-19 Impact Analysis |

| Companies covered:: | Septodont Holding, Kalstein France, Heyer Medical AG, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rise in dental procedures backed by national health policies is expected to propel the growth of the dental anesthesia market in France. The French government has improved access to dental care by implementing major changes to its healthcare system. The French Health Ministry reports that during the last three years, dental visits have increased by 7%, mostly as a result of campaigns to raise awareness and encourage preventive care. Dental practices are increasingly implementing contemporary anesthetic protocols, which improve patient comfort and safety during procedures, according to groups like the French National Federation of Dental Surgeons.These organizations' continuous support shows a steady demand for dental anesthesia, which boosts the French market as a whole.

Restraining Factors

The high price of sophisticated anesthetic equipment, complicated reimbursement procedures, and possible adverse effects of some anesthetic agents are some of the obstacles facing the French dental anesthesia market. Further impeding widespread adoption in smaller dental practices are regulatory barriers and the requirement for specialized training in newer techniques.

Market Segmentation

The France dental anesthesia market share is classified into product type and technique.

- The articaine segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France dental anesthesia market is segmented by product type into lidocaine, mepivacaine, prilocaine, articaine, and others. Among these, the articaine segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Articaine is becoming more and more popular in a variety of dental applications, especially in the prosthetic field, thanks to its special chemical structure that makes it possible for it to penetrate bone more effectively.

- The local infiltration segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France dental anesthesia market is segmented by technique into local infiltration, field block, and nerve block. Among these, the local infiltration segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Local infiltration is a popular option for minor dental procedures because of its well-established effectiveness in controlling pain at particular locations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France dental anesthesia market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Septodont Holding

- Kalstein France

- Heyer Medical AG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France Dental Anesthesia Market based on the below-mentioned segments:

France Dental Anesthesia Market, By Product Type

- Lidocaine

- Mepivacaine

- Prilocaine

- articaine

- others

France Dental Anesthesia Market, By Technique

- local infiltration

- field block

- nerve block

Need help to buy this report?