France Composites Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Carbon Fiber and Glass Fiber), By Manufacturing Process (Layup, Filament, Injection Molding and Pultrusion), and France Composites Market Insights, Industry Trend, Forecasts to 2035.

Industry: Chemicals & MaterialsFrance Composites Market Insights Forecasts to 2035

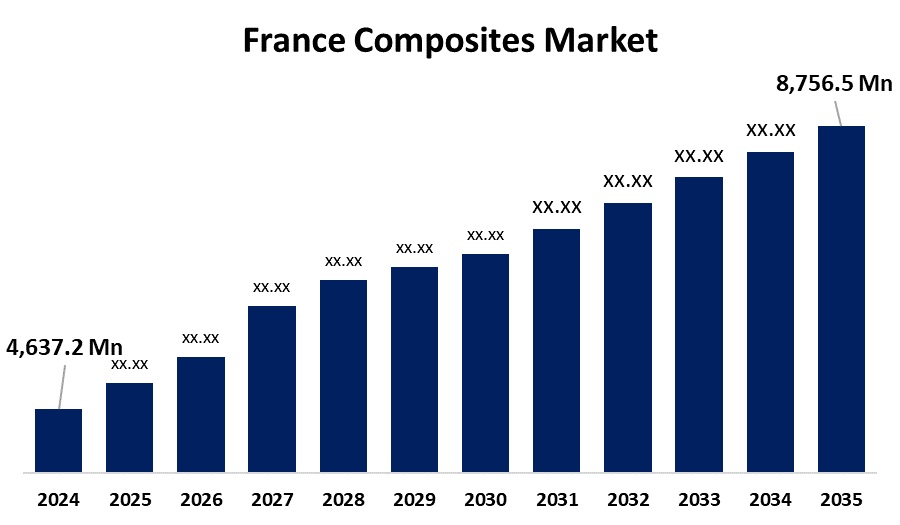

- The France Composites Market Size was estimated at USD 4,637.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.95% from 2025 to 2035

- The France Composites Market Size is Expected to Reach USD 8,756.5 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the France Composites Market Size is anticipated to reach USD 8,756.5 Million by 2035, growing at a CAGR of 5.95% from 2025 to 2035. The growing need for lightweight components in the transportation and automotive sectors is the reason for the market expansion.

Market Overview

The France market for materials is made up of a variety of materials that have better qualities than their components is known as the France composites market. These materials offer advantages like a high strength-to-weight ratio, corrosion resistance, and customization for a range of applications, in that it is designed to combine the best qualities of multiple materials. The market encompasses a broad range of industries, such as sports equipment, automotive, aerospace, and construction. The growing demand for lightweight components in the transportation and automotive sectors is the reason for this expansion. Also, it is projected that the manufacturing industries' growing use of elegant lightweight components will fuel market growth. Given that composites can significantly lower the body weight of military aircraft and helicopters, it is used in aerospace and defense manufacturing. Weight reduction is thought to be crucial for improving overall performance and fuel efficiency, and it is expected to be the primary factor driving the growing popularity of the sector.

Report Coverage

This research report categorizes the market for the France composites market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France composites market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France composites market.

France Composites Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4,637.2 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.95% |

| 2035 Value Projection: | USD 8,756.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type (Carbon Fiber and Glass Fiber), By Manufacturing Process (Layup, Filament, Injection Molding and Pultrusion) |

| Companies covered:: | Teijin Ltd., PPG Industries, Inc, Toray Industries, Inc., DuPont, Huntsman Corporation LLC, Compagnie de Saint-Gobain S.A., Hexcel Corporation, Weyerhaeuser Company, Owens Corning, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The France composites market is driven by the growing environmental concerns, and strict pollution control regulations have compelled automakers to improve their technologies and create low-pollution vehicles. Furthermore, the use of composites in automobile production has been compelled by environmental regulations. It is anticipated that this will gradually quicken market expansion. The market for composites is driven by several important factors, such as the rising need for high-performance, lightweight materials, improvements in manufacturing techniques, and growing use across a range of sectors, including construction, automotive, and aerospace. The market is growing as a result of increased safety regulations, lower emissions, and the drive for fuel efficiency.

Restraining Factors

The French market for composites is restricted by the component manufacturers' acquisition procedures are likely to be limited by the high cost of raw materials for composites. Furthermore, producers of composites may face trouble due to the expanding need for these raw materials by other manufacturing sectors. To create inexpensive composite grades with mechanical qualities comparable to those of the more prohibitively costly versions.

Market Segmentation

The France composites market share is classified into product type and manufacturing process.

- The glass fiber segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France composites market is segmented by product type into carbon fiber, glass fiber. Among these, the glass fiber segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. Given that glass fibers are lightweight, rigid, and can achieve a high tensile strength, their bodies are frequently utilized as a raw material for composites. Glass fiber is mostly utilized in composite manufacturing because of its excellent impact resistance.

- The layup segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The France composites market is segmented by manufacturing process into layup, filament, injection molding, and pultrusion. Among these, the layup segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the layup process segment in the France composites market is anticipated to be driven by the rising production of boats, wind turbine blades, and architectural moldings.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France composites market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Teijin Ltd.

- PPG Industries, Inc

- Toray Industries, Inc.

- DuPont

- Huntsman Corporation LLC

- Compagnie de Saint-Gobain S.A.

- Hexcel Corporation

- Weyerhaeuser Company

- Owens Corning

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France composites market based on the below-mentioned segments:

France Composites Market, By Product Type

- Carbon Fiber

- Glass Fiber

France Composites Market, By Manufacturing Process

- Layup

- Filament

- Injection Molding

- Pultrusion

Need help to buy this report?