France Consumer Packaged Goods Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Food Beverage, Cosmetics Personal Care, Pharmaceuticals, Nutraceuticals, and Others), By End User (Residential/Retail, Commercial, and 20Above), and France Consumer Packaged Goods Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsFrance Consumer Packaged Goods Market Size Insights Forecasts to 2035

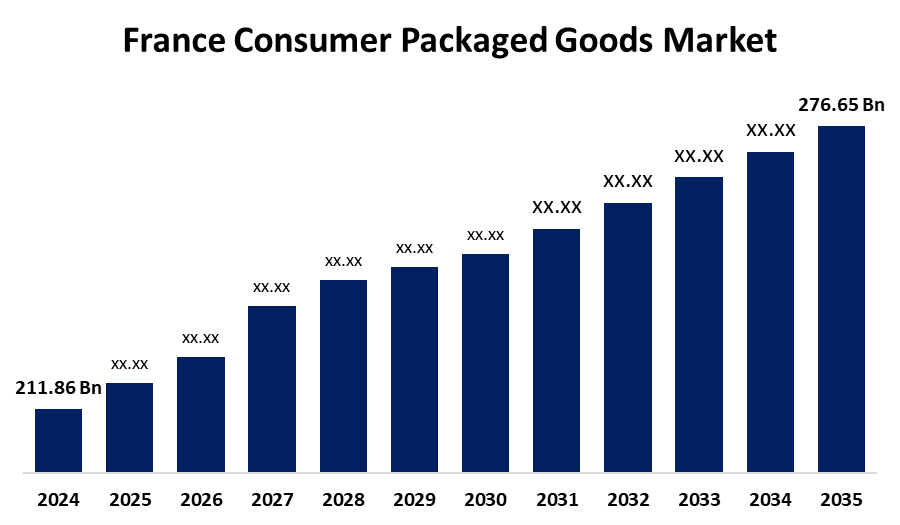

- The France Consumer Packaged Goods Market Size was estimated at USD 211.86 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 2.46% from 2025 to 2035

- The France Consumer Packaged Goods Market Size is Expected to Reach USD 276.65 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the France Consumer Packaged Goods Market Size is anticipated to reach USD 276.65 billion by 2035, growing at a CAGR of 2.46% from 2025 to 2035. Anticipated to expand gradually as a result of consumers' growing health consciousness, which is driving up demand for natural and nourishing products.

Market Overview

The France consumer packaged goods (CPG) market refers to the industry that produces, distributes, and sells common consumables that are packaged for individual use is known as the consumer-packaged goods (CPG) market in France. These products, which include food, drinks, personal care items, and necessities for the home, are usually not long-lasting and are bought often. Additionally, with the French government's strong commitment to sustainability and environmental protection, this change offers CPG companies a number of opportunities to innovate and position their products as sustainable options. More recently, it has become evident that the CPG industry is moving toward healthier options. Natural products with less sugar and better nutrition are becoming more and more popular among French consumers. This trend is further fueled by rising health concerns and interest in wellness lifestyles, which leads to brands repurposing existing products or developing new ones to meet consumer demands. Further, shopping convenience is crucial, particularly for residents of French cities like Paris. More people are shopping online because it's more convenient, and there has been a recent shift towards e-commerce and a direct-to-consumer business model.

Report Coverage

This research report categorizes the market for the France consumer packaged goods market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France consumer packaged goods. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France consumer packaged goods market.

France Consumer Packaged Goods Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 211.86 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 2.46% |

| 2035 Value Projection: | USD 276.65 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 156 |

| Tables, Charts & Figures: | 127 |

| Segments covered: | By Product Type, By End User and COVID-19 Impact Analysis |

| Companies covered:: | LVMH, L’Oreal, Groupe SEB, Danone, Carrefour, CMP Group, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Consumers' purchasing habits are significantly shifting toward being health-conscious, according to the France consumer packaged goods market industry. More than 60% of French adults actively choose products labeled as organic or natural, according to a study from the French Ministry of Agriculture, demonstrating the growing awareness of health issues. Demand for healthier packaged goods that suit consumers' dietary preferences is being driven by this trend. Transparency in product sourcing and labeling is emphasized by a number of well-known organizations, including the "Syndicat des Industries de la Nutrition Animale."Supply dynamics in the consumer packaged goods market are being impacted by the rise in startups concentrating on offering healthier options in supermarkets and e-commerce platforms throughout France as a result of the push for minimal processing and organic certification.

Restraining Factors

The market for consumer-packaged goods in France is constrained by factors such as price sensitivity brought on by inflation, a low willingness to pay for sustainable products, a reliance on conventional retail practices, and growing raw material costs. These elements impede the uptake of high-end products and impede efforts at digital transformation.

Market Segmentation

The France consumer packaged goods market share is classified into product type and end user.

- The food beverage segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France consumer packaged goods market is segmented by product type into food beverage, cosmetics personal care, pharmaceuticals, nutraceuticals, and others. Among these, the food beverage segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. With dietary preferences shifting and consumers becoming more interested in health-conscious options, food and beverage stands out as an important component. Organic and locally sourced foods are becoming more and more popular in France as a result of consumers' growing desire for authenticity and quality in their food choices.

- The residential/retail segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France consumer packaged goods market is segmented by end user into residential/retail, commercial, and 20above. Among these, the residential/retail segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The residential/retail sector is essential because it serves households and individual customers who frequently buy packaged goods, which reflects shifting consumer preferences for quality and convenience. This market shows that French households have a considerable need for food, drink, and personal care products due to changing lifestyles and rising disposable income.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France consumer packaged goods market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- LVMH

- L'Oreal

- Groupe SEB

- Danone

- Carrefour

- CMP Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France Consumer Packaged Goods Market based on the below-mentioned segments:

France Consumer Packaged Goods Market, By Product Type

- Food Beverage

- Cosmetics Personal Care

- Pharmaceuticals

- Nutraceuticals

- Others

France Consumer Packaged Goods Market, By End User

- Residential/Retail

- Commercial

- 20Above

Need help to buy this report?