France Cereal Ingredient Market Size, Share, And COVID-19 Impact Analysis, By Type (Wheat, Rice, Barley, and Oats), By Source (Organic and Conventional), By Form (Flakes and Puff), and France Cereal Ingredient Market Insights, Industry Trend, Forecasts To 2035

Industry: Food & BeveragesFrance Cereal Ingredient Market Insights Forecasts to 2035

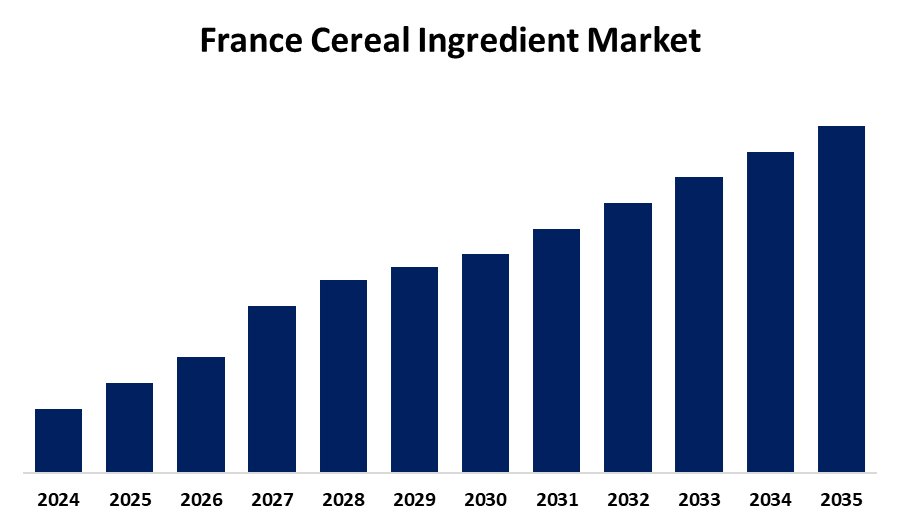

- The France Cereal Ingredient Market Size is Expected to Grow at a CAGR of around 4.4% from 2025 to 2035

- The France Cereal Ingredient Market Size is Expected to Hold a Significant Share by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The France Cereal Ingredient Market Size is anticipated to Hold a Significant Share by 2035, Growing at a CAGR of 4.4% from 2025 to 2035. The France Cereal Ingredient Market Size is driven by increasing health consciousness, a growing demand for convenient breakfast options, and the expanding food and beverage industry.

Market Overview:

Cereal grains contain easily digestible nutritive material in several foods and can be used well in many processed foods due to being cost-effective. Wheat, oats, barley, and corn are the grains that are several high-fiber. Cereals contain high nutrients and are good sources of some vitamins and minerals, and form staple foods of the majority of diets across the world today. The trend towards healthy food consumption and the growing vegetarianism are also expected to increase the market for cereal ingredients towards a healthy diet. Cereal ingredients are used in processed foods such as breakfast cereals, snack bars, and bakery products, thereby driving the demand for the market. The clean-label culture of the market and the application of old grains like amaranth and quinoa in cereal formulation have also been a leading factor for the growth of the cereal ingredients market, as it satisfies the demand of consumers for minimally processed healthy food. It was confirmed that the cereals ingredients are poised for robust growth in the future based on alterations in customer demand and more diverse production.

Report Coverage:

This research report categorizes the France cereal ingredient market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the France cereal ingredient market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the France cereal ingredient market.

France Cereal Ingredient Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.4% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Type, By Form |

| Companies covered:: | Kellogg NA Co., General Mills, Inc., Cargill Inc., Balchem Inc., ADM, Bunge Limited, Groupe Limagrain Holding, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factor

Increasing demand from consumers for convenient and healthy breakfasts is likely to drive the growth of the market for cereal ingredients. People are now looking for food that can be prepared within minutes due to busy schedules, and hot cereals are quick to prepare and have quick rates of consumption. This ease, combined with the health benefits of whole grains, is making consumers among health-aware individuals and are ready to consume cereals. Companies are responding to this by bringing a number of flavors and preparations, as the products come in different flavors and for different diets.

Restraining Factor

Climate disruption is inflicting intense distress on the cereal ingredients industry mainly because of the uncertainty of cereal crop prices. Key cereal crops like wheat, oats, barley, and corn are exposed to unpredictable climatic conditions around the world in the form of droughts, floods, and heat waves.

Market Segmentation

The France cereal ingredient market share is classified into type, source, and form.

- The wheat segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period

The France cereal ingredient market is segmented by type into wheat, rice, barley, and oats. Among these, the wheat segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental expansion can be attributed to its various uses and general acceptability among final consumers. Wheat is a basic ingredient in most cereal food items, such as flakes, biscuits, and ready-to-eat breakfast cereals. Its gluten is elastic, which contributes desired texture of baked foods and overall sensory acceptability.

- The organic segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period

The France cereal ingredient market is segmented by source into organic and conventional. Among these, the organic segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growing consumer demand for organic and environmentally friendly food products. With growing concerns about pesticides, GMOs, and environmental sustainability, consumers are shifting towards organic cereals. Organic ingredients are widely used in a variety of applications, such as whole grain cereals, granola bars, and breakfast cereals for health-oriented individuals and households.

- The flakes segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period

The France cereal ingredient market is segmented by form into flakes and puffs. Among these, the flakes segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental expansion can be attributed to their convenience, versatility, and consumer preference. They give a nice crunch and bite and act as the basis for bringing in diversified flavors, grains, and nutritional additives. Flakes are easy to manufacture in large quantities, enabling cereal manufacturers to have streamlined manufacturing procedures. Their thin, flat shapes also enable uniform milk or yogurt distribution, enhancing the culinary experience.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the France cereal ingredient market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Kellogg NA Co.

- General Mills, Inc.

- Cargill Inc.

- Balchem Inc.

- ADM

- Bunge Limited

- Groupe Limagrain Holding

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the France, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the France cereal ingredient market based on the below-mentioned segments:

France Cereal Ingredient Market, By Type

- Wheat

- Rice

- Barley

- Oats

France Cereal Ingredient Market, By Source

- Organic

- Conventional

France Cereal Ingredient Market, By Form

- Flakes

- Puff

Need help to buy this report?