France Chemical Logistics Market Size, Share, And COVID-19 Impact Analysis, By Mode of Transportation (Roadways, Railways, Airways, Waterways, Pipelines), By Service (Transportation And Distribution, Storage & Warehousing, Customs & Security, Green Logistics, Consulting & Management Services, Others), By Industry Vertical (Chemical and Specialty Chemicals Industry, Pharmaceutical Industry, Oil & Gas Industry, Food and Berverges, Others) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), and France Chemical Logistics Market Insights, Industry Trend, Forecasts to 2033.

Industry: Chemicals & MaterialsFrance Chemical Logistics Market Size Forecasts to 2033

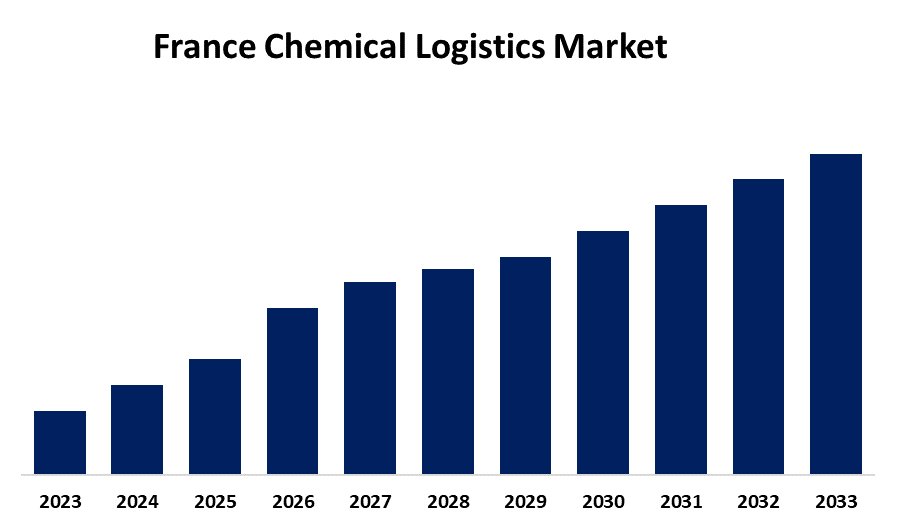

- The France Chemical Logistics Market Size is Expected to Grow at a CAGR of around 5.6% from 2023 to 2033

- The France Chemical Logistics Market Size is Expected to reach a significant share by 2033.

Get more details on this report -

The France Chemical Logistics Market size is expected to grow 5.6% CAGR from 2023 to 2033, is expected to reach a significant share by 2033. The market growth is influenced by the expansion in industries including agriculture, medicines and technology breakthroughs, and development in the logistics industry.

Market Overview

The French chemical logistics market refers to the business of the logistics industry that emphasizes delivering chemicals along the supply chain with the aid of shipping, storage, and various other services provided by chemical logistics firms, with key logistics vendors. Nearly every other industry, including the manufacturing of plastics, pharmaceuticals, food, and transport systems, relies on chemical manufacturing. These substances, either fluid or solid, are the basic constituents of medication, food, and other daily commodities. Moreover, to avoid safety hazards, including contamination and spoilage, special attention must be paid to the handling, storage, and transportation of these chemicals, which are used in the manufacturing of common items. Further, development news such as Nexxiot and Arkema partnered to revolutionize chemical transportation by integrating cutting-edge IoT devices and intelligent cloud platforms into Arkema's Isotank and rail freight wagon fleet. This collaboration aims to provide end-to-end visibility for customers, enhancing quality standards and transforming the service experience. By monitoring critical cargo parameters like location, temperature, pressure, and shock events, the partnership seeks to improve trust, safety, and sustainability in chemical transport, boost the market growth, and highlight the growing opportunities across the region.

Report Coverage

This research report categorizes the France chemical logistics market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the France chemical logistics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the France chemical logistics market.

France Chemical Logistics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.6% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Mode of Transportation, By Service, By Industry Vertical, By Region And COVID-19 Impact Analysis |

| Companies covered:: | Agility, BASF, GEODIS, Bolloré Logistics, Deutsche Bahn (DB) Schenker, Deutsche Post AG (DHL), Rhenus Logistics, Ryder System Inc., and others key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The chemical logistics market in France has been expanding rapidly due to high demand for specialized logistics and rigorous regulatory mandates. Further, the intricacy of chemical products necessitates specialized handling, storage, and transportation propel the market growth. Moreover, the convey of hazardous chemicals needs specialized logistics services, thereby fostering market growth. Further, growing use of smart technology, such as robotics, smart sensors, and the Internet of Things (IoT), green practices, artificial intelligence (AI), machine learning, radio-frequency identification (RFID), Bluetooth, and other technologies, drives the logistics industry. Concurrently, the chemical logistics industry across the region is growing due to the need for modern green warehouses for business operations that are ecologically conscious.

Restraints & Challenges

The France chemical logistics market growth is being hindered by some barriers such as high initial costs and deployment expenses, and a lack of skilled labor or personnel to upkeep them periodically. Moreover, delayed permission from regulatory authorities, which impacts infrastructure expansions, hammers the market growth.

Market Segmentation

The France chemical logistics market share is classified into mode of transportation, service, and industry vertical.

- The waterways segment held a significant share of the France chemical logistics market in 2023 and is expected to grow at a rapid pace over the forecast period

Based on the mode of transportation, the France chemical logistics market is categorizedinto roadways, railways, airways, waterways, and pipelines. Among these, the waterways segment held a significant share of the France chemical logistics market in 2023 and is expected to grow at a rapid pace over the forecast period. This is because the least expensive transportation solution and the infrastructure development in the shipping industry. Further, logistics companies and chemical firms are forming joint ventures for such transportation options. For instance, France's ports, such as Marseille and Le Havre, are prepared to manage chemical logistics, which strongly supports the segment growth.

- The storage & warehousing segment accounted for a significant share of the France chemical logistics market in 2023 and is projected to grow at a rapid pace during the forecast period.

Based on the service, the France chemical logistics market is classified into transportation and distribution, storage & warehousing, customs & security, green logistics, consulting & management services, and others. Among these, the storage & warehousing segment accounted for a significant share of the France chemical logistics market in 2023 and is projected to grow at a rapid pace during the forecast period. This segment growth is driven by the practice of keeping items safe, handling, and storage of chemicals, making warehousing a focal point of the chemical logistics sector. Beyond that, smart warehouses with automated inventory management and real-time tracking are becoming more popular among key chemical industry players and logistics vendors. Furthermore, inventory management and e-commerce are supporting the segment expansion.

- The chemical and specialty chemicals industry segment accounted for a significant share of the France chemical logistics market in 2023 and is anticipated to grow at a rapid pace during the forecast period.

Based on the industry vertical, the France chemical logistics market is segmented into chemical and specialty chemicals industry, pharmaceutical industry, oil & gas industry, food and beverages industry, and others. Among these, the chemical and specialty chemicals industry segment accounted for a significant share of the France chemical logistics market in 2023 and is anticipated to grow at a rapid pace during the forecast period. This segmental growth contributes to the market expansion because there is a high demand for commodity or bulk chemicals used as raw materials to produce various chemical merchandise. Moreover, the rising need for logistics services in the chemical industry is driven by the emphasis on domestic manufacturing of chemicals, compliance with environmental and strict safety regulations by the regional authorities.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France chemical logistics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Agility

- BASF

- GEODIS

- Bolloré Logistics

- Deutsche Bahn (DB) Schenker

- Deutsche Post AG (DHL)

- Rhenus Logistics

- Ryder System Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Key Market Developments

- In April 2025, Dorf Ketal Chemicals and the LEHVOSS Group expanded their distribution partnership to France and other major European countries. The expansion aims to enhance customer proximity, application support, and supply chain reliability across the regions.

Market Segment

This study forecasts revenue at France, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the France chemical logistics market based on the below-mentioned segments:

France Chemical Logistics Market, By Mode of Transportation

- Roadways

- Railways

- Airways

- Waterways

- Pipelines

France Chemical Logistics Market, By Service

- Transportation And Distribution

- Storage & Warehousing

- Customs & Security

- Green Logistics

- Consulting & Management Services

- Others

France Chemical Logistics Market, By Industry Vertical

- Chemical and Specialty Chemicals Industry

- Pharmaceutical Industry

- Oil & Gas Industry

- Food and Beverages

- Others

Need help to buy this report?